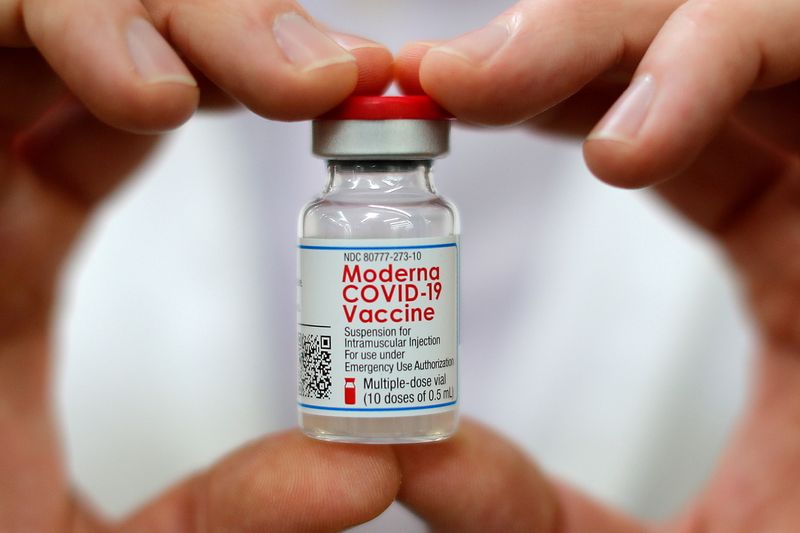

In a turbulent market environment, Moderna Inc . (BMV:MRNA) stock has recorded a new 52-week low, dipping to $41.52. The biotechnology company, known for its pivotal role in developing one of the first COVID-19 vaccines, has faced a challenging year, with its stock price reflecting a significant downturn. Over the past year, Moderna (NASDAQ:MRNA)'s shares have plummeted, marking a 1-year change of -44.81%. This decline has been influenced by a combination of factors, including investor concerns over vaccine demand sustainability and the broader market volatility affecting the biotech sector. Despite the company's efforts to expand its vaccine portfolio and advance its mRNA technology platform, the stock has struggled to regain momentum, leaving investors watchful for signs of recovery.

In other recent news, Moderna Inc . has received Health Canada's approval for its RSV vaccine, mRESVIA, marking the vaccine as the first mRNA product targeting RSV to gain approval in Canada. The vaccine's approval follows its authorization in the United States, Europe, and Qatar. Moderna plans to make mRESVIA available in Canada in early 2025, further expanding its global presence in mRNA vaccines.

Moderna also reported a robust financial performance for the third quarter of 2024, with revenues reaching $1.9 billion and net income standing at $13 million, outperforming consensus estimates by 50%. Despite challenges with its RSV vaccine, the company maintains its annual product sales estimate between $3 billion to $3.5 billion.

TD (TSX:TD) Cowen has revised its price target for Moderna, lowering it to $55 from the previous $60, while keeping a Hold rating on the stock. The firm cites recent developments at Moderna, including the expected submission of new vaccine candidates, as the reason for this adjustment.

Furthermore, Moderna is expected to announce top-line data for its cytomegalovirus (CMV) vaccine candidate by the end of the year, and plans to submit its next-generation COVID-19 vaccine, mRNA-1283, and its combination flu/COVID vaccine, mRNA-1083, for regulatory approval by the end of this year.

In addition to these developments, Moderna is set to buy its Norwood campus for $400 million, with the deal expected to close in December 2023. The company also plans to file for multiple vaccine approvals in 2024 and aims for 10 product approvals in the next three years.

InvestingPro Insights

Moderna's recent stock performance aligns with several key insights from InvestingPro. The company's shares are currently trading near their 52-week low, with InvestingPro data showing a significant 67.16% price decline over the past six months. This downward trend is further emphasized by the stock's 48.77% drop in the last three months, reflecting the market's ongoing concerns about Moderna's future prospects.

InvestingPro Tips highlight that Moderna holds more cash than debt on its balance sheet, which could provide some financial stability during this challenging period. However, the company is also quickly burning through cash, a factor that may contribute to investor unease. The relative strength index (RSI) suggests the stock is in oversold territory, potentially indicating that the sell-off may be approaching its limit.

For investors seeking a more comprehensive analysis, InvestingPro offers 16 additional tips that could provide valuable insights into Moderna's financial health and market position. These additional tips could be particularly useful for understanding the company's trajectory in the post-pandemic vaccine market.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.