- The 13F updates for Q1 2024 reveal major fund managers' early-year performance and sector focuses, available via InvestingPro.

- Warren Buffett invested $6.7 billion in Chubb and reduced his Apple holdings by $19.9 billion, signaling a defensive shift.

- Bill Gates sold Berkshire Hathaway and Microsoft shares, while Ray Dalio focused on tech, notably increasing investments in Alphabet, NVIDIA, and Apple.

The highly-anticipated 13F updates for the first quarter of 2024 have been released, revealing how major fund managers have performed early in the year. These documents allow retail investors to see which sectors financial experts are focusing on and which stocks they are selling.

InvestingPro provides one-click access to 13F statements from the best-known market professionals in the United States. To start, you can subscribe to InvestingPro+ by clicking HERE and taking advantage of the MAY DISCOUNT (more information at the bottom of the analysis).

By visiting the "ideas" section of InvestingPro and selecting the name of the fund manager you want to learn more about, you can access SEC documents and other relevant data on their holdings, including classification tables with major sales and purchases, sector concentration, and position summaries.

The overall picture of stock movements shows how Wall Street professionals are preparing for more volatility after the rally in late 2023 and early 2024. Notably, some seem to be shifting away from tech to focus on defensive sectors such as retail, consumer goods, and insurance. However, there are always those who prefer growth stocks. Let's take a look at the portfolios of three major investors.

InvestingPro provides one-click access to 13F statements from the best-known market professionals operating in the United States.

Buffett Raises Guard

One can only begin with an investor who, despite being known to everyone, never ceases to amaze the markets. The reference, of course, is to Warren Buffett, who, after asking the SEC to keep his latest big buy secret for three quarters in a row, has finally revealed his cards. The Oracle (NYSE:ORCL) of Omaha, in fact, disclosed in the 13F update that arrived yesterday the mystery stock he has decided to bet on.

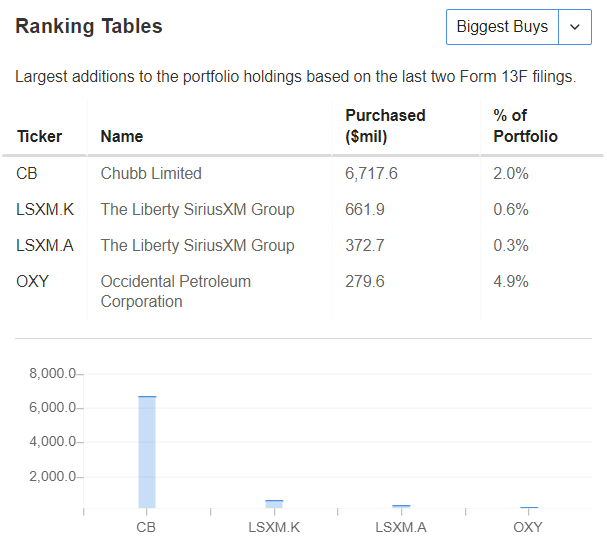

It turns out to be Chubb (NYSE:CB), a leader in property and casualty insurance, in which Buffett has invested as much as $6.7 billion since September 2023.

So, the most famous investor of all time is sticking to his beliefs and moving into a field well known to him. Now, the insurance company occupies the ninth place by weight within Buffett's portfolio, comprising 2 percent of the total.

After the news, Chubb's stock jumped, gaining more than 8 percent in after-hours trading.

Source: InvestingPro

In recent months, the Berkshire Hathaway (NYSE:BRKa) (NYSE:BRKb) owner also decided to invest in shares of Liberty SiriusXM (NASDAQ:LSXMA), an entertainment company, and to increase his position in Occidental Petroleum Corporation (NYSE:NYSE:OXY).

In contrast, Buffett has taken profits in Apple shares (NASDAQ:AAPL) (with a massive sale of over $19.9 billion in the last two quarters), which remains his largest holding with a 40.8% weighting in the portfolio.

The big picture shows that the American billionaire has chosen to approach the second quarter of the year with a more defensive stance, focusing on insurance and commodities and reducing his tech holdings. Finally, Buffett also sold all his HP (NYSE:HPQ) shares, cashing out $687.6 million over the past two quarters.

