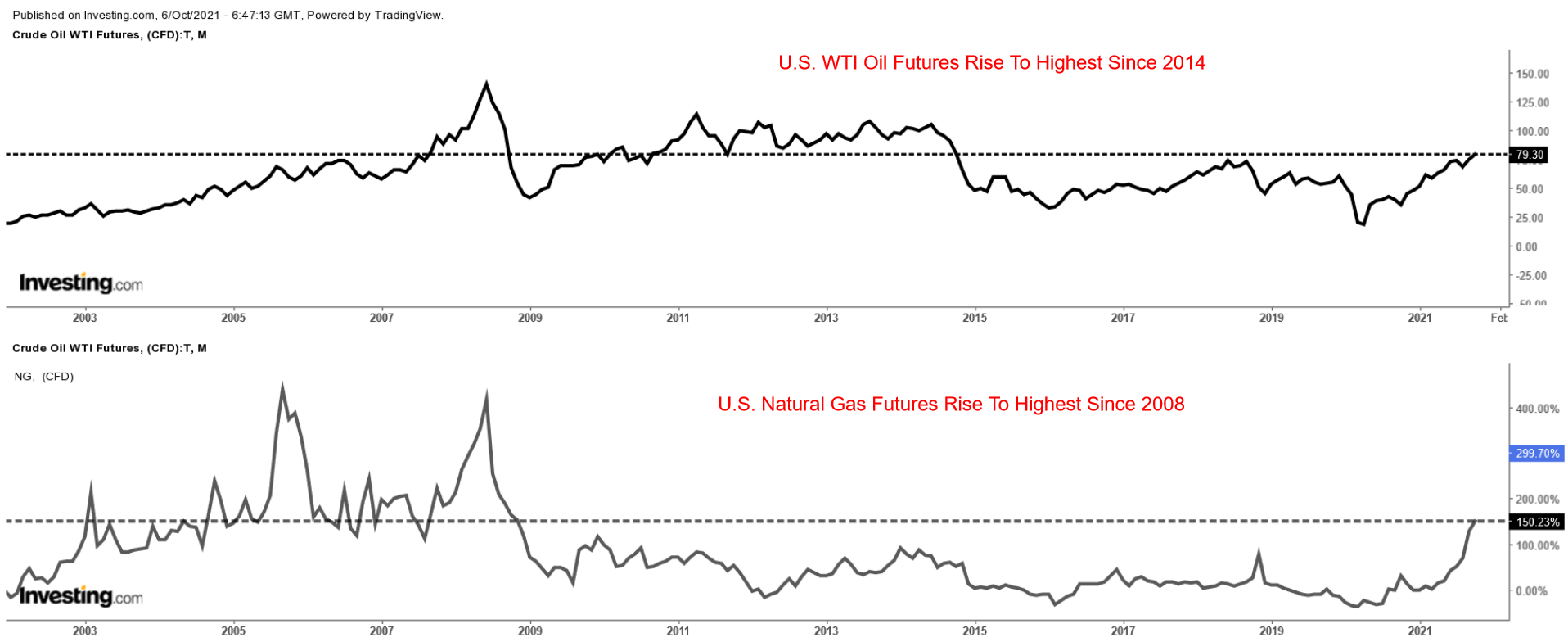

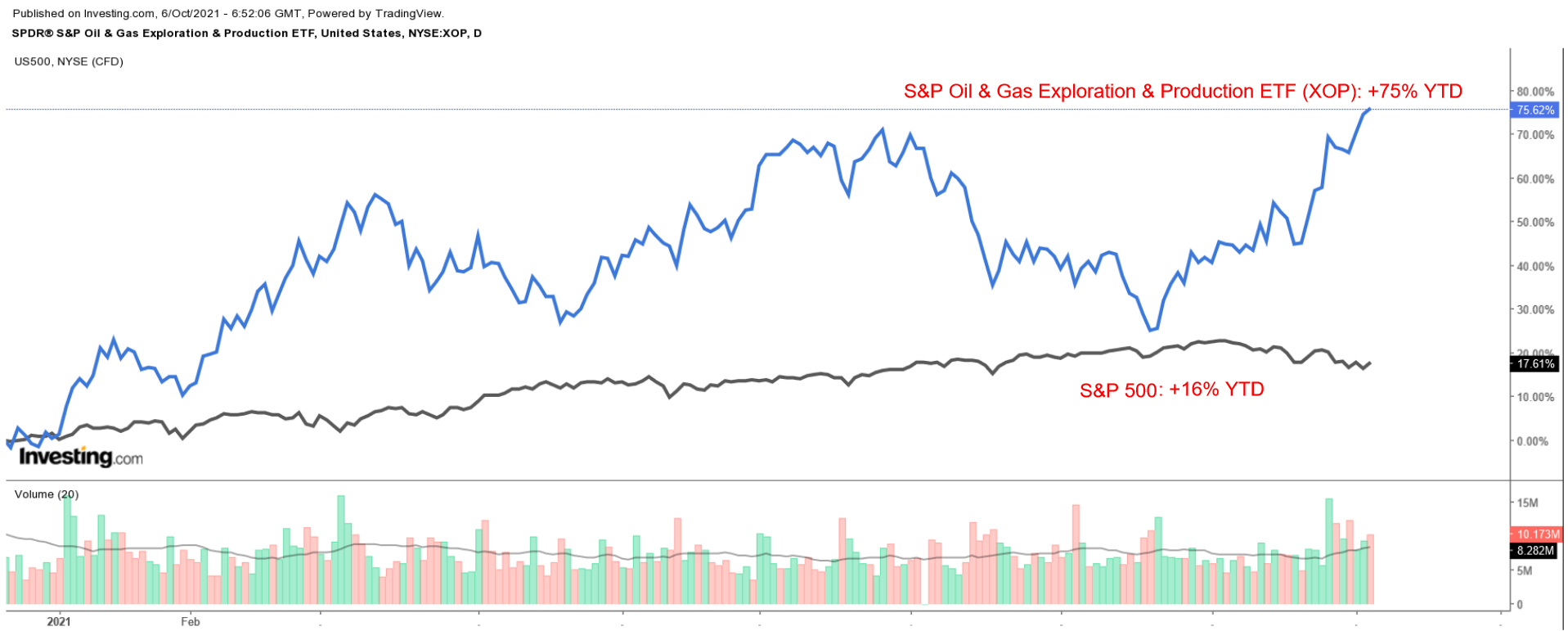

Energy stocks have been on fire in recent weeks, boosted by a furious rally in crude oil and natural gas prices, which are both trading at their best levels in years.

Not surprisingly, one of the energy sector’s main ETFs—the SPDR S&P Oil & Gas Exploration & Production Fund (NYSE:XOP)—has rallied 75% year-to-date to reach its highest level since July 2019. The S&P 500, for its part, is up roughly 16% over the same timeframe.

With crude and gas prices set to test new highs, here are three energy stocks which are well-positioned to extend their march higher in the weeks and months ahead.

1. Pioneer Natural Resources

- Year-To-Date Performance: +59.7%

- Market Cap: $42.3 Billion

Pioneer Natural Resources (NYSE:PXD) is one of the largest shale oil and natural gas exploration and production companies in the United States. It explores for, develops, and produces oil, gas, and natural gas liquids, with operations primarily located in the Midland portion of the Permian Basin in West Texas.

Shares of the Irving, Texas-based energy firm have outperformed the broader market by a wide margin this year, soaring by roughly 60% in 2021. Year-on-year, Pioneer’s stock is up 110% in the last 12 months, benefitting from the dramatic rally in oil and natural gas prices.

PXD rose to its highest level since October 2018 on Tuesday, before closing at a fresh three-year high of $181.96. At current levels, Pioneer has a market cap of $42.3 billion, making it the fifth largest U.S. energy producer, behind Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX), ConocoPhillips (NYSE:COP), and EOG Resources (NYSE:EOG).

With strong year-to-date gains, Pioneer remains one of the best names to own for investors who want to play the ongoing recovery in the U.S. oil and gas sector.

The exploration and production company is poised to continue to benefit from its stellar Permian operations, while taking advantage of strong oil and gas prices, which will help fuel future profit and sales growth.

Pioneer, which reported mixed second quarter financial results in early August, announced it was introducing an inaugural variable dividend of $1.51 per share. The company next reports earnings after the U.S. market closes on Monday, Nov. 1.

Consensus calls for the Permian-focused shale driller to post earnings per share of $3.83, improving by a whopping 2,100% from EPS of $0.17 in the year-ago period. Revenue is expected to surge 154% year-over-year to $4.63 billion, thanks in large part to the impressive rebound in crude and gas prices.

Beyond the top- and bottom-line figures, investors will keep an eye on Pioneer’s update regarding its oil and gas production targets for the year ahead as well as its plans to return more cash to shareholders and reduce debt.

2. Devon Energy

- Year-To-Date Performance: +157.4%

- Market Cap: $26.2 Billion

Devon Energy (NYSE:DVN) is one of the leading independent energy companies in the country, with operations focused in four core areas: the Delaware Basin, Eagle Ford, Powder River Basin, and the Anadarko Basin. It also has key drilling assets in the STACK shale formation in Oklahoma.

Shares of the Oklahoma City, Oklahoma-based energy major have thrived this year, rallying 157% so far in 2021, as it reaps the benefits of strong production and high oil and gas prices. Year-on-year, Devon’s stock has soared 324%, making it one of the sector’s top performers over the last 12 months.

DVN stock climbed to a fresh three-year high of $40.24 yesterday, before ending at $40.08. At current levels, it has a market cap of $26.2 billion.

The low-cost oil and gas producer looks attractive going forward, due in part to its robust year-to-date gains, and considering its leading position in the U.S. oil and gas industry.

Devon's second quarter earnings and revenue easily topped estimates. The company is scheduled to report third quarter earnings after U.S. markets close on Tuesday, Nov. 2.

Consensus expectations call for earnings of $0.89 per share, swinging from a loss of $0.04 in the year-ago period. Revenue meanwhile is forecast to jump nearly 195% year-over-year to $3.16 billion, boosted by strong oil and gas prices and increased global energy demand.

More importantly, shareholders will pay close attention to the company’s plans to return more cash to investors. Devon declared a fixed-plus-variable dividend of $0.49 per share in Q2, 44% higher than the preceding quarter's payout.

3. Diamondback Energy

- Year-To-Date Performance: +115.2%

- Market Cap: $18.1 Billion

Diamondback Energy (NASDAQ:FANG) is one of the biggest oil and natural gas producers in the Permian basin, making it a major player in the U.S. energy sector. The region, which spans across western Texas and southeast New Mexico, accounts for approximately 30% of total domestic oil output.

Shares of the Midland, Texas-based company—whose core business operations involve exploring, developing, and producing crude oil, natural gas, and natural gas liquids—have taken off this year, jumping around 115% in 2021. Year-on-year, Diamondback’s stock has gained a whopping 241%, as surging crude and gas prices boosted investor sentiment on the energy producer.

FANG ended Tuesday’s session at a more than two-year peak of $104.16, earning it a valuation of $18.1 billion.

Diamondback is expected to continue to benefit from improving energy market fundamentals, especially as crude oil and natural gas prices charge towards new multi-year highs.

The high-flying oil and gas producer—which crushed expectations for earnings and revenue in the second quarter—next reports financial results after the U.S. market closes on Monday, Nov. 1.

Analyst estimates call for Q3 earnings of $2.65 per share on revenue of $1.49 billion, up roughly 327% and 107% respectively from the year-ago period. Additionally, investors are hoping the company will update its full-year guidance to reflect the positive impact of skyrocketing commodity prices on its business.

Market players will also be eager to hear if the energy firm plans to return more cash to shareholders in the form of higher dividend payouts and share buybacks. In September, Diamondback’s board of directors authorized an up to $2 billion share buyback program to complement its plan to return 50% of free cash flow to stockholders. The company also recently increased its annual dividend by 12.5% to $1.80 per share.