- Ongoing excitement around artificial intelligence continues to fuel strong gains in the stock market, especially throughout the tech sector.

- Despite the blistering rally, several software stocks offer compelling investment opportunities for investors seeking exposure to the AI revolution.

- As such, below I highlight three companies that are capitalizing on the AI boom through their innovative use of generative AI.

- Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

As the artificial intelligence (AI) revolution continues to reshape industries, drive innovation, and take the stock market by storm, investors are increasingly turning their attention to companies harnessing the power of generative AI (GenAI).

By leveraging GenAI to enhance their offerings, drive revenue growth, and increase sales, these companies are well-positioned to thrive in an increasingly digital and AI-driven world.

If you're looking for a list of picks that will help you ride this boom, I recommend you check out our flagship predictive AI-powered strategies - particularly Tech Titans, which yielded 20.8% in February alone. With our monthly updated array of 100+ winners, you will never miss another uptrend again by not knowing which stocks to buy.

Subscribe here for under $9 a month and start compounding gains today!

Now let's have a look at three value-oriented GenAI picks - namely Cognizant Technology Solutions (NASDAQ:CTSH), Dynatrace (NYSE:DT), and Gen Digital (NASDAQ:GEN) - to understand how each company is capitalizing on the AI boom.

1. Cognizant

- 2024 Year-To-Date: +3%

- Market Cap: $38.7 Billion

Cognizant Technology Solutions (NASDAQ:CTSH) is a global leader in digital transformation and technology consulting, providing a wide range of services to help businesses navigate the complexities of the digital landscape.

The Teaneck, New Jersey-based company has been making great strides in integrating generative AI into its solutions to drive innovation and create value for its clients. Through its AI & Analytics practice, Cognizant leverages advanced machine learning algorithms to deliver predictive analytics, personalized recommendations, and intelligent automation capabilities across various industries.

Cognizant's GenAI-driven approach enables the company to unlock new revenue streams and increase sales by offering differentiated services and solutions powered by AI. Taking that into account, Cognizant's expertise in GenAI positions the company as a trusted partner for digital transformation initiatives worldwide.

Not surprisingly, Cognizant is a strong buy recommendation according to the quantitative models in InvestingPro, which point to a gain of 18% in CTSH stock in the next 12 months.

Source: InvestingPro

That would bring shares closer to their ‘Fair Value’ of $91.74, compared to last night’s closing price of $77.78.

As ProTips points out, Cognizant has several tailwinds that are expected to fuel further gains in its stock in the months ahead, with highlights including a healthy profitability outlook, as well as robust growth in free cash flows which should allow it to continue raising dividend payments.

Source: InvestingPro

With a P/E ratio of around 18.5, Cognizant comes at a substantial discount when compared to other notable IT services providers, such as Fiserv (NYSE:FI), and Infosys (NS:INFY), which trade at 30 times and 27 times earnings, respectively.

2. Dynatrace

- 2024 Year-To-Date: -13.7%

- Market Cap: $14 Billion

Dynatrace (NYSE:DT) is a leading provider of application performance monitoring and management solutions. The company has integrated generative AI capabilities into its platform to help businesses and governments worldwide monitor, analyze, and optimize application performance, IT infrastructure, as well as software development and security practices.

Through its Davis AI engine, Dynatrace employs advanced algorithms to automatically detect, diagnose, and resolve performance issues in real-time, empowering organizations to deliver exceptional digital experiences to their customers.

As businesses increasingly rely on digital platforms to engage customers and drive revenue, Dynatrace's AI-powered solutions position the company for sustained growth in a competitive market landscape, ultimately contributing to both its top and bottom lines.

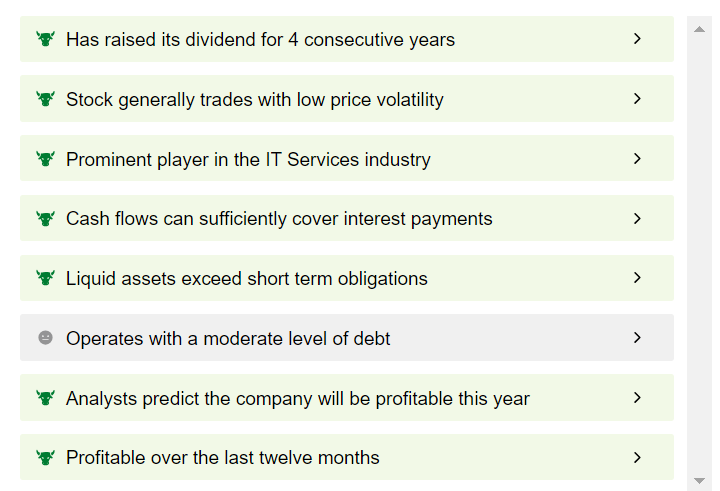

It should be noted that DT stock is extremely undervalued according to InvestingPro and could see an increase of 12.4% from Tuesday’s closing price of $47.21.

Source: InvestingPro

That would take shares within proximity of their ‘Fair Value’ price target of $53.04.

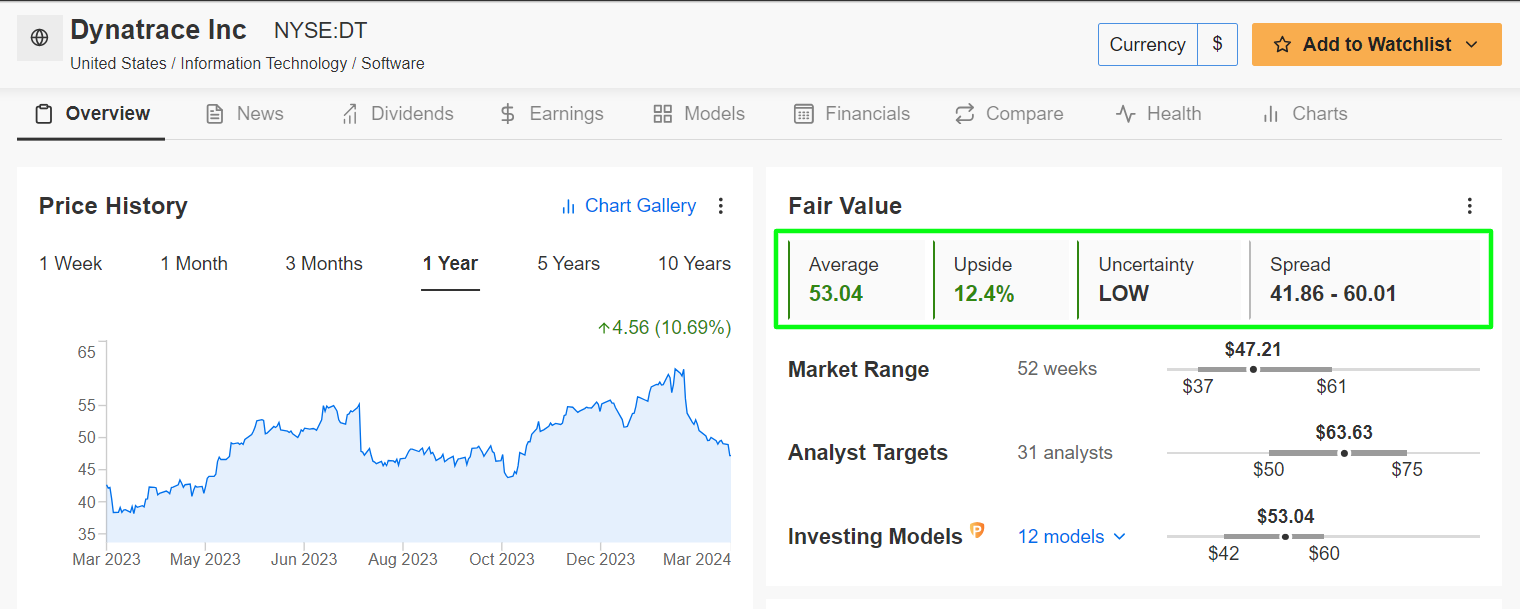

Demonstrating the strength and resilience of its business, ProTips mentions that Dynatrace is in good financial health condition thanks to its strong growth prospects, rising net income, impressive margins, and a relatively attractive valuation.

Source: InvestingPro

At a forward P/E ratio of roughly 35, Dynatrace’s stock is not cheap, but it comes at a relative bargain compared to its major competitors, such as Datadog (NASDAQ:DDOG), and Nutanix (NASDAQ:NTNX), which trade at around 69- and 48-times forward earnings, respectively.

3. Gen Digital

- 2024 Year-To-Date: -7.2%

- Market Cap: $13.5 Billion

Gen Digital is a multi-national software company co-headquartered in Tempe, Arizona, and Prague, Czech Republic. The company provides a wide range of cybersecurity software and services.

By integrating generative AI into its cybersecurity solutions, Gen Digital strengthens its ability to identify and mitigate cyber risks proactively. With a portfolio that includes Norton, Avast, LifeLock, Avira, AVG, and other leading cybersecurity brands, Gen can leverage AI-driven threat detection and prevention capabilities to enhance its cybersecurity offerings and protect consumers and businesses from evolving cyber threats.

As cybersecurity threats continue to proliferate in an increasingly digitized world, Gen Digital's AI-powered security solutions position the security software company for continued success in the ever-evolving digital landscape.

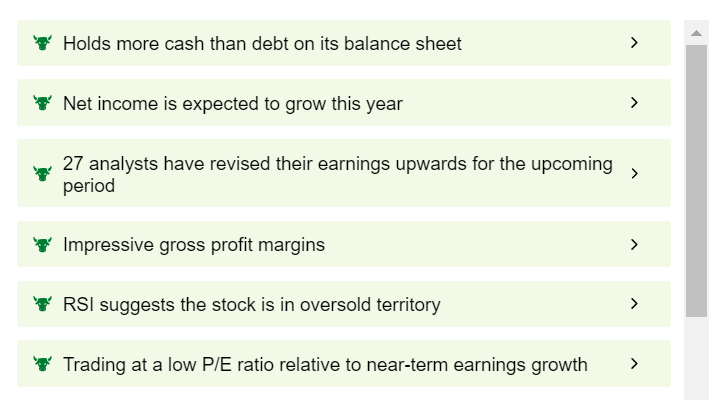

With its cutting-edge AI-driven cyber safety solutions set to power growth, the average ‘Fair Value’ price target for GEN stock implies a 39.2% upside over the next 12 months according to insights from InvestingPro.

Source: InvestingPro

As the above chart shows, such a move would take shares to $29.49 from last night’s closing price of $21.18.

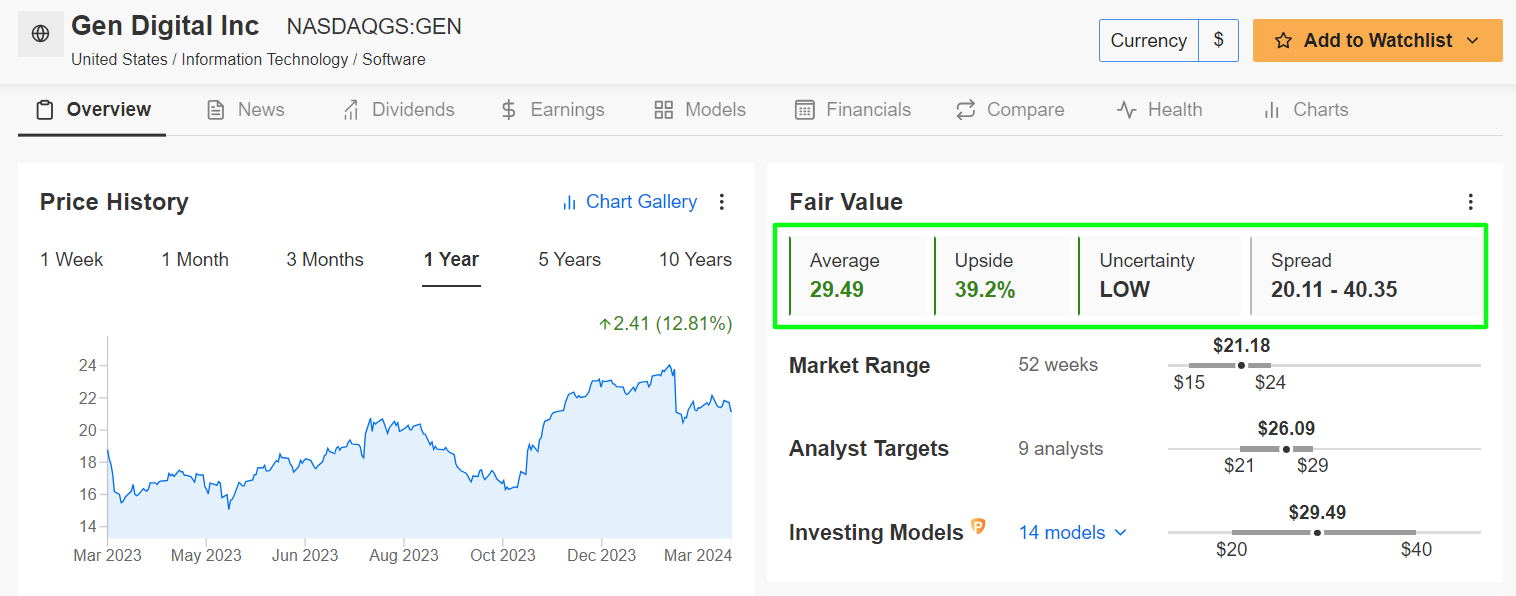

Furthermore, it should be noted that Gen Digital sports a near-perfect InvestingPro ‘Financial Health’ score, thanks to its robust earnings prospects, upbeat gross profit margins, and high free cash flows which have allowed it to maintain its dividend for 12 consecutive years.

Source: InvestingPro

Additionally, Gen Digital’s stock trades at a forward price-to-earnings multiple of under 10, which makes it an absolute bargain compared to its industry peers, such as Okta (NASDAQ:OKTA) (41 forward P/E), UiPath (NYSE:PATH) (42 forward P/E), Cyberark (NASDAQ:CYBR) (77 forward P/E), and Elastic (NYSE:ESTC) (80 forward P/E).

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.