By Laura Sanchez

Investing.com - As if investors weren't already nervous enough, The Wall Street Journal's economic analyst Nick Timiraos has added fuel to the fire and just released a new report showing a preview of the FOMC.

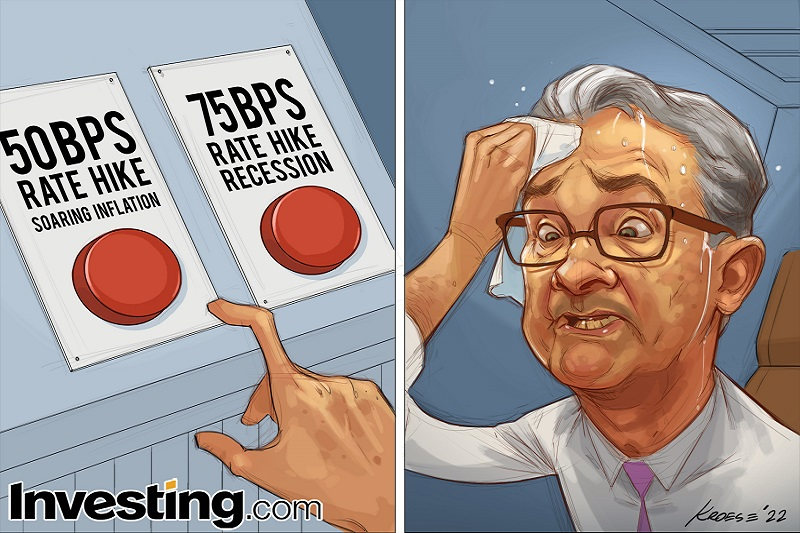

"A series of concerning inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a higher-than-expected 0.75 percentage point interest rate hike at their meeting this week," he writes.

The report is entirely speculative, but experts point out that the Fed has on occasion taken advantage of WSJ reports to leak new strategies.

However, the consensus is still for a 50 basis point hike at tomorrow's meeting.

"There is an increase in implied Fed Funds futures probabilities for Wednesday's meeting that comes with this, with a 57% probability of 75bp now," WSJ reports.

The report notes that Fed officials said their 50 bp signals were conditional on inflation developments. And, as we saw last Friday, the data has been higher than expected.

"Such data could alarm Fed officials because they believe that such expectations can be self-fulfilling," warns Timiraos.