- The stock market is back in rally mode, with tech shares leading the charge, amid easing recession fears.

- Identifying tech companies with strong growth prospects and massive upside potential can be a game-changer for investors.

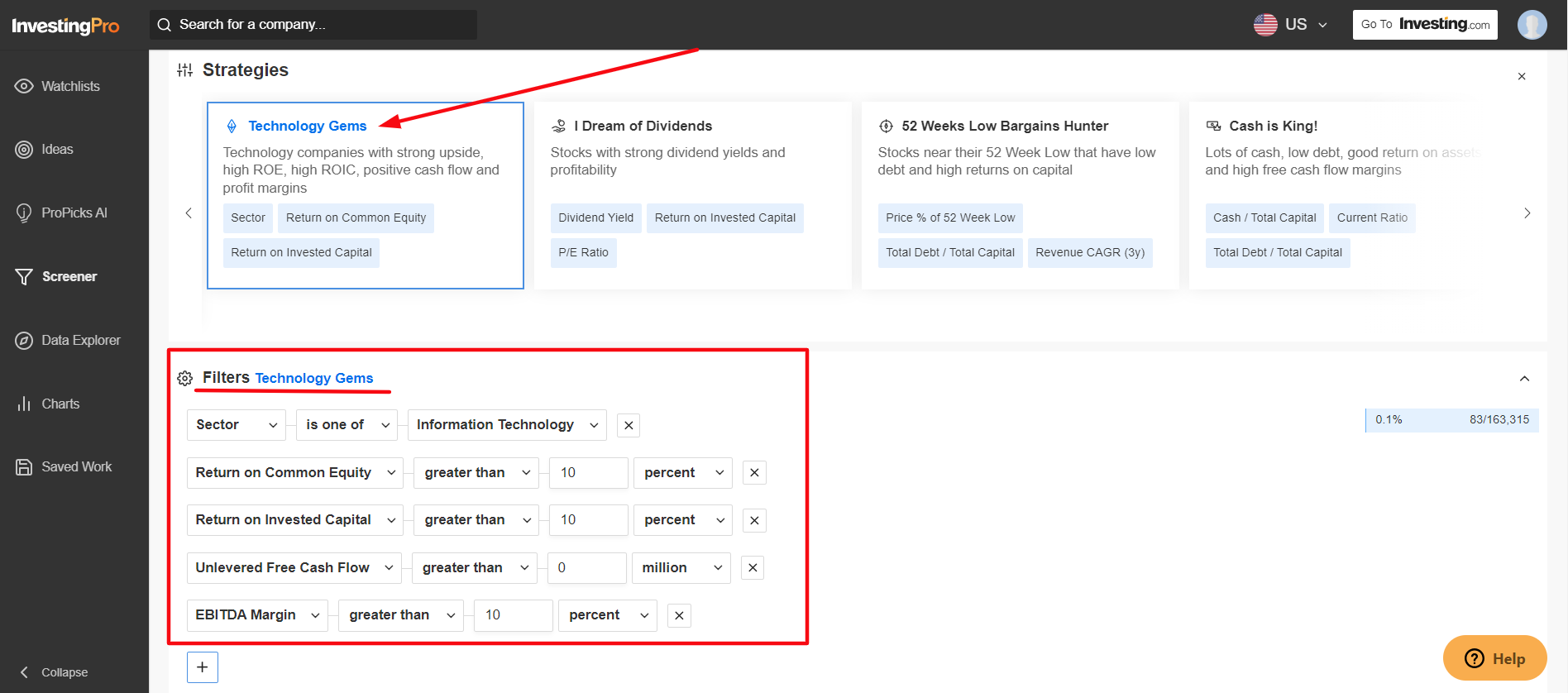

- As such, I used the InvestingPro stock screener to find promising under-the-radar tech stocks with strong upside ahead.

- Looking for more actionable trade ideas? Try InvestingPro for under $8/Month.

In today’s dynamic tech landscape, identifying companies with strong growth prospects and significant upside potential can be a game-changer for investors.

Using the 'Technology Gems' stock screener on InvestingPro, I have pinpointed three standout companies: Qualys (NASDAQ:QLYS), Teradata (NYSE:TDC), and Adeia (NASDAQ:ADEA).

Each of these companies has promising tailwinds, robust growth prospects, and a strong foothold in the AI-driven future.

