- Coca-Cola and Procter & Gamble have outperformed the S&P 500 this year, making them attractive value plays amid rate-cut expectations.

- Both companies boast resilient business models, strong financial health, and a history of returning capital to shareholders through growing dividends.

- As consumer demand remains strong, these blue-chip giants are well positioned for further growth, offering stability and upside potential in uncertain markets.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro for less than $9 a month!

As market participants anticipate potential interest rate cuts from the Federal Reserve, certain value stocks have proven to be reliable bets in a shifting economic landscape.

Among them, Coca-Cola (NYSE:KO) and Procter & Gamble (NYSE:PG) stand out as two value giants worth considering.

Both companies have consistently outperformed the S&P 500 this year, with Coca-Cola shares up nearly 21% and Procter & Gamble gaining about 20%, compared to the benchmark’s 15% increase.

Source: Investing.com

With their strong financial health and resilient business models, these stocks offer investors a sense of stability, even in volatile markets.

1. Coca-Cola

- Year-To-Date Performance: +20.8%

- Market Cap: $306.3 Billion

Coca-Cola is a global beverage giant that offers a wide range of products, from its flagship soda to water, sports drinks, and juices. Its portfolio includes household names such as its namesake Coca-Cola brand, as well as Sprite, Fanta, and Powerade.

The company is well-positioned to benefit from several key factors, including its diversification beyond sugary drinks, and ongoing innovation in healthier and functional beverages.

With consumers shifting toward health-conscious choices, Coca-Cola’s ability to adapt through product innovation, such as its Coca-Cola Zero Sugar line, continues to drive demand.

KO stock - which touched an all-time peak of $73.53 on September 4 - closed at $71.17 last night, earning the Atlanta, Georgia-based beverage giant a valuation of $306.3 billion.

Source: Investing.com

Coca-Cola’s ability to navigate changing consumer preferences while maintaining leadership in the global beverage market ensures that it will remain a core holding for value investors.

As inflation cools and interest rates are poised to drop, Coca-Cola’s dividend yield, robust global distribution network, and pricing power should continue to attract long-term shareholders.

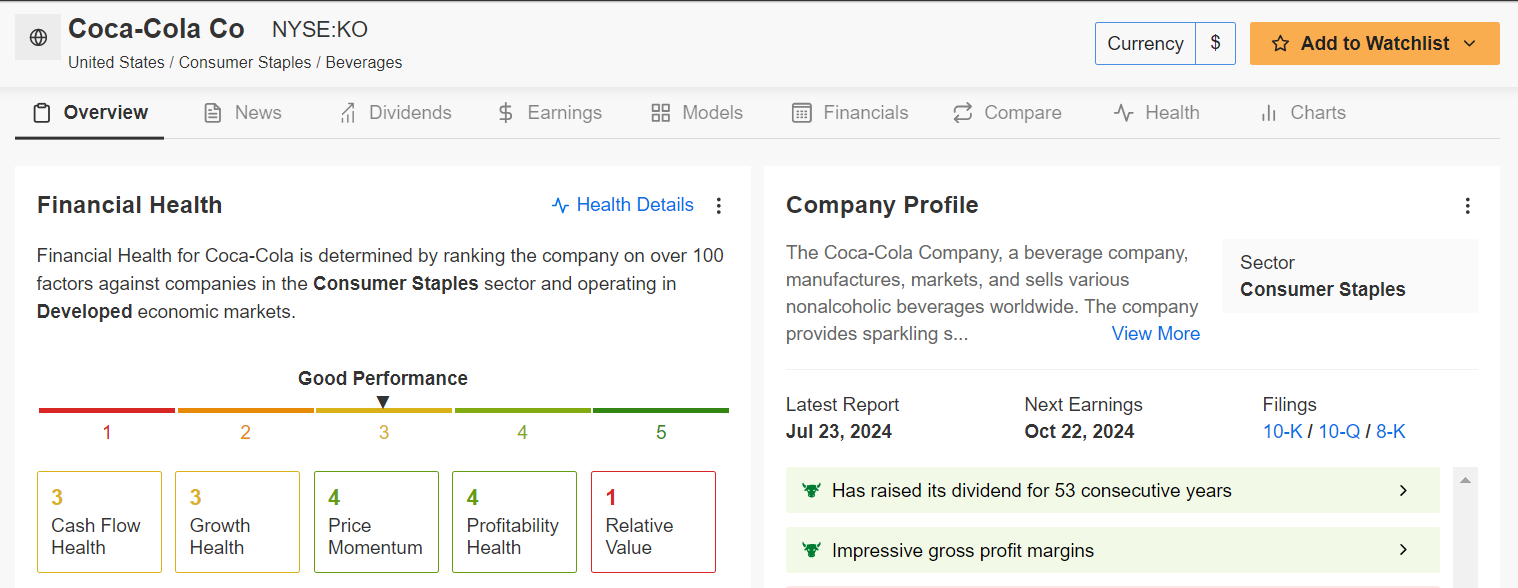

It should be noted that Coca-Cola boasts an above-average InvestingPro Financial Health Score, reflecting its resilient business model, high profitability, and solid cash flow generation.

