Investment Thesis

For growth investors looking to ride the next wave of Gen AI, Palantir (NASDAQ: NASDAQ:PLTR) something to offer them. With its Artificial Intelligence Platform (AIP), Palantir aspires to change code development as we know it. Launched in April 2023, AIP is in the process of putting a fork in the road of code development with its mercurial deployment of LLMs via the Ontology framework. And the marvels of AIP cast a bright future for Palantir and its shareholders. Based on holistic and comprehensive projections, deeply woven by engineering calibre of Palantir, the stock lays out an incredible upside for investors.Q4 2024 Performance

The biggest growth news for investors from Palantir's Q4 2024, was the near 50% growth in its FY 2024 full year free cash flow from FY 2023. By crossing the $900 billion mark in free cash flow, Palantir is in a commanding position to double down on R&D and continue its quest to come up with breakthrough innovations. Additionally, Palantir's U.S commercial revenue grew more than it US Government revenue by 24% for FY2024. indicating the company's endeavor to expand and diversify its revenue channels.Investment Upsides

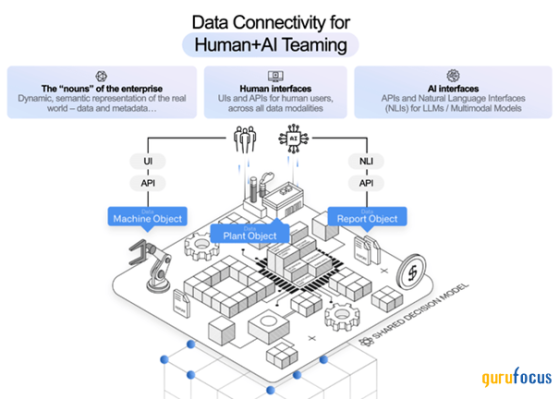

AIP OverviewPalantir's Artificial Intelligence Platform (AIP) has transformed code development by condensing third-party software products into just a few lines of code. AIP has been consistently integrated into platform toolkits and allowed LLMs to embed into the privately owned networks. In the practice, it implies that AIP essentially allows enterprises to effectively eradicate specialized software platforms, and by extension support staff. AIP accomplishes this objective by the help of its two branches: AIP Assist and AIP Logic. Superficially, AIP Assist operates like a cookie-cutter chatbot in the entire AIP platform. However, the might of AIP Assistant kicks in, when we learn that AIP Assist allows users to ask natural language questions about Palantir's documentation by combining NLP and third-party LLM.

On the other hand, AIP Logic is fundamentally a no-code substitute to the model catalogue for LLM-powered functions. AIP Logic strives to bring down the sophistications of API calls, making it easier for an enterprises' in-house LLM to interact with the user's ontology. An enterprise in practice can set out its ontology objects as function input. And then, AIP Logic can independently either return a value or edit the ontology object based on the customization of function input.

Anirvan Mukherjee, Palantir's Head of AI/ML Solutions, has synthesized AIP's capabilities in workflow management by describing that AIP enables the creation of autonomous organizations via taking care of all security and infrastructure requirements in the background. Months of coding have now been reduced to a few lines of code that equate to autonomous operations. Crucially, AIP achieves automation without leaving data in the dark. Growth investors can smell high growth the opportunities Palantir's stock has to offer.

AIP's long-term impact on stock price

In the span of 15 months, Palantir's operating income grew by a CAGR of 58.94%. This coincides with the launch of AIP, where AIP was launched in April 2023. To visualize the importance and impact of AIP on its customers' operations, Cleveland Clinic reported a 75% drop in time spent calculating bed capacity. In mission-critical industries like healthcare and the military, Palantir reaps the harvest of high switching costs for its customers, forging an economic moat for Palantir.

Total Addressable Market

Palantir's Revenue Trajectory

From the above chart, we can deduce that Palantir's revenue grew on par with the data analytics market in the past couple of years. If we run down the numbers, as of 31st December 2024, Palantir had a market share of 5.74% of the global data analytics market. This leaves a gigantic market for Palantir to capture. Precedence Research expects the data analytics market to grow at a CAGR of 29% through 2034. Historically Palantir's revenue has grown at a similar rate to that of the market and hence a moderate CAGR of 30% would imply Palantir's revenue to hit $39.57 billion mark by 2034. However, under these assumptions, it would imply Palantir's market share grow by merely 0.26% through 2034. Such conservative and pessimistic assumptions are plugged in to ensure the thesis does not overvalue Palantir's stock and try to give the audience a view of the future of the stock price even if Palantir loses some of its steam in the coming years.

Valuation

P/SAt the time of writing this, Palantir's stock is trading at a P/S multiple of 72.62 and the chart above helps us see that 2024 was the year when the stock picked up the meteoric momentum. As shown above, Palantir's revenue has historically grown on par with the data analytics market, forging a market share of 5.74% as of 31st December 2024. With the help of the mercuriality of AIP's LLMs, we estimate that Palantir's revenue would grow at a CAGR of 30% through 2034, netting revenue of $17.77 billion for FY 2034.And the math makes sense when you factor in the AI spending American corporations have done past few years and projected spending outlook by Goldman Sachs (NYSE:GS). This coupled with Palantir's strong hold in the US markets make the future for Palantir's revenue look bright.

As of Q4 of 2024, the US GDP was $29.7 trillion, and even at a conservative growth of 1% in GDP, which deduces a $32.81 trillion GDP figure, Goldman forecasts that software related AI spending could hit almost $220 billion in the US. And the engineering reason why Palantir is set to benefit the most is because of the Ontology framework, AIP deploys.

Palantir explains the core function of Ontology in the following way.

A Function is a piece of code-based logic that takes in input parameters and returns an output. Functions are natively integrated with Ontology: they can take objects and object sets as input, read property values of objects, and be used across action types and applications that build on the Ontology.

It is reasonable to expect Palantir to head towards and/or be in the vicinity of the industry's maturity by 2034. The median PS ratio of the data analytics company specializing partially in workflow management as we know hovers around the 8.4X multiple. And barring some earth-shattering innovations and technological breakthroughs, Palantir is also expected to walk down that route. And with an 8.4x PS multiple, we get a market cap of $332.388 billion for the analytics company. Palantir has 2.35 billion outstanding shares, and the company saw its outstanding shares grow by almost 50% since its IPO. However, from a managerial perspective, it is unreasonable to expect Palantir to issue more shares without any proper cause. But to continue our conservatism in our projections, we estimate 3 billion outstanding shares.

Hence under these assumptions, via the PS ratio we can obtain an implied share price of almost $110.80.

Palantir has the lowest 1-year forward PEG ratio, quite naturally. Wall Street perceives Palantir as the next company to lead the group of Big Tech in the coming years with blistering growth, particularly in EPS. This also implies that in the long-term growth, investors have plenty to gain from the opportunity.

Investment Risk

For investors, the biggest risk on Palantir's stock is its embedded volatility. With a beta of 2.6, Palantir's volatility is twice that of the benchmark. This is not something unique to Palantir only. High-growth tech stocks have always been volatile. And the biggest tradeoff investors have to deal with investments in high opportunities is volatility. And it is not like Palantir is just only volatile like a penny stock but the rewards of having Palantir in portfolio have also been promising. This can be understood by looking at the Historical Sharpe Ratio.

The Historical Sharpe Ratio measures the risk-adjusted return of a security. This metric analyzes the return investors are generating on a security in comparison to the amount of volatility expected. The historical Sharpe ratio uses historical returns to calculate the return and standard deviation. As a rule of thumb, a Sharpe ratio of 3 or higher is what hedge fund investment managers strive for because securities with a Sharpe ratio of 3.0 or higher offer stronger risk-adjusted return, meaning the investment generates significantly more return for the level of risk taken, compared to other investments. Hence with a Sharpe ratio of 3.44, investors are assured of solid risk-adjusted returns.

Guru Trades

The uncertainty of Palantir has kept Gurus off from from adding the stock into their portfolio. Additionally, we can observe that as the levered beta grew, the volume of trade by Gurus fell. This sends a strong message to deep-value investors.

Final Thoughts

As stated above, the core of the valuation is derived from the public comps approach. And Palantir can underperform or outperform its peers. However, the odds of outperformance are high because of the engineering revolution AIP is set to unleash eventually. As Mr. Mukherjee stated organizations can aim to fully automize IT departmental works and help them ramp up their efficiencies and this in turn boosts the margins and cashflows of these organizations. It is not intended to give a pinpoint target share price via this thesis, but it is aimed to give a sense of the range of share prices that are deemed fair based on the mercurial engineering Palantir has at its core. In a nutshell, it is fair to say Palantir's stock has a lot to offer to high-growth investors.This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI