- November has seen notable developments for major Altcoins, with Ethereum, Avalanche, and Chainlink forming price squeeze patterns.

- Ethereum's symmetrical triangle suggests a potential breakout above $2,060

- Meanwhile, Avalanche faces resistance at $21.5, and Chainlink's recovery hinges on a daily close above $15.

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

Cryptocurrencies faced resistance in their upward trajectory throughout the first half of November, experiencing declines that were met with progressively higher levels of support.

Over the past two weeks, this price action has given rise to a price squeeze pattern for certain altcoins, with Ethereum being a prominent example.

After encountering resistance around the $2,100 mark, Ethereum entered a narrow trading range, forming lower lows in the short term. Avalanche and Chainlink, among cryptocurrencies with significant market capitalization, share a similar outlook.

From a technical perspective, a swift price movement is anticipated following such price compression, contingent on the direction of the breakout. Let's assess the potential short-term price movements by examining the current status of ETH, AVAX, and LINK.

1. Ethereum: Watch Out for the Price Staying Above $2000

Ethereum jumped as high as $2,100 in the first days of November. The cryptocurrency then began to fluctuate, forming a symmetrical triangle pattern with lower peaks and troughs throughout the month.

It seems to have reached the last part of the price squeeze that continued before entering December.

Accordingly, Ethereum will also break the upper line of the symmetrical triangle if it can achieve a net day close above an average of $2,060 in its next upward move.

Such a breakout could strengthen the buy side and Ethereum could quickly move towards the $2,300 band with a 12% increase in value in proportion to the size of the triangle.

The short-term price target for Ethereum also makes sense with Fibonacci levels set relative to the recent bearish momentum. ETH entered a rapid recovery phase after finding support at $1,520 in October.

The cryptocurrency, which encountered resistance at the April peak at the beginning of the month, turned its direction upwards again after a partial correction.

Given that the recovery trend continues, breaking the last resistance at $ 2,100 shows that there is no obstacle until the Fibonacci expansion zone in the range of $ 2,270 - $ 2,470.

On the other hand, daily closes below $2,000 would be a move that could disrupt the bullish setup for Ethereum. A possible bearish momentum could trigger ETH to retreat to the $1,800 band.

As a result, as long as Ethereum stays above $ 2,000 and can break above $ 2,060 and $ 2,100 resistances, we can see that the next trading range could be in the range of $ 2,270 - $ 2,470.

2. Avalanche: Look for a Break Above $21.5

After recording a steep accelerated rise in November, AVAX retreated slightly after profit sales in the $ 24 band.

While the retreat was met with demands in the average $ 20 band, the AVAX price started to move in a narrow band in the last 2-week period. In the current situation, we see that the $ 21.5 level remains an important resistance point for AVAX.

With the formation of a clear daily candle above this level, the triangle pattern formed in the short term will break upwards and we can see that the next move may continue up to the average $ 27 band.

In the lower region, there is a support line starting at $ 20.8. If AVAX, which is stuck in a very narrow price range, once again sags below $ 20, the bullish scenario may be invalidated.

In this case, eyes will be on the second support line extending to the $ 18 level, while the loss of this support could trigger a correction to below $ 15.

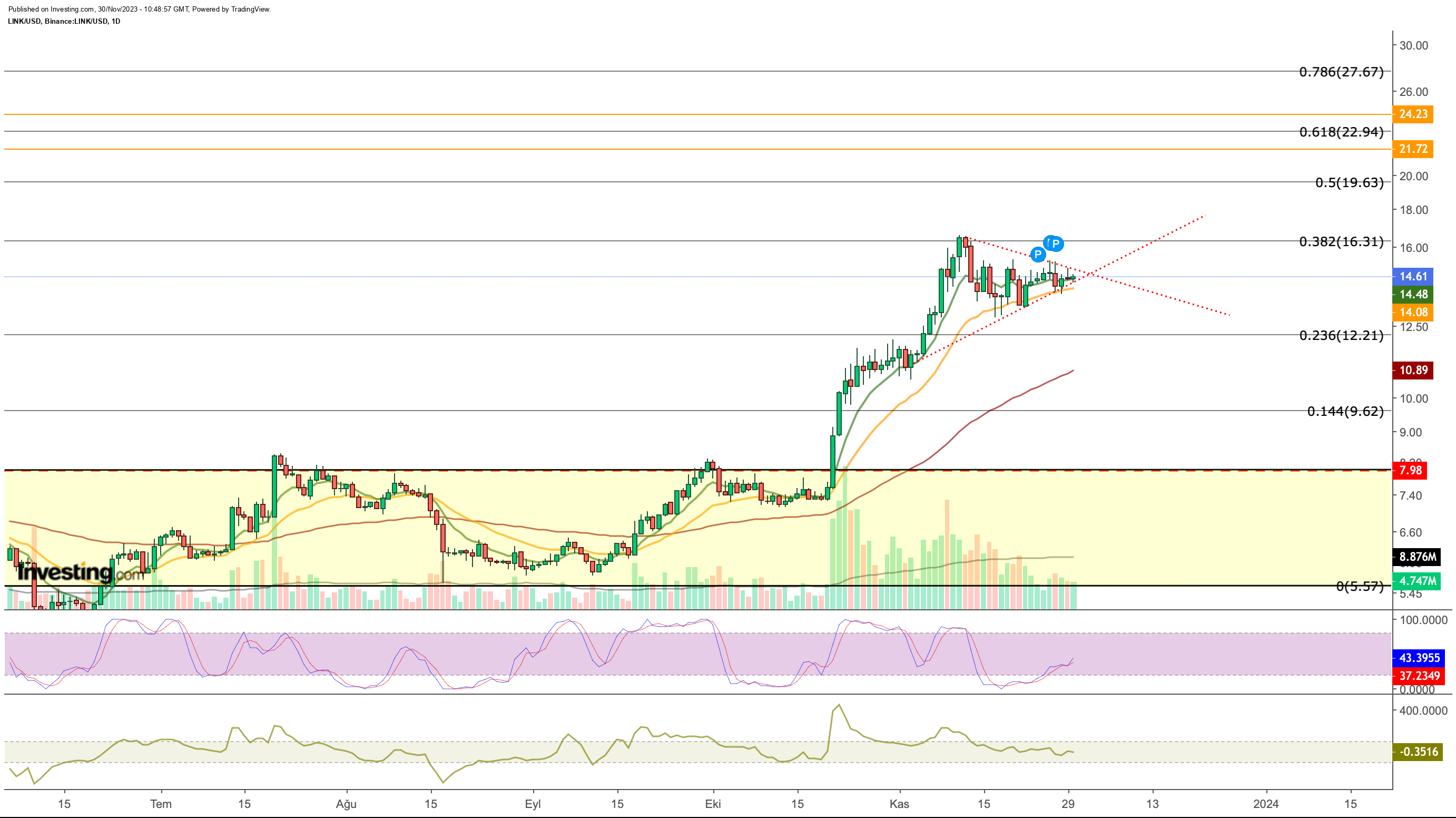

3. Chainlink: Keep an Eye on a Daily Close Above $15

LINK continued its recovery trend throughout November after ending its long-term sideways movement in October.

LINK, which rose as high as $ 16.5 in the first half of November, encountered resistance of Fib 0.382 when measured against the long-term downtrend.

In the last two weeks, after the rejection of this point, the correction trend in crypto money has been quite limited with the re-engagement of buyers at $ 13.7 levels.

In the LINK market, where trading volumes have decreased in the last week, it is seen that the price has started to move in a narrower band.

For the rest of the week, day closures at $ 15 levels could re-trigger buyer volume, and the cryptocurrency could break the short-term downtrend and make a quick move toward $ 20.

The 21-day EMA, which is at $14 today, has been acting as dynamic support in recent days. This price level also forms the bottom line of the short-term triangle.

This may cause the LINK price to accelerate its downward momentum if it falls below $ 14. Thus, as the probability of a deepening correction increases, LINK is likely to retreat to $10.

As a result, it can be mentioned that the direction of exit from the $ 14 - $ 15 range will be decisive for the next direction of LINK.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclosure: The author does not own any of the securities mentioned in this report.