- Shares of the logistics and courier company FedEx have been flat in 2021

- Management recently announced robust Q2 results, and the revised outlook created optimism for FDX stock

- Long-term investors could consider buying the dips in FDX shares, especially if they decline toward $250.

Shares in the logistics and delivery heavyweight FedEx (NYSE:FDX) are down 0.8% in 2021. In comparison, the Dow Jones Transportation Average has returned 31.7% in the past 52 weeks.

On May 27, FDX shares went over $319 to hit a record high. But since that peak, they have declined more than 19%, closing at $257.49 on Wednesday. The stock’s 52-week range has been $216.34 - $319.90, while the company's market capitalization stands at around $68.3 billion.

In 2020, the global courier, express and parcel (CEP) market was valued around $370 billion. By 2028, it is forecast to reach almost $600 billion, growing at a compound annual growth rate (CAGR) of about 6%. Despite the lackluster return for FDX in 2021, FedEx’s market share in the U.S. is close to 50%. Its main competitors include United Parcel Service (NYSE:UPS) and Deutsche Post (DE:DPWGn) (OTC:DPSGY), better known as DHL.

FedEx released better-than-expected Q2 figures on Dec.16. The company’s fiscal year ends May 31. Easing of staffing pressures and strong demand provided tailwinds for the logistics group. Revenue was $23.5 billion, up 14% year-over-year. But diluted non-GAAP earnings per share (EPS) remained flat at $4.83.

On the results, CFO Michael C. Lenz said:

“FedEx operating income grew in our second quarter.… While adjusted earnings per share was unchanged year over year, this year’s effective tax rate was significantly higher, as last year’s earnings included a $0.71-per-share tax benefit.”

The company also revised its FY22 forecast. Management now expects to achieve $20.50 - $21.50 adjusted EPS versus the prior guidance of $19.75 - $21.00. Meanwhile, the board has authorized a new $5-billion share repurchase program.

Prior to the release of the quarterly results, FDX stock was trading around $240. Since then, investors have hit the “buy” button boosting the value of the shares.

What To Expect From FedEx Stock

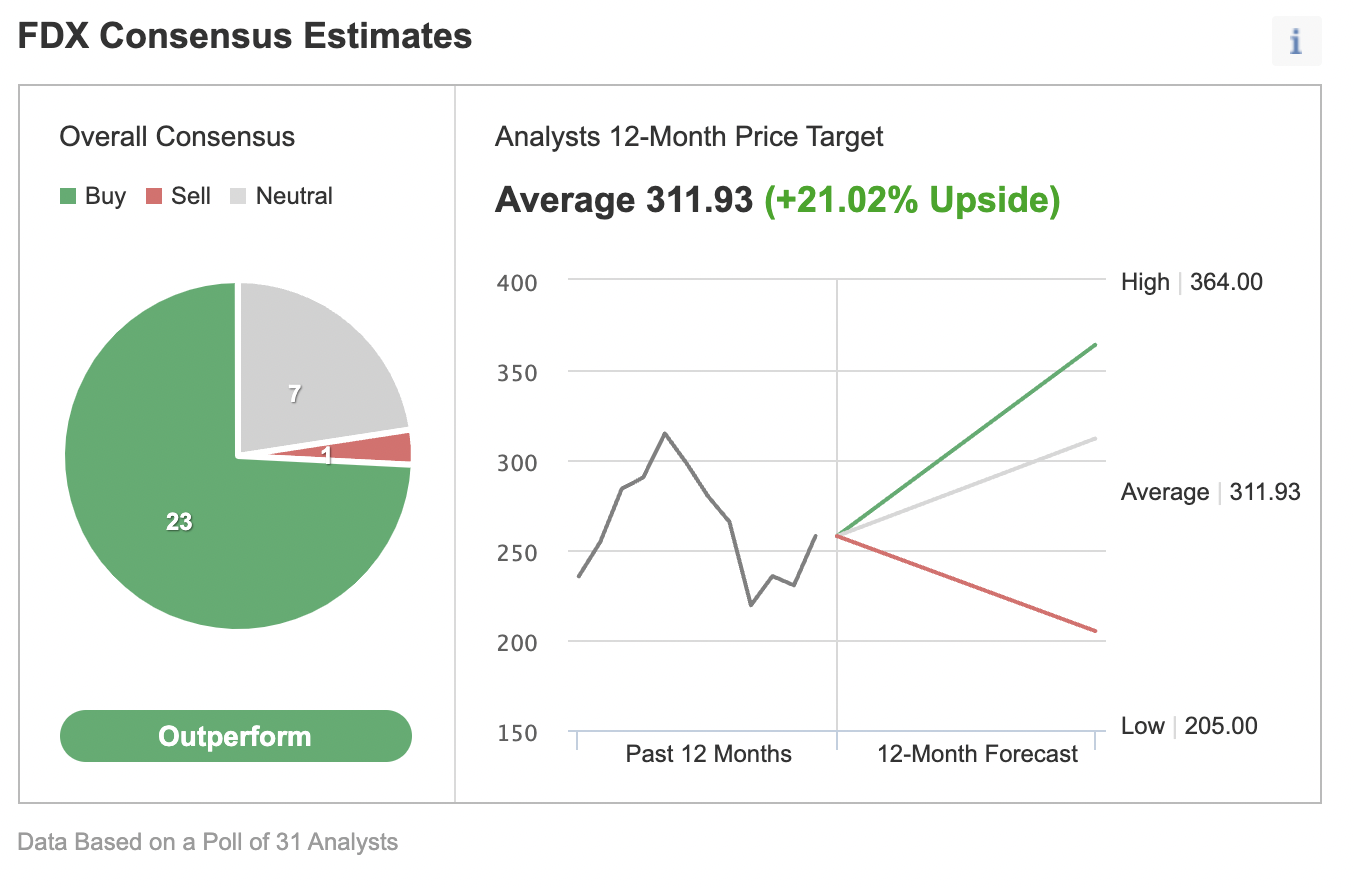

Among 31 analysts polled via Investing.com, FDX stock has an “outperform" rating.

Analysts also have a 12-month median price target of $311.93 on the stock, implying an increase of about 21% from current levels. The 12-month price range currently stands between $205 and $364.

Chart: Investing.com

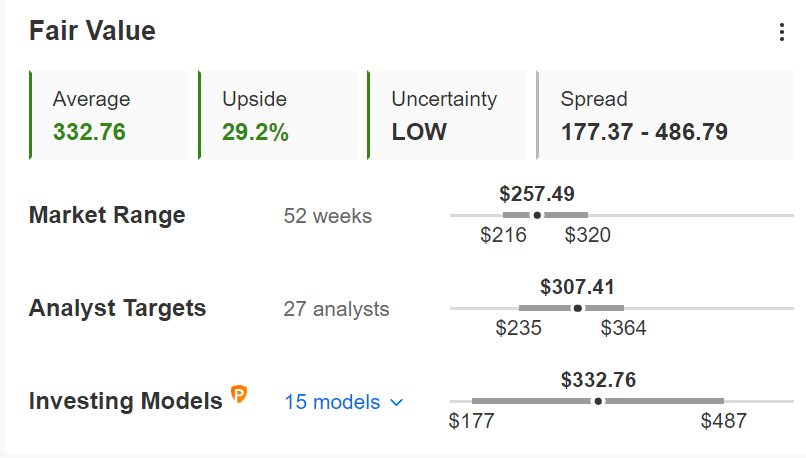

Similarly, according to a number of valuation models, like the dividend discount model or DuPont analysis, the average fair value for FDX stock via InvestingPro stands at $332.76, implying a potential increase of about 29%.

Chart: InvestingPro

Moreover, we can look at the company’s financial health determined by ranking more than 100 factors against peers in the industrials sector. In terms of growth, FedEX scores 4 out of 5 (top score). Its overall performance is rated as “good.”

Trailing P/E, P/B and P/S ratios for FDX stock are 13.9x, 2.7x and 0.8x. By comparison, those metrics for peers stand at 15.7x, 3.3x and 1.2x. Readers might also be interested to know that the numbers of UPS stock are 29.0x, 15.6x and 2.0x.

In the coming weeks, we expect FedEx stock to trade in a range, possibly between $240 and $260. Once it establishes a base, a new leg up is likely to start in 2022.

Adding FedEx Stock To Portfolios

FDX bulls with a two- to three-year horizon who are not concerned about short-term volatility could consider buying the stock around these levels for long-term portfolios. Analysts’ consensus expectations have set a target of $311.93.

Alternatively, investors could consider buying an exchange traded fund (ETF) that has FDX as a holding. Examples would include:

- iShares Transportation Average ETF (NYSE:IYT),

- American Customer Satisfaction ETF (NYSE:ACSI),

- Invesco S&P 500® Equal Weight Industrials ETF (NYSE:RGI)

- Vanguard U.S. Value Factor (NYSE:VFVA).

Finally, those who are experienced with options strategies and believe there could be further declines in FedEx shares might prefer to do a bear put spread.

Most option strategies are not suitable for most retail investors. Therefore, the following discussion is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bear Put Spread On FDX Stock

Current Price: $257.49

In a bear put spread, a trader has a long put with a higher strike price as well as a short put with a lower strike price. Both legs of the trade have the same underlying stock (i.e. FedEx here) and the same expiration date.

The trader wants FDX stock to decline in price. However, in a bear put spread, both the potential profit and the potential loss levels are limited. Such a bear put spread is established for a net cost (or net debit), which represents the maximum loss.

Let’s look at this example:

For the first leg of this strategy, the trader might buy an at-the-money (ATM) or slightly out-of-the-money (OTM) put option, like the FDX Feb. 18, 2022, 250-strike put option. This option is currently offered at $5.75. It would cost the trader $575 to own this put option, which expires in slightly less than two months.

For the second leg of this strategy, the trader sells a FDX put, like the FDX Feb. 18, 2022, 240-strike put option. This option’s current premium is $3.15. The option seller would receive $315, excluding trading commissions.

Maximum Risk

In our example, the maximum risk will be equal to the cost of the spread plus commissions. Here, the net cost of the spread is $2.60 ($5.75 – $3.15 = $2.60).

As each option contract represents 100 shares of the underlying stock, i.e. FDX, we’d need to multiply $2.60 by 100, which gives us $260 as the maximum risk.

The trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the FedEx stock price at expiration is above the strike price of the long put (or $250.00 in our example).

Maximum Profit Potential

In a bear put spread, potential profit is limited to the difference between the two strike prices minus the net cost of the spread plus commissions.

So in our example, the difference between the strike prices is $10.00 ($250.00 – $240.00 = $10.00). And as we’ve seen above, the net cost of the spread is $2.60.

The maximum profit, therefore, is $7.40 ($10.00 – $2.60 = $7.40) per share less commissions. When we multiply $7.40 by 100 shares, the maximum profit for this option strategy comes to $740.

The trader will realize this maximum profit if FDX stock price is at or below the strike price of the short put (lower strike) at expiration (or $240.00 in our example).

Investors who have traded options before are likely to know that short put positions are typically assigned at expiration if the stock price is below the strike price (i.e., $240.00 here). However, there is also the possibility of early assignment. Therefore, the position would need monitoring up until expiration.

Break-Even FDX Price At Expiration

Finally, we should also calculate the break-even point for this trade. At that price, the trade will not gain or lose any money.

At expiration, the strike price of the long put (i.e., $250.00 in our example) minus the net premium paid (i.e., $2.60 here) would give us the break-even FDX price.

In our example: $250.00 − $2.60 = $247.40 (minus commissions).

Bottom Line

Shipping heavyweight FedEx has recently posted robust gains after the quarterly report. However, shares are ending the year flat. Nonetheless, in 2022, we expect shareholders to be pleased with the performance of FDX stock.