Furthermore, the company has raised its annual dividend payout for 53 years in a row, earning the prestigious status of ‘Dividend King’.

Source: InvestingPro

With its steady growth prospects and strong track record of returning capital to shareholders through dividends, Coca-Cola is a standout value stock to own as market conditions evolve.

2. Procter & Gamble

- Year-To-Date Performance: +19.7%

- Market Cap: $411.8 Billion

Procter & Gamble is a global leader in consumer goods, offering a diverse portfolio of well-known brands in various segments, including beauty, grooming, health care, home care, and baby care. Iconic names under its umbrella include Tide, Gillette, Pampers, and Crest.

The global consumer products company is benefiting from several key tailwinds, including strong demand for essential goods and its ability to raise prices without significantly impacting volume sales. Additionally, its ongoing efforts to streamline operations, invest in digital initiatives, and expand in emerging markets are expected to drive long-term growth.

PG stock ended Thursday’s session at a fresh record high of $175.47, giving the Cincinnati-based consumer goods giant a market cap of $411.8 billion.

Source: Investing.com

P&G’s extensive range of essential household products positions it as a reliable company in both prosperous and uncertain economic climates.

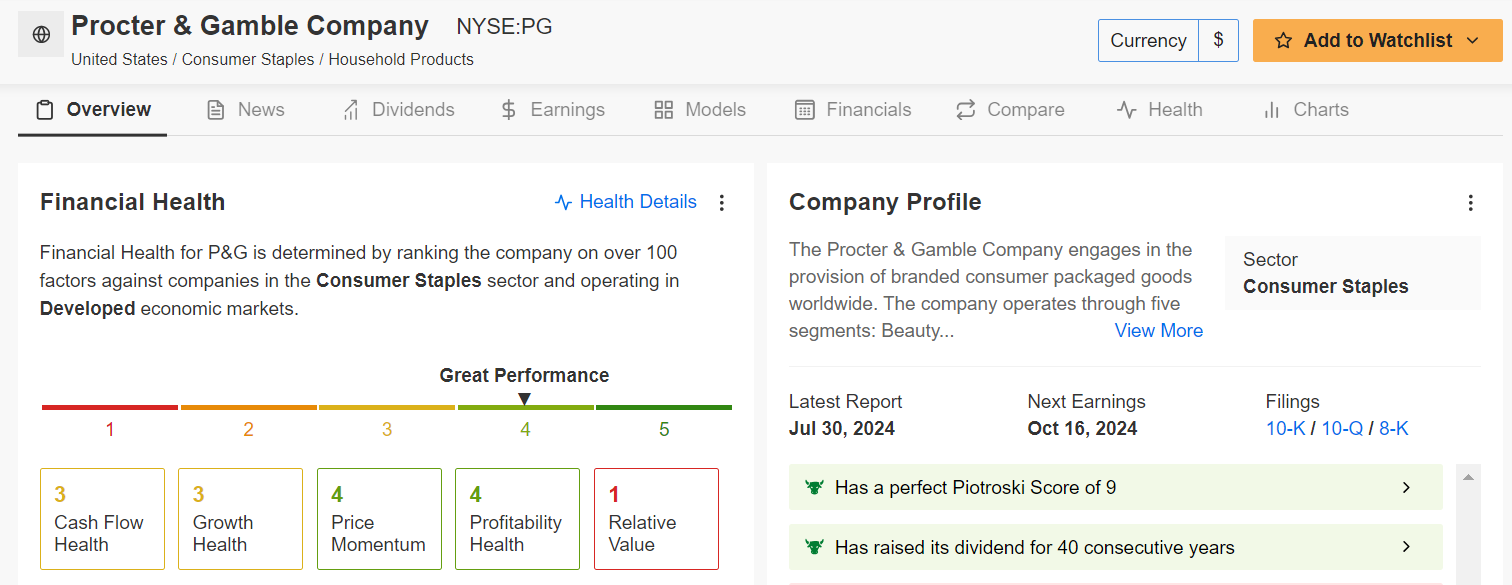

The company has also built a strong track record of returning capital to shareholders, increasing its annual dividend for 40 consecutive years, making it a compelling value stock to hold as the Fed approaches potential rate cuts.

With an above-average InvestingPro Financial Health Score, Procter & Gamble's business model is a testament to its operational efficiency and profitability.

Source: InvestingPro

Procter & Gamble’s consistent ability to deliver strong earnings growth, coupled with its resilient portfolio of essential products, makes it a defensive play in times of market uncertainty.

Conclusion

In the current climate, with investors bracing for multiple Fed rate cuts, Coca-Cola and Procter & Gamble stand out as value giants that offer stability, growth, and income.

Both companies have demonstrated resilience, consistently outperforming the broader market with strong operational performance and a focus on shareholder returns. As such, they remain attractive investments for those looking for reliable, blue-chip names to weather any future market turbulence.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and unlock access to several market-beating features, including:

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.