Source: InvestingPro

Let's explore why these lesser-known technology gems should be on your radar.

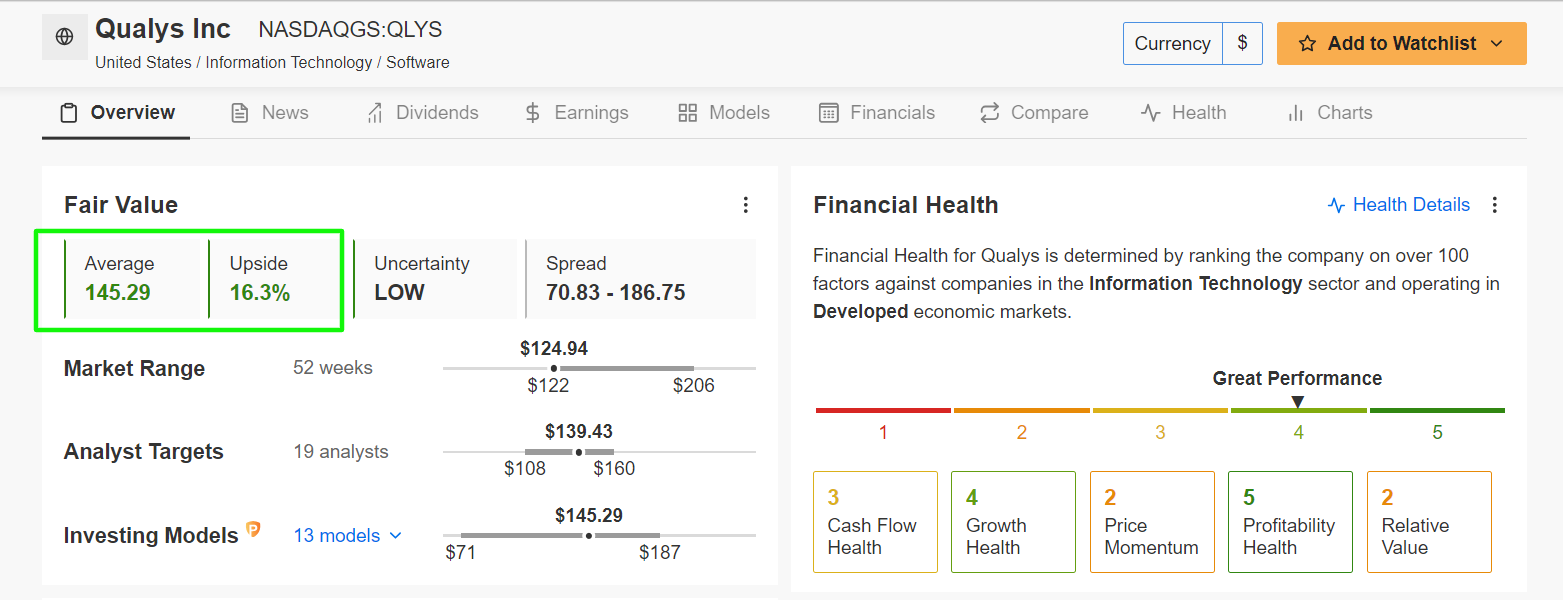

1. Qualys

- Current Price: $124.94

- Fair Value Price Target (NYSE:TGT): $145.29 (+16.3% Upside)

Qualys is an under-the-radar leader in cybersecurity, offering unique cloud-based security and compliance solutions. As the world becomes increasingly digital, the demand for robust security infrastructure continues to rise.

The company is perfectly positioned to capitalize on this trend, especially with its integrated platform that helps businesses manage their security risks effectively.

It closed at $124.94 on Thursday, earning the Foster City, California-based tech company a valuation of $4.6 billion.

Source: Investing.com

One of the key tailwinds for the cybersecurity company is its continuous innovation in AI-driven security solutions. By leveraging artificial intelligence, Qualys enhances its threat detection and response capabilities.

This not only improves security outcomes for its clients but also sets it apart from its competitors in the crowded cybersecurity market.

Given the increasing importance of cybersecurity and the advanced AI capabilities that Qualys offers, I believe the company is poised to benefit from sustained demand.

Source: InvestingPro

Indeed, the AI-powered quantitative models on InvestingPro highlight a +16.3% upside potential, making it a compelling investment opportunity.

