Stocks finished yesterday's session flat after a big opening move, with the gains vanishing in the afternoon.

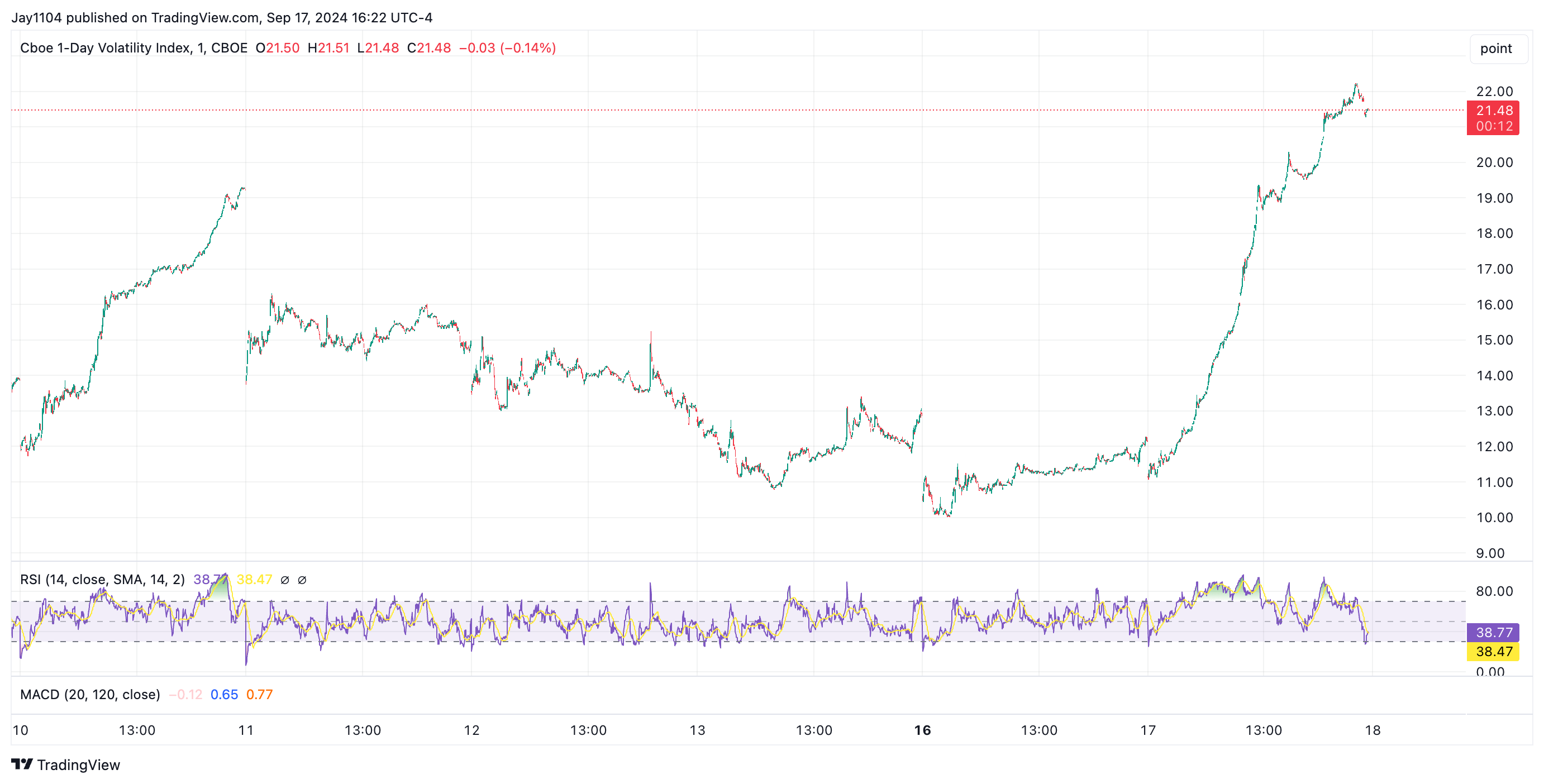

Implied volatility was bid for all day, and that is probably because there is a Fed meeting today. The VIX 1-Day rose to 21.5 from around 11 to start the day.

I wonder what could happen after the Fed's decision today. A volatility crush that pushes the S&P 500 higher regardless of what Powell has to say? Probably.

Of course, where that rally starts, where it goes, and how long it lasts is an entirely separate question. My guess is that implied volatility will likely keep rising this morning, which means stocks may very well start from a lower level heading into the FOMC meeting.

They could rally during the meeting as IV melts, but what happens afterward will depend entirely on what the Fed says.

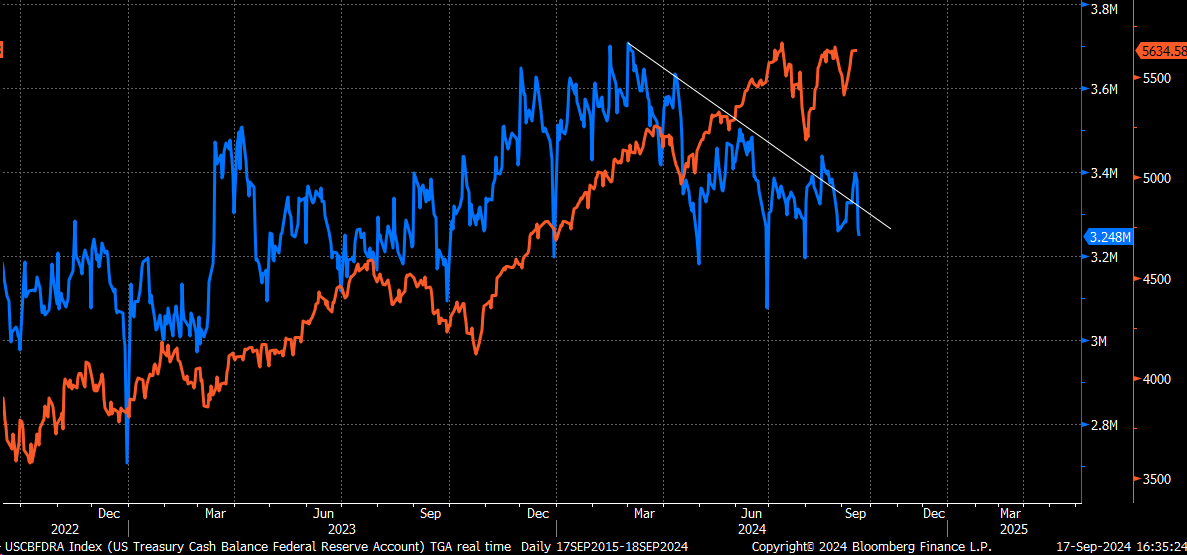

Yesterday, we saw how much the TGA (Treasury General Account) rose yesterday, which was pretty much as expected. This brought reserve balances down, and I’m estimating they are probably around $3.25 trillion right now.

Reserves should continue to decline as we approach quarter-end, with repo activity picking up and TGA levels stabilizing. It wouldn’t surprise me if reserves dip below $3 trillion by quarter-end, but we’ll see.

That doesn’t necessarily mean the SPX has to fall, but history suggests it does due to the draining of the reserve balance.

With that backdrop, let's consider 2 charts that show that the Nasdaq 100 and S&P 500 could be at risk of topping out, as the indexes battle key resistances.

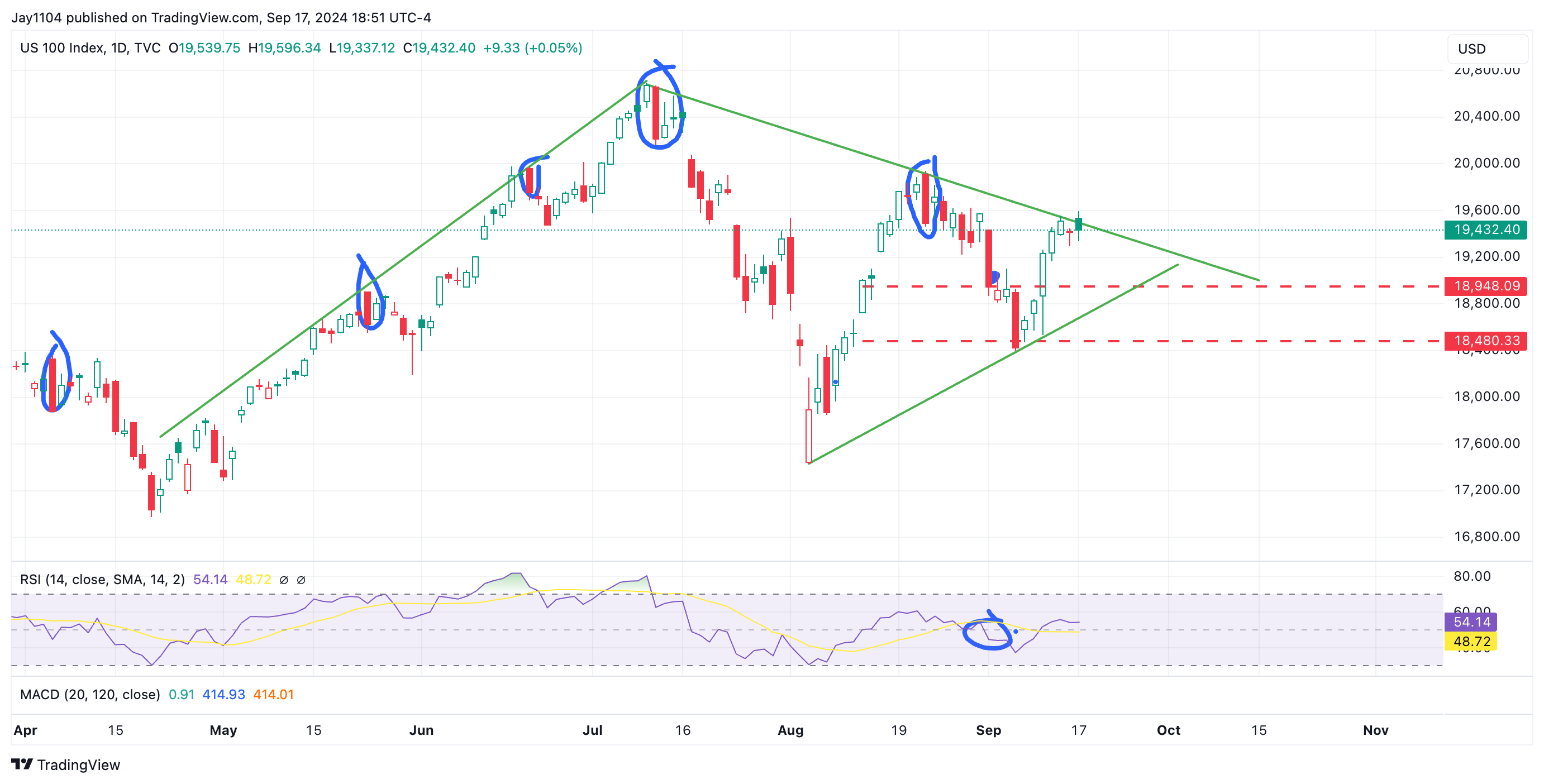

1. Nasdaq 100 Nears Resistance

Yesterday, the Nasdaq 100 100 hit resistance at the trendline and attempted to break out but couldn’t. The Nasdaq 100 is the index that matters because it’s been the leader, unlike the S&P 500 or the Dow, and it’s still 5.5% off its highs.

The trendline in the Nasdaq 100 is strong, and, for now, it’s keeping a lid on things. We’ll see if the Nasdaq 100 can break through the 19,450 level, but my guess will be that it won’t.

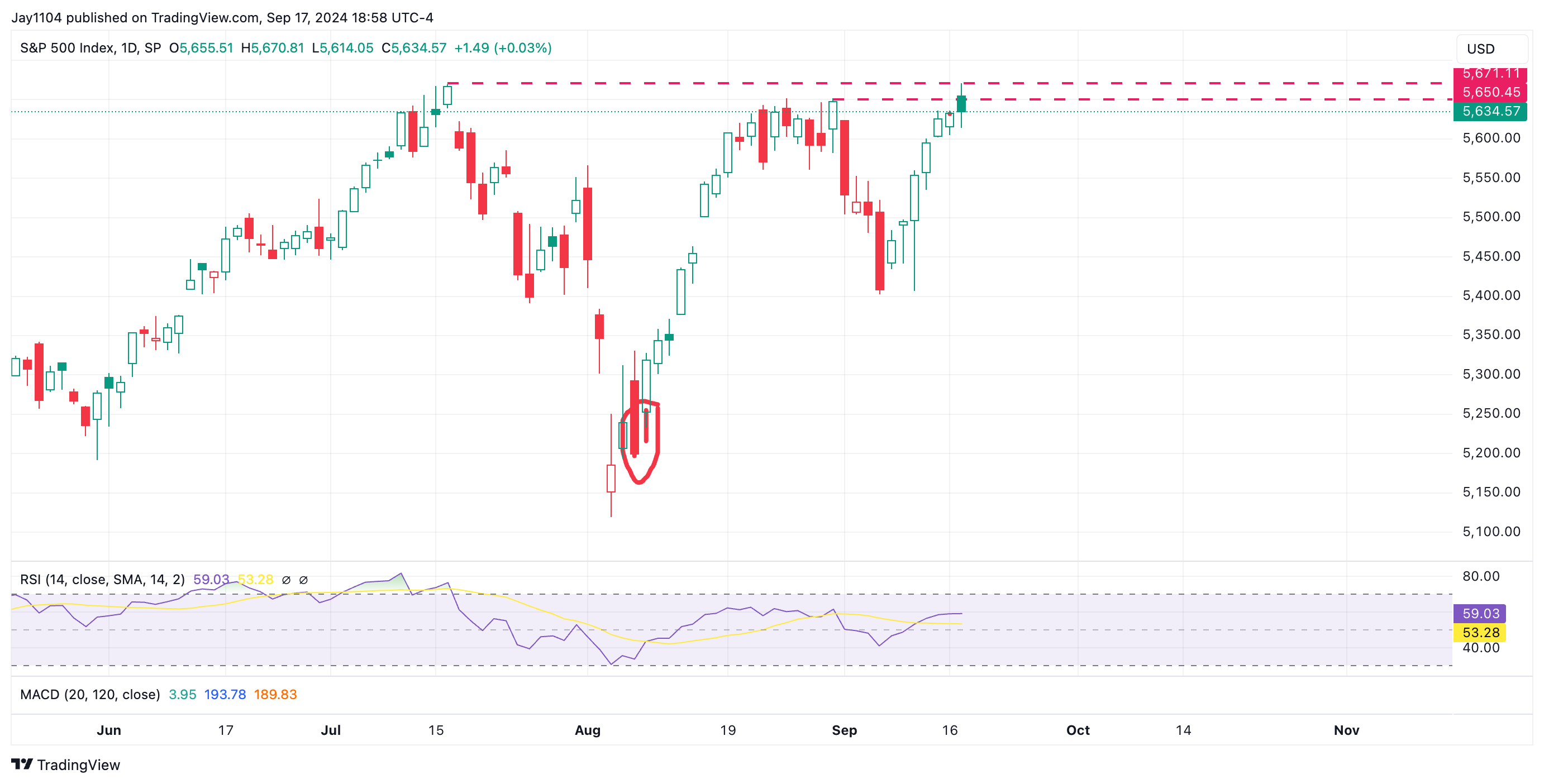

2. S&P 500 Topping Out?

It sure also looks like the S&P 500 put in a 2b top yesterday when yesterday’s high surpassed the high and closed below the price on August 30. If that is what it is, the rebound is over, and the next move is back down again.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI