- Marathon Digital has caught the Bitcoin mining wave.

- MARA stock is up more than 500% so far in 2021, and saw a multi-year high recently.

- Those who want to buy Bitcoin could regard MARA stock as a proxy for the crypto and invest for the long run, especially if the price goes toward $55 in the short run

Investors in Bitcoin miner Marathon Digital (NASDAQ:MARA) have seen their shares rally 501% so far this year. This means, the proverbial $1,000 invested in MARA stock in January would now be worth about $6,000. By comparison, Bitcoin returned about 114% so far this year.

MARA stock hit a multi-year high of $63.34 on Nov. 2. The 52-week range for the stock has been $2.06 - $63.34, while the company’s market capitalization stands at $6.4 billion.

Readers might be interested to know that shares of another Bitcoin miner, Riot Blockchain (NASDAQ:RIOT), returned about 83.5% in 2021. However, Bit Digital (NASDAQ:BTBT) stock is down more than 47% year-to-date. This shows that a given stock’s Bitcoin exposure has not necessarily been a sure bet for a rally in price or a gauge for the level of price increase.

Marathon Digital released Q2 metrics in August. Revenue was $29.3 million, up 10,147% year-over-year from $286,000 in the second quarter of 2020. The miner produced 654 self-mined Bitcoins during the quarter. As of June, 30, it had produced 846 coins.

In addition, the group’s investment fund, which had purchased 4,812.66 Bitcoins for approximately $150 million at the start of 2021, increased in fair value by $16.9 million in the first six months of the year. So far this year, the company has mined 2,516 Bitcoins.

On Nov. 2, management gave an operational update. Marathon Digital produced 417.7 Bitcoins in October. Total Bitcoin holdings are 7,453 and the fair value stands at $457.4 million. Investors were pleased with these numbers and hit the ‘buy’ button.

What To Expect From MARA Stock

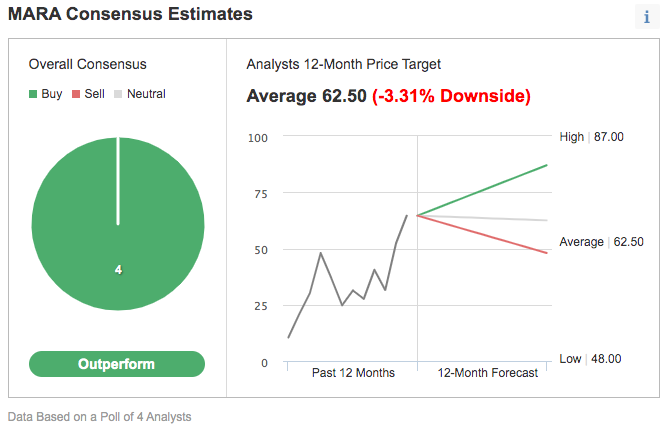

Among four analysts polled via Investing.com, Marathon Digital stock has an 'outperform' rating. The shares have a 12-month price target of $62.50, but as of Wednesday's $64.66 close that's down 3.31% from current levels.

The 12-month price range currently stands between $48-$87. So some on Wall Street believe much of the good news has already been priced into MARA shares.

Source: Investing.com

Meanwhile, the stock is trading at 250 times sales, an overstretched valuation level. By comparison, P/S ratios for RIOT and BTBT stocks are 46.88x and 7.12x.

Readers who watch technical charts might be interested to know that a number of MARA's short- and intermediate-term oscillators are overbought. Although they can stay extended for weeks—if not months—there could be some profit-taking soon.

Our expectation is for Marathon Digital to give up some of its recent gains and move below $60, possibly hitting $55. Afterward, the shares would likely trade sideways while it establishes a new base.

3 Possible Trades On Marathon Digital Stock

1. Buy MARA Stock At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in Marathon Digital stock now.

MARA stock is currently around $64.60. Buy-and-hold investors should expect to keep this long position for several months, if not multiple quarters, while the stock makes an attempt at a new record high, possibly mirroring increases in the price of Bitcoin.

Readers who opt for this approach, but are concerned about large declines, might also consider placing a stop-loss at about 3%-5% below their entry point.

2. Buy An ETF With MARA As A Main Holding

Many readers are familiar with the fact that we regularly cover exchange-traded funds (ETFs) that might be suitable for buy-and-hold investors. Thus, readers who do not want to commit capital to Marathon Digital Holdings stock but would still like to have substantial exposure to the shares could consider researching a fund that holds the company as a top holding.

Examples of such ETFs include:

- Global X Blockchain ETF (NASDAQ:BKCH): This fund is up 33.9% since inception in July, and MARA stock’s weighting is 18.97%;

- VanEck Digital Transformation ETF (NASDAQ:DAPP): The fund is down 16.1% since inception in April, and MARA stock’s weighting is 9.14%;

- Bitwise Crypto Industry Innovators ETF (NYSE:BITQ): The fund is up 23.4% since inception in May, and MARA stock’s weighting is 5.76%;

- Amplify Transformational Data Sharing ETF (NYSE:BLOK): The fund is up 67.6% YTD, and MARA stock’s weighting is 3.55%.

- Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (NYSE:BLKC): The fund is up 11.7% since inception on Oct. 7, and MARA stock’s weighting is 1.92%.

3. Cash-Secured Put Selling

Investors who are bullish or would consider buying MARA shares at a level less than the current price could consider selling a cash-secured put option in Marathon Digital stock—a strategy we regularly cover. As it involves options, this set-up is not appropriate for all investors.

A put option contract on MARA stock is the option to sell 100 shares. Cash-secured means the investor has enough money in his or her brokerage account to purchase the security if the stock price falls and the option is assigned. This cash reserve must remain in the account until the option position is closed, expires or the option is assigned, which means ownership has been transferred.

Let's assume an investor wants to buy MARA stock, but does not want to pay the current price at time of writing of $64.66 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

This would involve the sale of a cash-secured MARA put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting on this trade until the option expiry date of Jan. 21, 2022. As the stock is $61.35 at time of writing, an OTM put option would have a strike of $55.00.

So the seller would have to buy 100 shares of Marathon Digital at the strike of $55.00 if the option buyer were to exercise the option to assign it to the seller.

The MARA Jan. 21, 2022, 55-strike put option is currently offered at a price (or premium) of $9.53

An option buyer would have to pay $9.53 X 100, or $953, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, Jan. 21.

Assuming a trader would enter this cash-secured put option trade at $64.66 now, at expiration on Jan. 21, the maximum return for the seller would be $953, excluding trading commissions and costs.

The seller's maximum gain is this premium amount if MARA stock closes above the strike price of $55.00. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of MARA stock is lower than the strike price of $55.00) any time before or at expiration on Jan. 21, this put option can be assigned. The seller would then be obligated to buy 100 shares of MARA stock at the put option's strike price of $55.00 (i.e., at a total of $5,500).

The break-even point for our example is the strike price ($55.00) less the option premium received ($9.53), i.e., $45.47. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the choppiness in MARA stock in the coming weeks.

Investors who end up owning Marathon Digital shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.