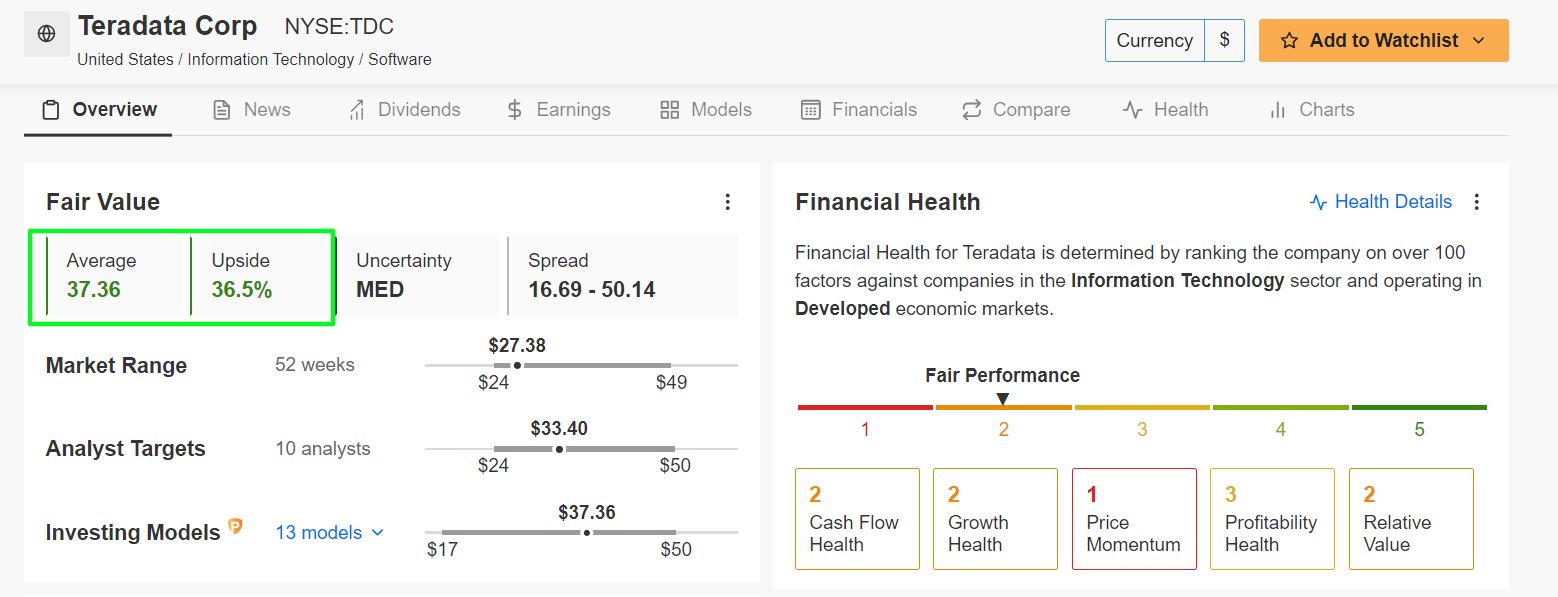

2. Teradata

- Current Price: $27.38

- Fair Value Price Target: $37.36 (+36.5% Upside)

Teradata is a leading provider of cloud-based data analytics solutions, a critical area in today’s data-driven world.

The company specializes in delivering scalable data solutions that empower businesses to make data-driven decisions, optimize operations, and gain a competitive edge in their respective markets.

TDC stock ended at $27.38 yesterday. At its current valuation, the San Diego, California-based company has a market cap of $2.6 billion.

Source: Investing.com

What sets Teradata apart from the competition is its significant strides in incorporating AI and machine learning into its analytics offerings.

These AI-driven enhancements enable customers to unlock deeper insights from their data, driving more accurate and actionable outcomes.

With businesses increasingly relying on advanced analytics to stay ahead, the company’s AI capabilities provide a strong growth catalyst.

Source: InvestingPro

With a massive +36.5% upside potential to its Fair Value price target of $37.36, the stock stands out as a tech gem poised for substantial growth as it continues to innovate and expand its market presence.

