I focus almost entirely on crude oil.

It has been well documented in articles and long opined on the influence OPEC has on the price of oil. This article is not about whether that influence has faded or is more diluted due to the US shale contribution to US output. All points that I'm sure others who write about the oil markets will address and traders debate.

This article is about one simple, reasonable question, that no one seems to be writing about or discussing on TV.

Why would an OPEC output freeze "NOW" have any price stabilizing affect whatsoever or assist in re-balancing the global over supply issue?

Remember that April DOHA Meeting.

No?

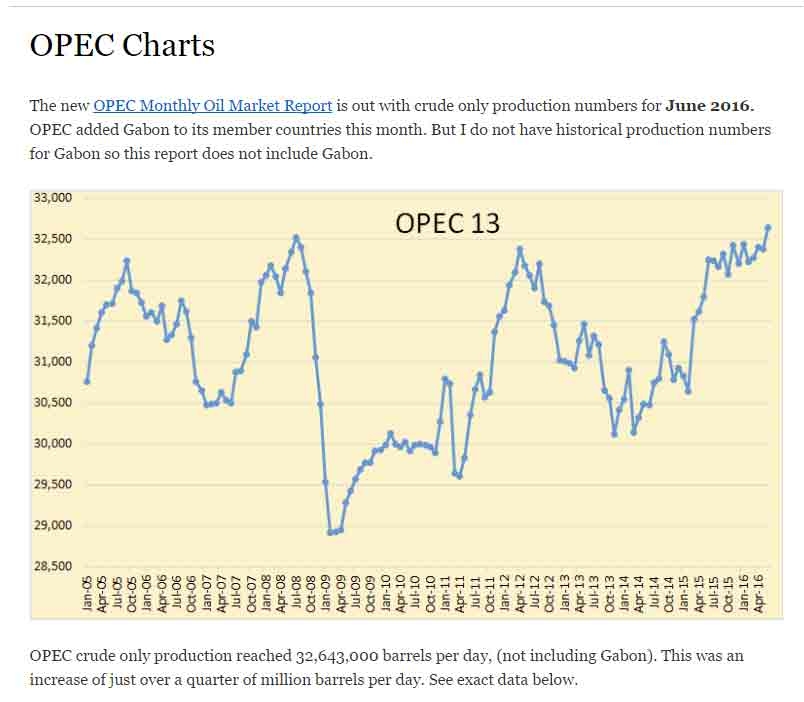

That's because it never happened. Too many OPEC members squabbling with each other and giving conflicting press statements which ultimately led OPEC to abandoned the April DOHA meeting it in favor of a June Qatar meeting. Fast forward a month to Qatar...and that meeting produced no results to freeze production. The basis of my simple question is in the Qatar's meeting primary goal. It centered around members agreeing to freeze total OPEC output at January 2016 levels. Most who study member output know that the only OPEC members with spare production capacity are the Saudi's and Iran. Iran's argument in Qatar was after having withstood long standing crippling sanctions now removed, they would not even consider freezing production. In fact, they publicly stated their intention was to get to full capacity as quickly possible. In January OPEC produced roughly 32.3M bpd (see below chart_1).

That record production OPEC wanted to freeze, was the result of a largely Saudi decision made in December 2014, to flood the global oil markets to keep market-share. They needed to prevent Iran from taking back the market-share the Saudi's gained while Iran was under sanctions and also deal with the growing threat of large production gains in the US due to shale.)

Now, OPEC is deploying the oldest trick in the book. It’s one every single oil trader falls for regardless of how many times OPEC does it, and ironically know how the trick ends. “Let’s announce another meeting and say it's discuss a possible output freeze and drive price higher between now and the meeting time”. OPEC has recently made such an announcement and right on time...traders have reacted just like every other time OPEC jawbones this idea of an output freeze. The price of oil is up over 20% in 10 days. However, now OPEC is proposing a production freeze at current levels. Currently OPEC is producing in excess 33M bpd (see below chart_1). The attached chart is only 10 years of OPEC production. But go back even 30 years and it appears OPEC is pumping more oil than EVER. I cannot find in my research EVER a time OPEC produce and dumped more oil on the global markets than now.

So the current proposal is at even higher levels than the last time they bamboozled oil traders with talk of an output freeze…. so forgive when I ask….

Why would an OPEC output freeze "NOW" have any price stabilizing affect whatsoever or assist in re-balancing the global over supply issue

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI