- Earnings season is set to heat up, with majority of S&P 500 companies reporting in the coming weeks.

- PayPal and Spotify, currently trading at potentially undervalued levels, are under scrutiny as they aim to meet high expectations.

- A strong earnings report from these companies could reverse negative sentiment and spark a rally.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Earnings season kicks into high gear over the next few weeks, with over 60% of S&P 500 companies reporting in this period.

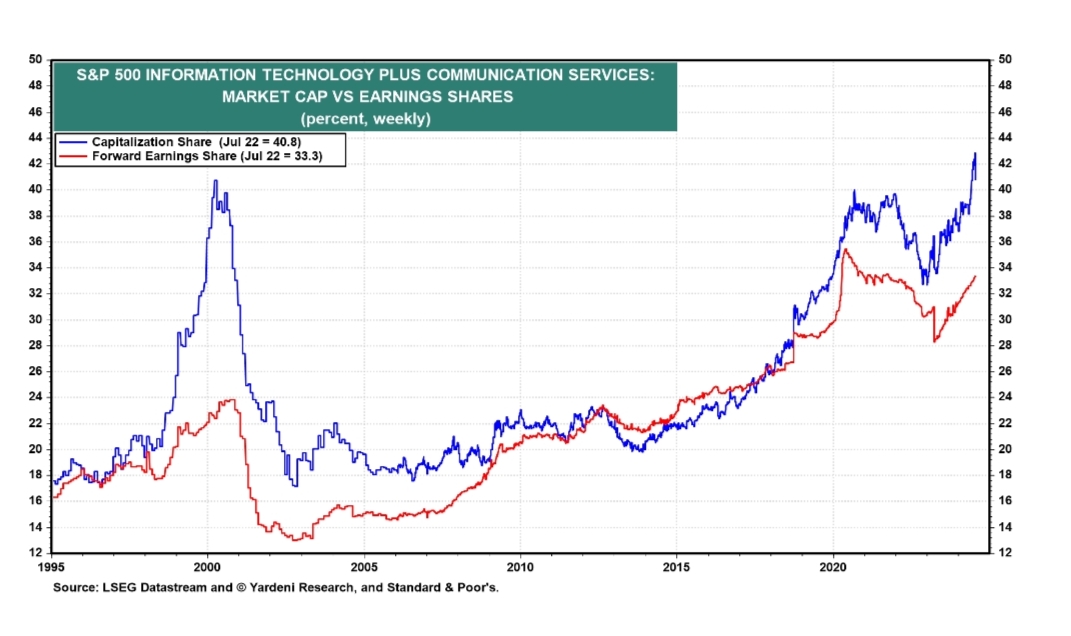

While healthy earnings growth has fueled the market's rise since October 2022, some stocks have seen valuations soar on less-than-ideal fundamentals. This raises concerns about whether their actual performance can live up to the hype.

However, not all companies are basking in the limelight. Some have faced negative sentiment due to recent price drops or other events.

But these very companies, one of them now trading at potentially undervalued levels, could surprise investors with better-than-expected results and spark a rally.

Today, we'll examine these two stocks' fundamentals in detail below: PayPal Holdings (NASDAQ:PYPL) and Spotify Technology (NYSE:SPOT).

1. PayPal: Can New Management Lead a Revival?

PayPal, the world's leading digital payments company, enters earnings season under new leadership with a clear vision.

Recent quarters confirm their strategy is on track, and despite sluggish stock price returns over the past three years, PayPal has a knack for exceeding analyst expectations (as the chart below demonstrates).

Source: InvestingPro

With negative sentiment still surrounding the stock, a strong earnings report could finally trigger a positive reaction. However, three key metrics will be crucial:

- YoY Active User Growth: A reversal of the previous decline and a return to consistent, positive growth is essential.

- Margins: The growth of white-label services like Braintree, which convert at lower rates than branded checkout, can impact margins. The recent adoption of innovations like Fastlane could improve this.

- Buyback: PayPal has allocated $5 billion in cash flow for share repurchases, but an early commitment to the program could further boost investor confidence, especially considering the current low share price.

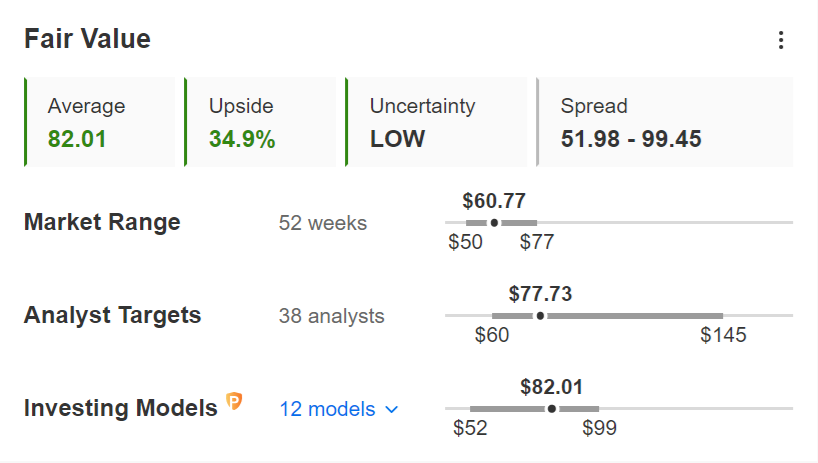

Source: InvestingPro

While PayPal appears undervalued, a significant turnaround requires a compelling catalyst. A strong earnings report addressing these key metrics could be the spark the stock needs.

2. Spotify: Can It Justify High Valuations Despite Losses?

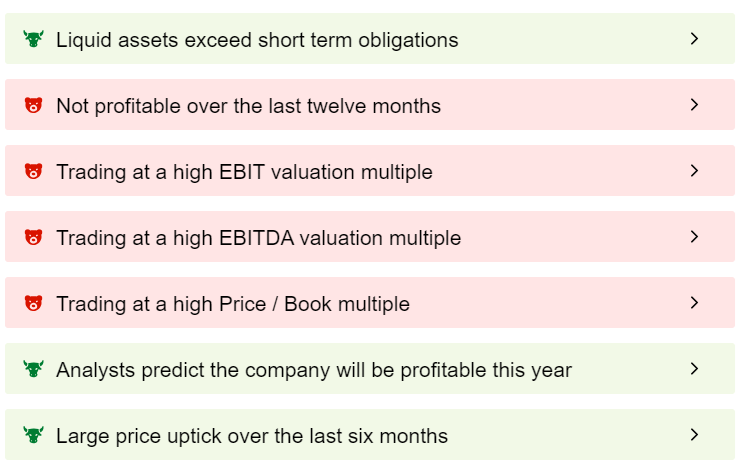

Spotify, the Luxembourg-based music streaming giant, heads into its earnings call with a curious mix of factors. While analysts recently revised their forecasts upwards, the company remains unprofitable and carries a hefty valuation.

Source: InvestingPro

On the surface, this wouldn't seem like an enticing investment opportunity. However, Spotify boasts a solid financial position with cash and near-cash assets exceeding current debt.

Additionally, their leading market presence and competitive advantage are undeniable.

Spotify's high valuations are a key focus for the upcoming earnings call. The aim is to present results that make the company's financial metrics more reasonable, as the current multiples are steep from any perspective.

Source: InvestingPro

The key takeaway for this earnings call lies not just in the numbers themselves, but in how the market interprets them for the future.

Historically, stock prices can fluctuate even after exceeding expectations. It's Spotify's ability to showcase a clear path towards profitability and justify its current valuation that will truly impact the stock price.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips.

Don't miss this limited-time offer!

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.