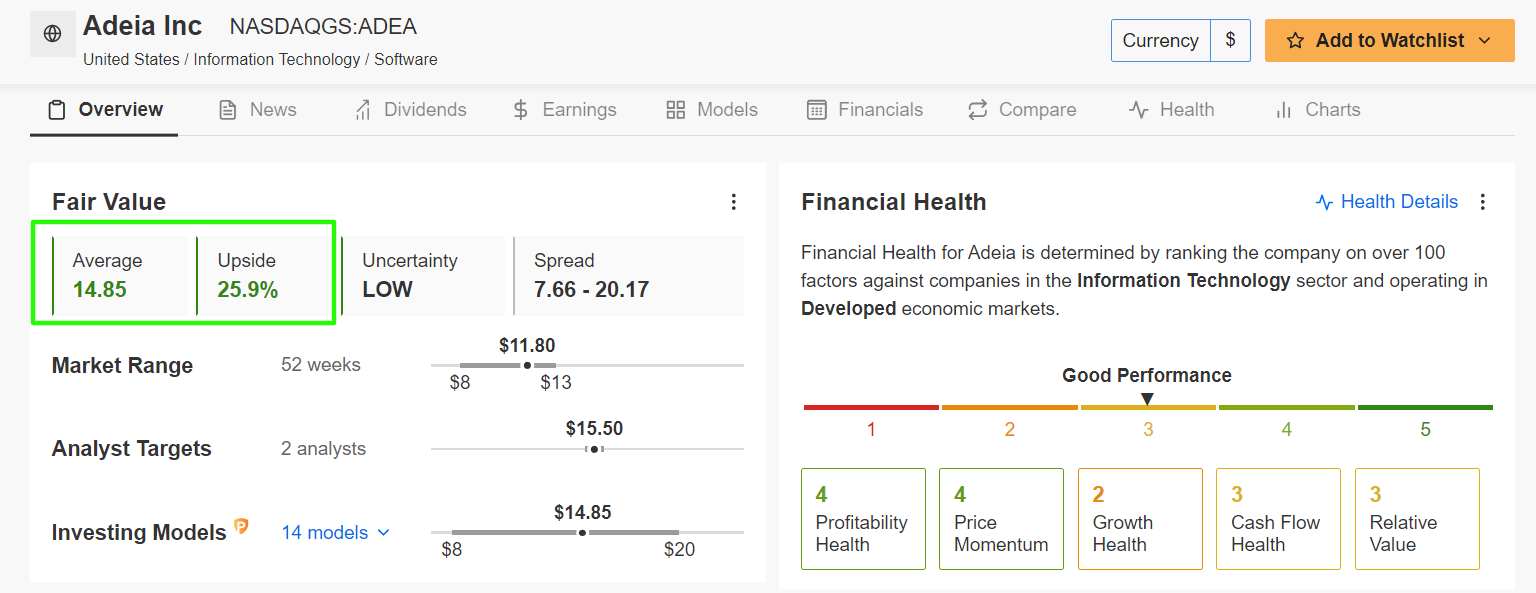

3. Adeia

- Current Price: $11.80

- Fair Value Price Target: $14.85 (+25.9% Upside)

Adeia, a lesser-known yet formidable player in the technology sector, specializes in intellectual property licensing, particularly in the areas of semiconductor memory and storage, as well as imaging technologies.

The company’s extensive portfolio of patented technologies plays a critical role in the development of next-generation electronics and digital imaging products.

ADEA shares closed at $11.80 last night, valuing the San Jose, California-based company at $1.3 billion.

Source: Investing.com

Adeia’s recent focus on AI-related breakthroughs in imaging and memory technologies positions it well to capitalize on the rapid advancements in AI and machine learning applications.

As AI continues to permeate various industries, Adeia’s innovations are likely to see increased demand, particularly in sectors such as autonomous vehicles, advanced imaging, and high-performance computing.

Not surprisingly, InvestingPro’s AI-powered quantitative models suggest a +25.9% upside potential, reflecting the company’s strong growth trajectory and the strategic importance of its patented technologies.

Source: InvestingPro

As AI-driven innovations continue to evolve, Adeia is poised to become an increasingly valuable player in the tech space, with its intellectual property playing a pivotal role in the next wave of technological advancements.

Conclusion

Qualys, Teradata, and Adeia are three under-the-radar technology gems with massive upside potential, making them attractive investments in today’s market.

Whether it’s through cybersecurity advancements, data analytics innovations, or intellectual property licensing in AI, these technology gems offer investors a compelling blend of growth potential and future-proofing in a rapidly evolving landscape.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Try it for 50% OFF using this link.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI