Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Daily FX Market Roundup October 29, 2019

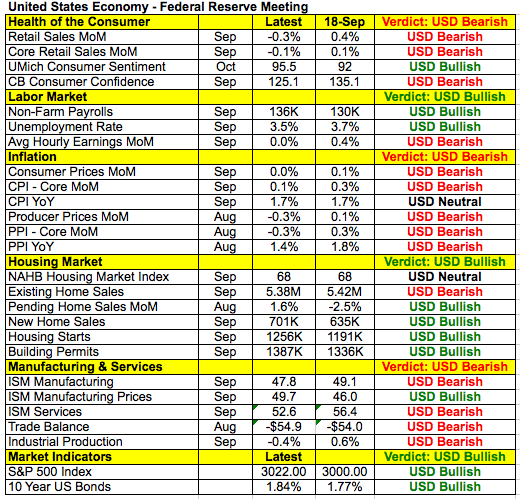

The Federal Reserve is widely expected to lower interest rates for the third time this year and the U.S. dollar is trading strongly ahead of the monetary policy announcement. USD/JPY hovers right underneath 109, its strongest level in nearly 2 months, which is unusual because the prospect of easing should be negative not positive for the currency. However with Fed fund futures showing a 94% chance of a cut, the performance of the dollar confirms that investors expect this to be the central bank’s last move of the year. If they are right, the dollar could extend its gains after the rate decision. Throughout this year, we’ve seen currencies rally after easing on numerous occasions including the September FOMC and ECB because of guidance, which sets expectations for forward-looking policy actions.

In the case of the Fed, an October cut would mark the third consecutive move by the central bank. The last time we had a series of back-to-back moves this long was in 2008. We know from the last policy meeting that the Fed is divided and there’s a subset of policymakers who do not believe further easing is necessary. Two FOMC members voted against a cut in September and that number goes up to five when non-voting members are included. Five who agreed with the cut that month did not see further moves this year.

The economy weakened since the last meeting with retail sales falling, wage growth slowing, prices easing and service-sector activity moderating. But there was also good news – the rate of unemployment in the U.S. hit a 50-year low, housing-market activity improved and stocks hit record highs. So while the central bank could justify another rate cut, it probably won’t be unanimous and Fed Chair Powell could downplay the need for additional moves. If that’s the case, USD/JPY will surge above 109 and could even hit 109.50 after the Fed lowers rates. We also expect a decent pullback in NZD/USD as the Reserve Bank of New Zealand is the last major central bank that could realistically lower interest rates this year.

However USD/JPY could see profit taking ahead of the rate decision. Third-quarter GDP numbers are scheduled for release and between the drop in retail sales and widening of the trade deficit, growth is expected to slow in the third quarter. Considering that the market is looking for the Fed to ease, no one will be surprised by softer numbers.

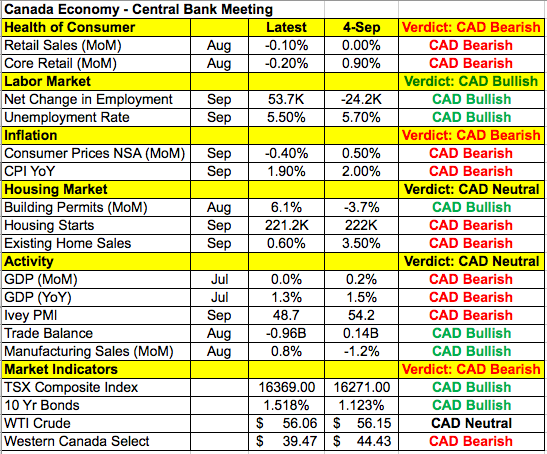

The Canadian dollar will also be in focus on Wednesday with a Bank of Canada policy announcement on the calendar. Although the moves in the greenback will be limited ahead of FOMC, if the Bank of Canada maintains their optimistic/neutral outlook, we could see new lows in the currency. When they last met, the BoC left rates unchanged and talked about the ongoing strength in the labor market, pickup in wages and overall strength in the economy. This time, they have to consider the impact of weaker consumer spending, lower CPI, softer GDP growth and moderation in housing. The labor market is still strong with Canada adding more than 50K jobs in September. Wage growth should be firmer as well but weakness in the rest of the economy along with the slowdown in the U.S. could lead to more cautious comments from the BoC. If that happens, Tuesday’s recovery in USD/CAD will turn into a sustainable bottom in the currency, especially if the U.S. dollar rallies.