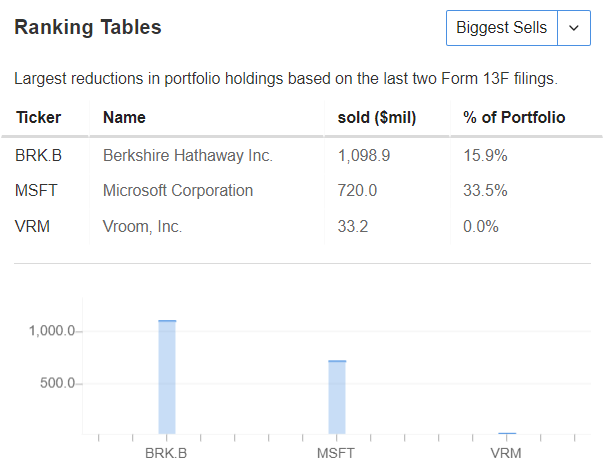

Bill Gates sells Buffett

Bill Gates also adopted a defensive strategy, moving to cash out just with Buffett's Berkshire Hathaway shares, selling more than 2.6 million of them in the last quarter, and with those of his Microsoft (NASDAQ:MSFT), with a 4.48 percent reduction in shares and an overall -1.52 percent impact on the portfolio.

Source: InvestingPro

On the buy side, however, Gates preferred not to move more in 2024, waiting for the right opportunity. The biggest deal in the past 2 quarters involves Walmart (NYSE:WMT), with the computer scientist betting $364.6 million on the retail chain, bringing the stock's specific weight in his portfolio to 1.2%.

Ray Dalio Goes All-In

On the other hand, the one who thinks differently from the other two "colleagues" and shows that he does not trust Americans' propensity to consume that much is Ray Dalio.

Indeed, at the top of the largest sales by the founder of Bridgewater Associates, the world's largest hedge fund, are all companies that work with consumer goods: Costco Wholesale Corp (NASDAQ:COST) (-111.9 million between the end of 2023 and the beginning of 2024), Coca-Cola (NYSE:KO) (-104.9 million), PDD Holdings Inc (NASDAQ:PDD) (-103.7 million) and Procter & Gamble (NYSE:PG) (-87.1).

In contrast, the investor decided to focus on tech, buying Alphabet (NASDAQ:GOOGL) (+501.8 million over the past 2 quarters), NVIDIA (NASDAQ:NVDA)(+394.1 million) and Apple (+315.7 million).

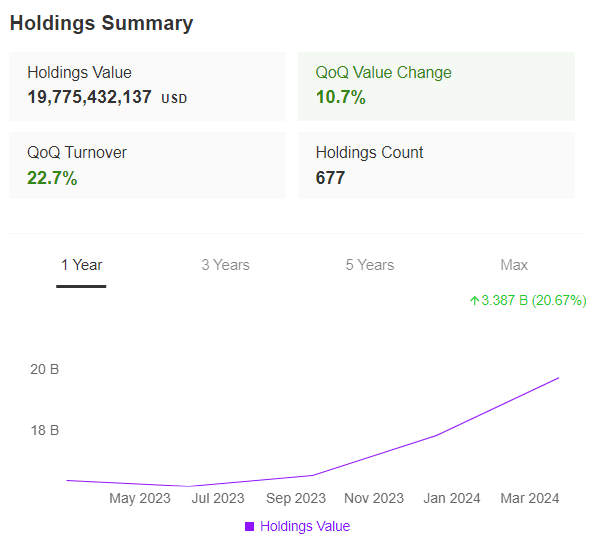

Over the past three months, stock picks have rewarded Dalio, who among the 3 big men of finance we analyzed today was the one who managed to achieve the highest return of +10.7 percent while Gates stopped at 8.5 percent and Buffett went on a 4.5 percent loss

At the same time, among the 3, Dalio is also the investor who has rotated his portfolio the most, with a quarterly turnover of 22.7% compared to Buffet's 6.4% and Gates' 4.2%. All that remains is to wait for the next 13F update to see who will prevail between the former's more unscrupulous approach or the other two's more defensive approach.

DISCOUNT CODE

Want to invest like a Pro?

Take advantage of a special discount to subscribe to InvestingPro+ and take advantage of all our tools to optimize your investment strategy.

You will get a number of exclusive tools that will enable you to better cope with the market:

- ProPicks: equity portfolios managed by a fusion of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide immediate insight into the potential and risk of each stock.

- Advanced Stock Screener: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!