- Market downturns can offer opportunities to buy strong companies at attractive valuations.

- Several growth stocks have dropped 30% or more in the current correction.

- Long-term investors may find value in these three tech stocks trading below recent highs.

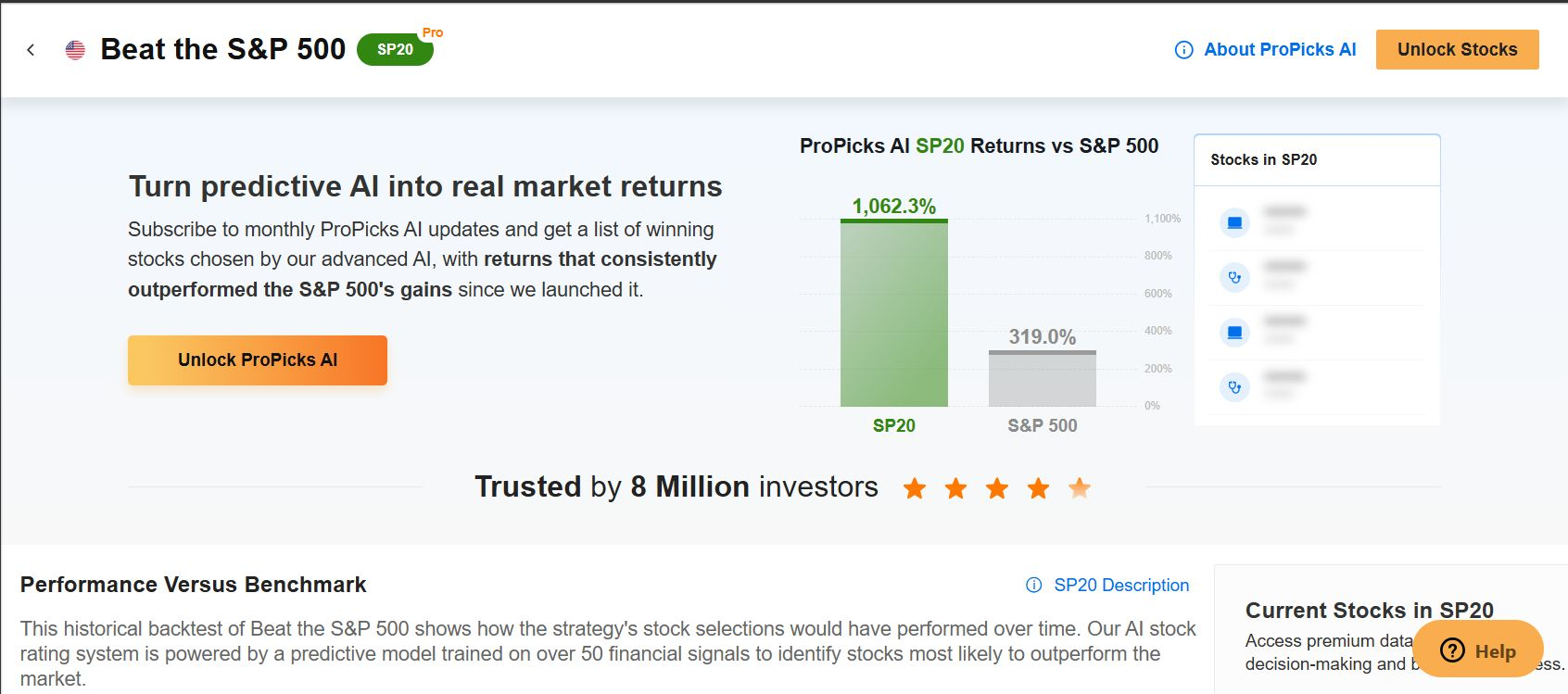

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

In the ever-evolving tech sector, market dips like the one we are currently experiencing can present strategic investment opportunities.

