- Recent US economic data, particularly in the manufacturing and services sectors, have strengthened the US dollar.

- This has created a bearish scenario for GBP/USD, with a key support zone at 1.2530 and the potential for a drop below 1.25.

- Meanwhile, USD/CHF has broken out of a bullish flag as EUR/GBP bounces off a strong support level from 2023.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

In the past few days, the macroeconomic calendar has been filled with data releases from the US. Most of these readings exceeded forecasts, leading to a continued strengthening of the US dollar.

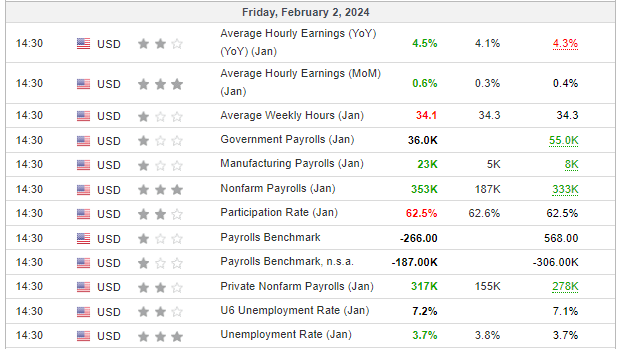

Alongside the ISM manufacturing and services data, the US labor market data, typically released on the first Friday of the month, also surpassed expectations significantly.

This backdrop provides comfort to the Fed, enabling it to refrain from hastily initiating a pivot and maintaining current interest rate levels until the June meeting.

Simultaneously, the UK is anticipated to implement its first interest rate cut as early as May. This divergence has started putting downward pressure on the {{2|British pound}.

Apart from the pound, a strengthening US dollar could also create trading opportunities in pairs like USD/CHF.

Elsewhere, trading setups are also found in the EUR/GBP pair. The analysis below discusses the key levels to watch when panning your trades.

Against this backdrop, let's take a look at three interesting trading levels to keep an eye on.

1. GBP/USD - Look to Sell if Pair Breaks Key Support Zone

GBP/USD has been moving sideways since the beginning of the month within a dynamic downward impulse, which led to a bottom breakout from the medium-term consolidation.

Currently, sellers are testing the local demand zone located in the price area of 1.2530, from where a strong demand impulse had started earlier.

Given the strength of the US dollar and potential dovish signals for the British pound, the basic scenario will be a drop below 1.25 and a continuation of the southward movement at least in the vicinity of 1.24.

A possible shallow defense and rebound from the currently tested zone could be an interesting zone for those looking to go short.

In this context, it is worth monitoring a potential retest of the previously breached lower limit of the consolidation around $1.26 per pound. A return to the sideways trend above 1.26 would negate this scenario.

2. USD/CHF Breaks Out of Bullish Flag

The technical situation on the currency pair USD/CHF corresponds with the strengthening of the US dollar.

Currently, we see an upward breakout from the flag formation, which signals a continuation of the northward movement.

Due to the fact that the next strong resistance falls only in the region of 0.89, buyers have a relatively large amount of space to develop a demand scenario.

A good line of defense in this case seems to be the local support level, which gave a dynamic demand rebound in the area of 0.8570.

A breakthrough and a return to decline could retest late December 2023 lows.

3. EUR/GBP - Pound Weakness Could Spur Buying Opportunity

The downward trend we have seen on the EUR/GBP currency pair has led to an attack on the strong support level formed in the second half of 2023.

Now the potential weakness of the British pound, combined with the technical opportunity to defend the support area, should be an opportunity to go long on the pair.

The first area of problems for buyers is currently the resistance zone located in the price area of 0.8590 and slightly higher than the supply zone of 0.8610.

On the other hand, the breakout of this important support will be an important selling signal, which could lead to a descent even to the area of August 2022 lows.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code OAPRO1 at checkout for a 10% discount on the Pro yearly plan, and OAPRO2 for an extra 10% discount on the by-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.