The United States represents about half of the world market cap—the value of shares of all companies globally. While that may seem like a giant piece of the pie, international markets, which make up the other half, offer an abundance of investment opportunities. Combining international investments with US investments, especially in a long-term portfolio, can result in better diversification as holdings don't necessarily always move in lockstep.

We've already addressed region and country specific exchange-traded funds (ETFs) offering exposure to Europe, China, India and Emerging Markets. ETFs that operate in the US can provide investors access to stocks that trade on foreign indices.

Below we'll look at two additional ETFs designed to track Australia and Mexico's indices, two of the top 20 economies by gross domestic product (GDP):

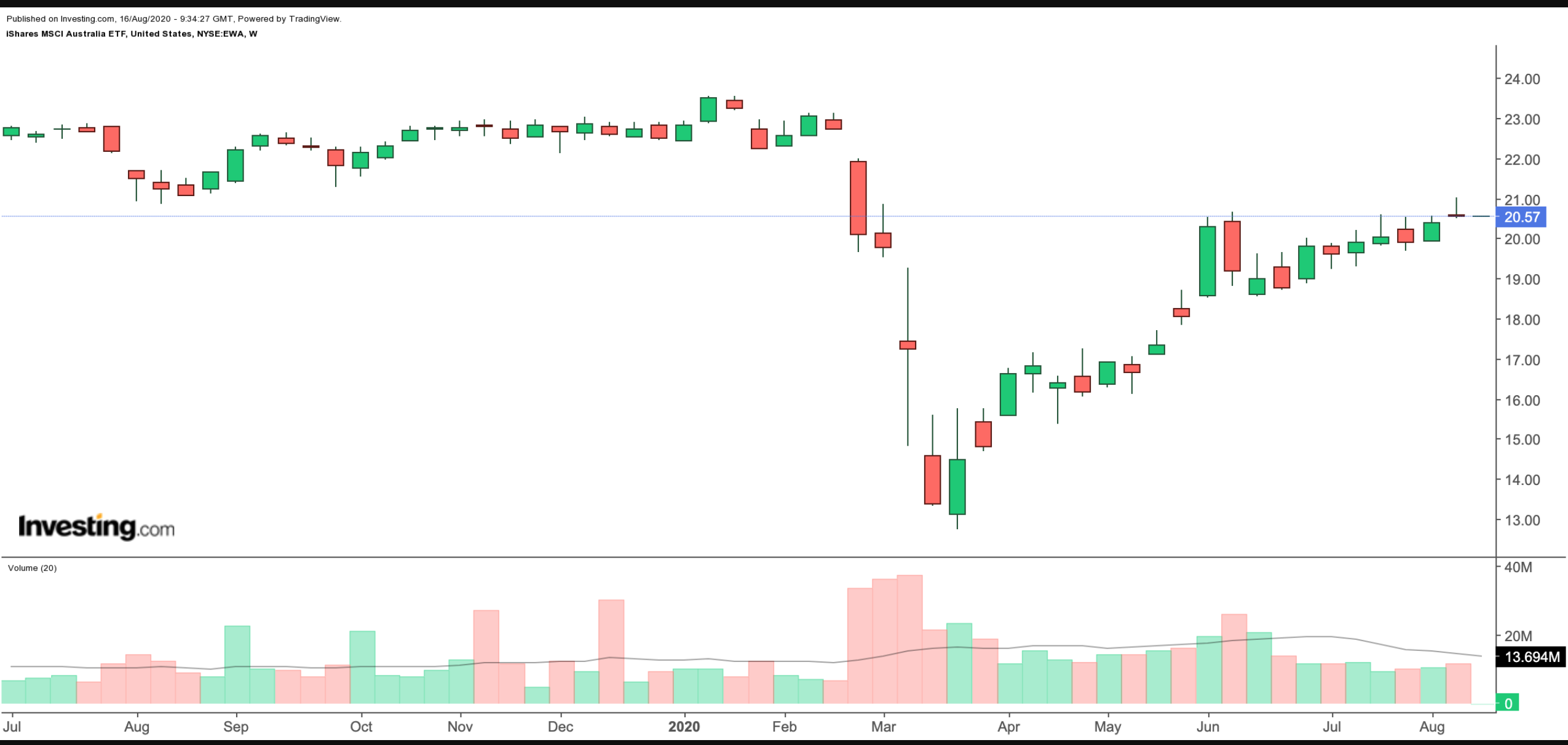

1. iShares MSCI Australia ETF

- Current level: $20.57

- 52-week range: $12.73-$23.54

- Dividend yield (12-month trailing): 3.7%

- Expense Ratio: 0.50% per year, or $50 on a $10,000 investment

The iShares MSCI Australia ETF (NYSE:EWA) provides exposure to large and mid-sized companies in Australia. EWA, which currently has 65 holdings, tracks the MSCI Australia index.

The top three companies are Commonwealth Bank Of Australia (ASX:CBA), CSL (ASX:CSL) and BHP Group (ASX:BHP). They comprise around 28% of net assets, which stand over $1.2 billion.

EWA's P/E and P/B ratios stand at 16.42 and 1.96, respectively. Year-to-date, the fund is down 9.14%. However, since hitting a 52-week low in late March, EWA has increased by more than 60%, so $1,000 invested in EWA in late spring would not be worth around $1,600.

As the world's 14th largest economy, Australia is regarded as stable and low-risk, making the iShares ETF and other Australia ETFs appealing to those looking to boost long-term portfolios with diversification from international markets.

Adding to the strong case for Australia, the nation is ranked AAA by global agencies, such as Standard & Poor's, owned by S&P Global, Fitch and Moody's. This strong credit rating helps investors gauge Australia's creditworthiness and has a significant impact on the country's borrowing costs.

Investors may want to monitor five important industries for the nation, including energy and resources, financial services, education, tourism and agricultural business. For example, Australia is among the top producers of iron ore, uranium, gold and agricultural commodities.

For those considering EWA, short-term profit-taking could potentially push EWA lower in the coming weeks, creating a better entry point.

2. iShares MSCI Mexico ETF

- Current level: $34.68

- 52-week range: $25.03-$48.19

- Dividend yield (12-month trailing): 1.71%

- Expense Ratio: 0.49% per year, or $49 on a $10,000 investment

The iShares MSCI Mexico Capped ETF (NYSE:EWW) provides exposure to a broad range of companies in Mexico. EWW, which currently has 46 holdings, tracks the MSCI Mexico IMI 25/50 index.

The top three companies are America Movil (MX:AMXL), Walmart De Mexico (MX:WALMEX) and Fomento Economico Mexicano (MX:FEMSAUBD). They comprise around 38% of net assets, which stand over $800 million.

EWW's P/E and P/B ratios currently stand at 14.05 and 1.76, respectively. Year-to-date, the fund is down 22.98%. However, since hitting a 52-week low in late March, EWA has gained by more than 38%.

According to the foreign trade statistics released by the US Census Bureau, Mexico is the top second trading partner, behind Canada, of the US in terms of goods exchanged. Therefore, as the world's 15th largest economy, Mexico holds an important place for the US economy.

In 2018 and 2019, both Mexican stocks and the peso were volatile, in part due to the rhetoric on tariff wars. While investors were optimistic about a healthy 2020, the pandemic shifted the sentiment significantly. The plunge in crude oil in the early part of the year hasn't helped Mexico's natural resources industry either.

Mexico will likely receive more attention in the coming weeks ahead of the US Presidential election of November. Mexican stocks may once again become volatile, however, we believe long-term investors can find value in EWW if the price drops toward $30 or below.

The Bottom Line

Country-specific ETFs offer diversification and index tracking benefits at relatively low cost. They can potentially be used by a wide range of retail and institutional investors for long-term passive investment, short-term speculative trading, tactical asset allocation, hedging as well as arbitrage. In the coming weeks, we plan to cover other funds that specialize in specific countries.