Shares of U.S. regional banks rebounded early in the week of May 15 as investors shifted their focus from the prevailing crisis of confidence, which had precipitated the downfall of three banks in two months, to the pressing matter of the U.S. debt ceiling debate.

During the week, PacWest Bancorp (NASDAQ:PACW.O) witnessed a substantial surge of 25.93% but remained down 74.76% year-to-date. Similarly, Western Alliance Bancorp (NYSE:WAL.N) experienced a notable leap of 24.94% but was still down 41.33% year-to-date. Comerica Inc (NYSE:CMA.N) recorded a gain of 19.92%. KeyCorp (NYSE:KEY.N) added 9.23% while Fifth Third Bancorp (NASDAQ:FITB.O) climbed by 6.27%. The KBW Regional Banking Index (.KRX) rose 6.19% bringing its year-to-date performance to a loss of 27.34%. The S&P Financials sector rose 2.18% but it still suffered a 5.02% decline for the year.

Despite this rebound, concerns continue to linger within the banking sector, as evidenced by recent data revealing an ongoing decline in U.S. commercial bank deposits, coupled with a downturn in lending activity as companies encounter greater difficulty in securing loans. These prevailing circumstances point towards an inevitable reduction in spending. The imposition of stricter lending standards is expected to curb economic growth in the wake of the Federal Reserve’s tight monetary policy.

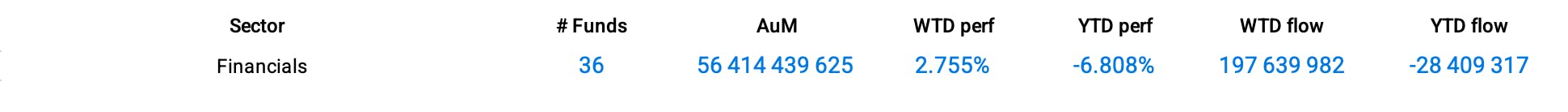

Group Data

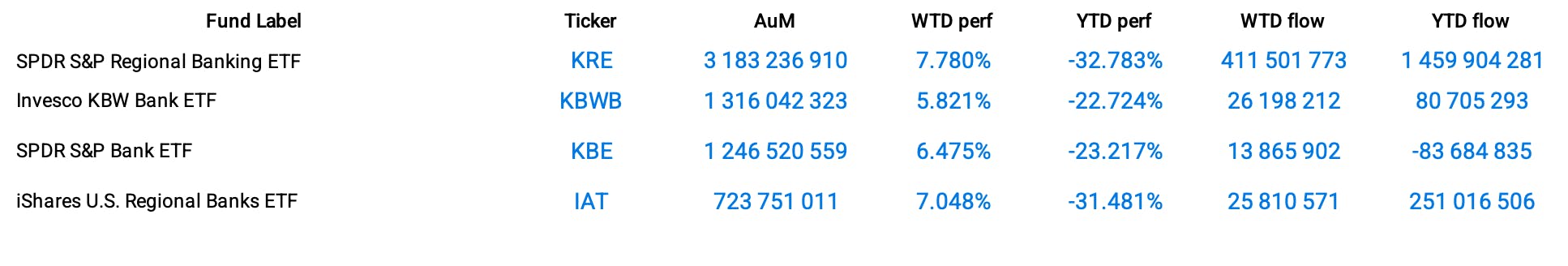

Funds Specific Data

This content was originally published by our partners at ETF Central.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI