As we roll into the last part of 2023, things seem to be quieter compared to the earlier months. Interest rates are holding steady, inflation has dropped a bit, and home prices in Ontario are on a decline. The Ontario housing market is acting just like it usually does during the winter season.

According to the Canadian Real Estate Association (CREA), it turns out that home prices in Ontario usually dip by 1-2% in the winter. For example, in 2022, the average home price in Ontario went down by 1.5% from October to November. The number of home sales also tends to go down during the winter months. In 2022, home sales in Ontario dropped by 10.4% from October to November. So, it’s more a seasonal thing where the housing market takes a bit of a breather during the colder months.

As a prospective buyer, this means anyone who can afford the monthly payment for a mortgage for their new home or is comfortably able to pay rent for their current place which is equivalent to or closer to the monthly mortgage of their future house; is in for a market that is quite favourable to buyers.

WHY SHOULD YOU CHOOSE THE WINTER MARKET?

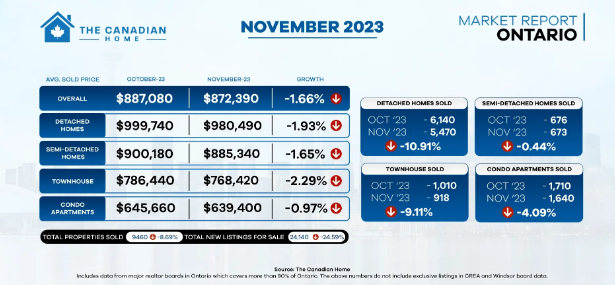

At the end of September, homes were selling for an average of $891K, but by November, the price dropped to $874K—a 2% decrease. This downward trend is expected to continue in the coming months. Additionally, there's a notable 16.32% decrease in the number of homes sold from quarter three to quarter four. This indicates that the winter housing market in Ontario heavily favours buyers, giving them strong negotiation power.

If you are considering taking advantage of the opportunities in the winter slowdown, time is of the essence. Manoj Karatha, Broker of Record for The Canadian Home, points out that "while home prices are falling, so is supply. The numbers reveal that supply is decreasing faster than demand. As a result, there's a high possibility that prices may start rising again by the end of the winter season or even beyond. So, if you're looking to make a move, now is the time to act."

In Ontario alone, from September 2023 (end of Q3) to November 2023 (middle of Q4) the number of new listings has decreased by 34.07%, which is double the decline in transactions. Given that new listings are unlikely to surge until April (spring season), and when they do, a 5%-10% increase in average prices can be anticipated (as per CREA and WOWA), it is financially prudent to consider buying at this juncture.

WHAT YOU NEED TO KEEP IN MIND?

As 2023 comes to a close, the Bank of Canada maintains steady rates, and inflation shows a decline, financial experts are turning their attention to the policy rate outlook for 2024. Notable entities such as The Financial Post, Bloomberg, and TD (TSX:TD) Economics predict a policy rate ranging from 4.25% to 4.75% by April 2024. If this forecast materialises, the spring season could witness a substantial surge in home prices, creating a fiercely competitive market where buyers may find themselves with minimal negotiation power.

Robin Cherian, CEO of The Canadian Home, anticipates potential price increases in the upcoming period, especially during the spring season. Despite the expected fall in interest rates, Cherian notes that they are projected to remain below the levels seen during the height of the COVID-19 pandemic, likely hovering around 4.75%. In light of this, he suggests that homebuyers may face a choice between lower home prices or lower interest rates, advocating for the former. He advises seizing the current stability in interest rates during the winter season and opting for lower home prices rather than waiting for potentially lower rates in the future.