Since their launch on January 10th, the new spot Bitcoin ETFs have garnered significant attention, giving investors a fresh way to participate in the cryptocurrency market.

In the short time since their introduction, these ETFs have demonstrated excellent tracking of the Bitcoin spot price, a key factor in their growing popularity. Additionally, most providers have offered aggressive fee waivers, making these ETFs an even more attractive option for cost-conscious investors.

For those interested in exploring the full range of available options, our earlier roundtable covering all 11 spot Bitcoin ETFs is a must-read.

Now, if you're considering adding one of these ETFs to your portfolio but aren't quite sure how they might fit in, I have two ideas that could help. With the right approach and a clear understanding of your investment goals and risk profile, spot Bitcoin ETFs can offer a unique and potentially rewarding addition.

It's important to keep in mind, however, that these ETFs are highly volatile. As with any investment, especially in the relatively new and rapidly evolving cryptocurrency market, it's crucial to assess your risk tolerance and conduct your own research (DYOR) before making a decision.

The core-satellite approach

Considering the inherent volatility of Bitcoin, with a historical standard deviation of around 77%, it's clear that this asset class is not for the faint-hearted. For most investors, the most prudent way to incorporate Bitcoin into their portfolio might be through a core-satellite approach.

This strategy involves dividing the portfolio into two parts: the 'core', which is dedicated to more stable and diversified investments, and the 'satellite', reserved for more speculative and alternative assets.

In this context, Bitcoin, or more specifically, Bitcoin ETFs like the Bitwise Bitcoin ETF (NYSE:BITB) (BITB), would fall under the 'satellite' part of the portfolio. This segment is where you can allocate a smaller portion of your assets to higher-risk, potentially higher-reward investments.

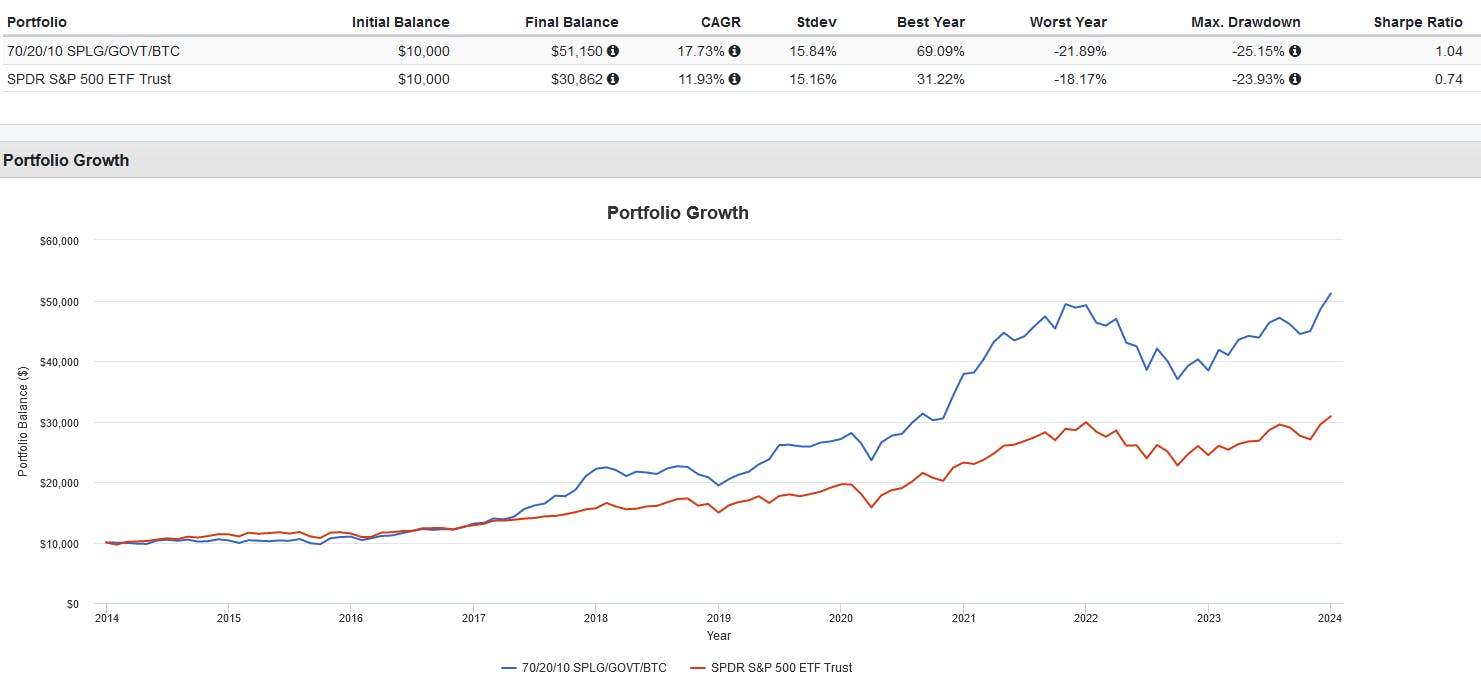

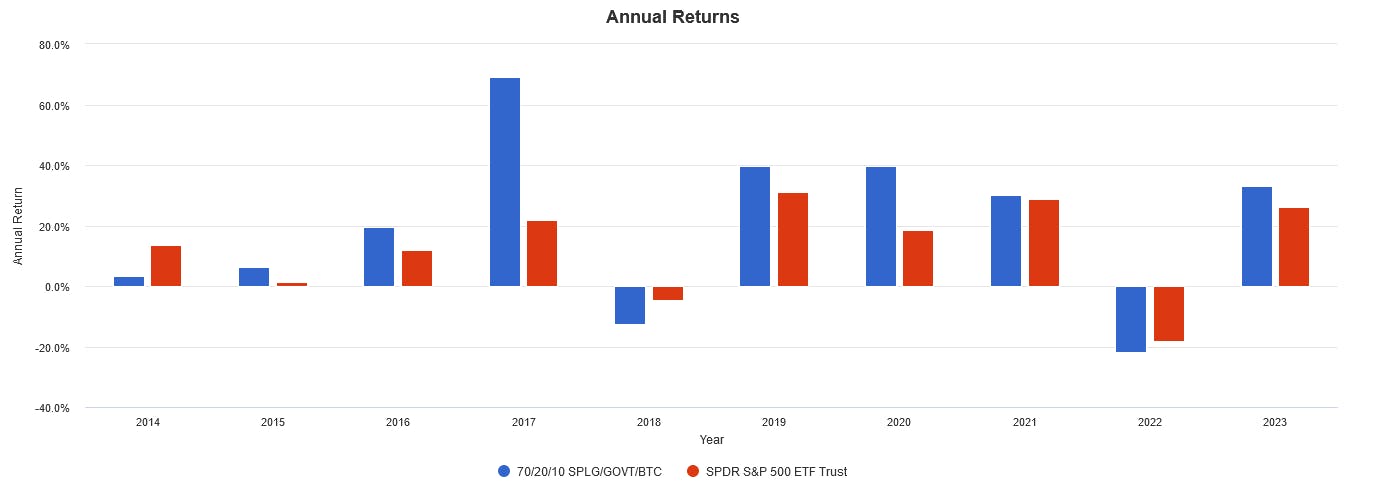

A suggested allocation could be 70% in a low-cost, broad-market equity fund like the SPDR Portfolio S&P 500 ETF (NYSE:SPLG) (SPLG), 20% in a stable and diversified bond fund like the iShares U.S. Treasury Bond ETF (NYSE:GOVT) (GOVT), and 10% in BITB for Bitcoin exposure.

This mix offers a well-rounded approach: SPLG provides a solid foundation of S&P 500 equities, GOVT covers the fixed income component with U.S. Treasury bonds, and BITB brings in the potential for high growth (and high risk) associated with Bitcoin.

The key here is balance – the stability of your core investments in SPLG and GOVT helps to mitigate the high volatility and risk that BITB brings to your portfolio.

The barbell approach

The volatility of Bitcoin indeed presents both risks and opportunities, making it a unique asset in an investment portfolio. Its history of sharp downturns is matched by periods of dramatic growth, such as in 2017 when Bitcoin surged by 1,271%, and again in 2020 with a 305% return.

This dual nature of Bitcoin – its potential for both steep declines and meteoric rises – makes it an intriguing candidate for a barbell investment strategy.

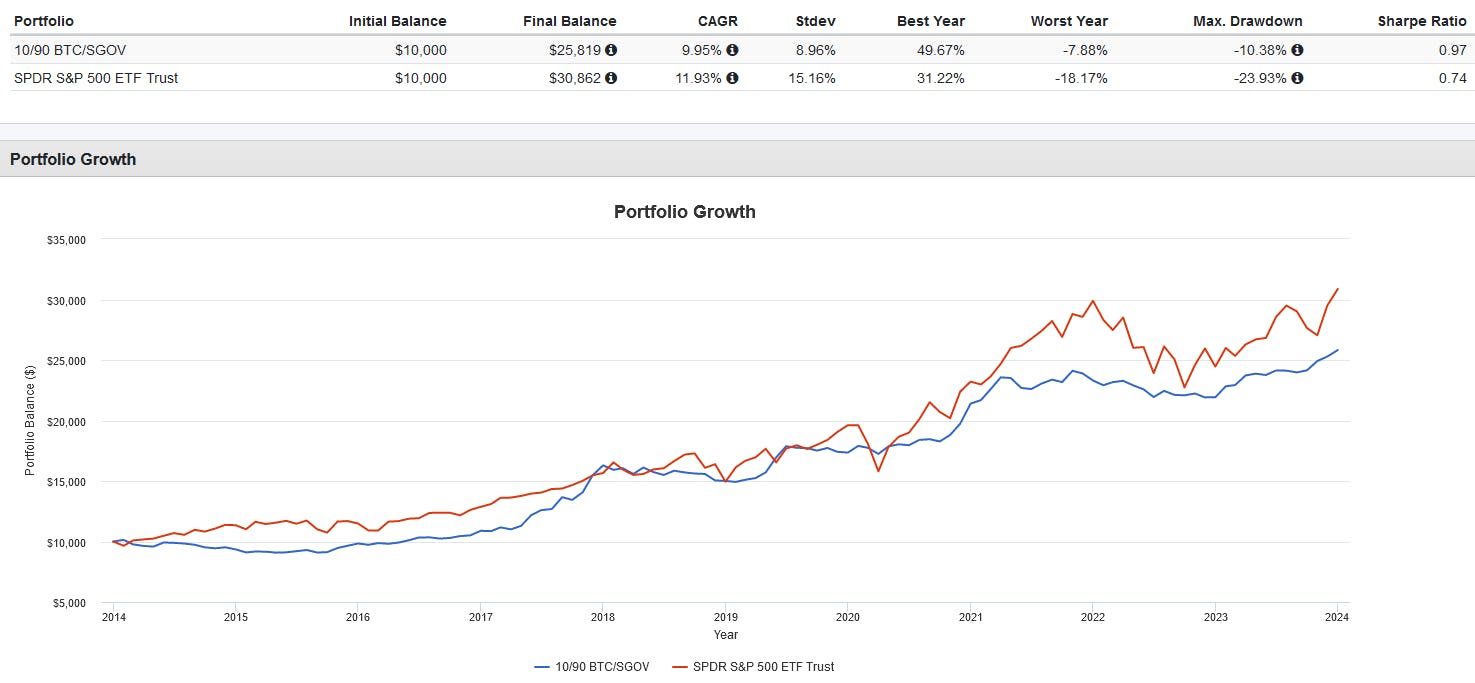

In a barbell strategy, the portfolio is divided into two extremes – one end holding very low-risk investments and the other end allocating to higher-risk, potentially high-reward assets.

A practical implementation of this strategy could be allocating 90% of your portfolio to a low-risk ETF like the iShares 0-3 month Treasury Bond ETF (NYSE:SGOV) (SGOV), and the remaining 10% to a Bitcoin ETF, such as the Grayscale Bitcoin Trust (BTC) (NYSE:GBTC) (GBTC).

SGOV, holding Treasury bills, offers stability and a degree of safety, currently paying a 5.11% 30-day SEC yield with monthly distributions. This forms the 'safe' end of your barbell. On the other end, GBTC provides exposure to the volatile yet potentially rewarding Bitcoin market.

The crucial element in this strategy is disciplined and mechanical rebalancing. This could mean rebalancing monthly or based on a predetermined threshold, such as if one asset moves 20% or more off its target weight.

This approach ensures that the portfolio maintains its intended risk profile and capitalizes on the potential upside of Bitcoin while buffering against its downside with the stability of Treasury bills.

This content was originally published by our partners at ETF Central.