Source: Investing.com

Notably, Marvell (NASDAQ:MRVL) Technology, Confluent (NASDAQ:CFLT), and Qorvo (NASDAQ:QRVO) have each experienced declines of 25% or more from their recent highs. However, this drop might not signal a downturn in fortunes but rather an opportunity for savvy investors to buy into these companies at a discount.

All three names exhibit strong fundamentals and growth prospects, making them attractive options for investors seeking value.

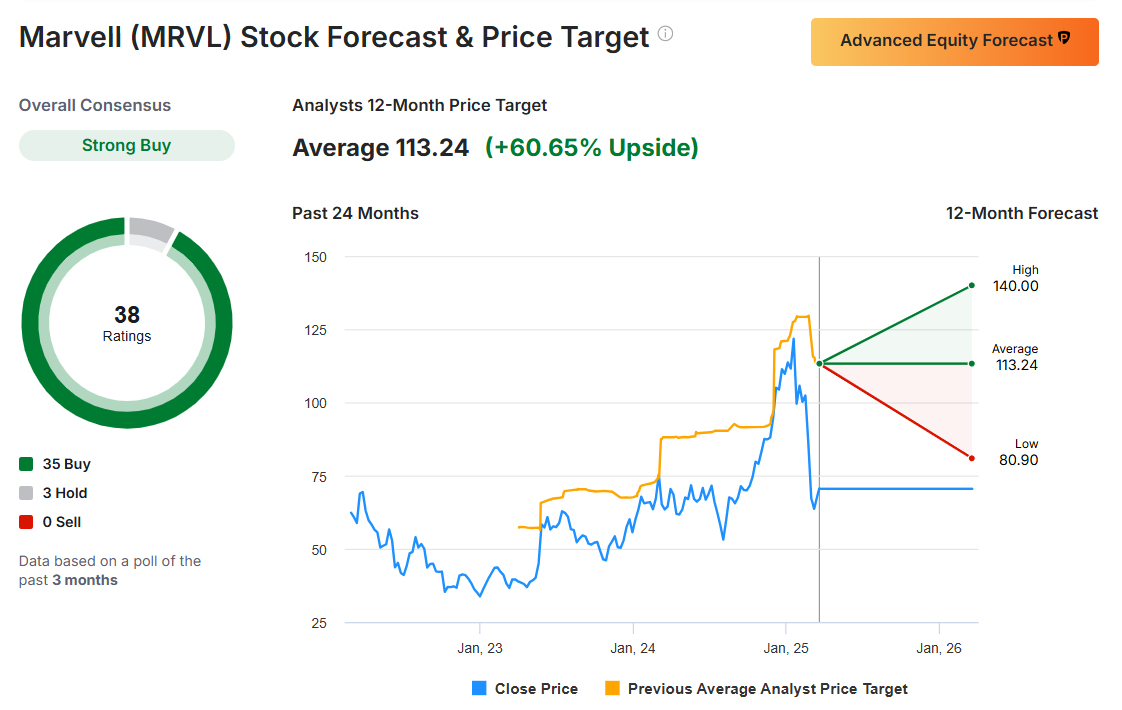

1. Marvell Technology

- Year-To-Date Performance: -36.2%

- Market Cap: $61 Billion

Marvell Technology specializes in semiconductor solutions, focusing on data infrastructure and networking. The company has a strong track record of innovation and has positioned itself at the heart of key growth areas in tech, including 5G and artificial intelligence.

Source: Investing.com

MRVL stock closed at $70.49 on Thursday, down a whopping 44% from its February 7 all-time high of $127.48, amid the selloff in semiconductor stocks.

Despite the market correction, Marvell's long-term growth prospects remain intact, thanks to its strategic investments in next-generation data solutions. Its diverse customer base and strong pipeline of new products make it an attractive buy on the dip for investors looking to capitalize on the data revolution.

Shares currently present a compelling investment case, with analysts projecting a massive 60% upside potential and price targets ranging from $81.00 to $140.00 (mean: $113.24).

Source: Investing.com

Marvell currently has a "FAIR" InvestingPro Financial Health score of 2.17, suggesting moderate stability despite some challenges.

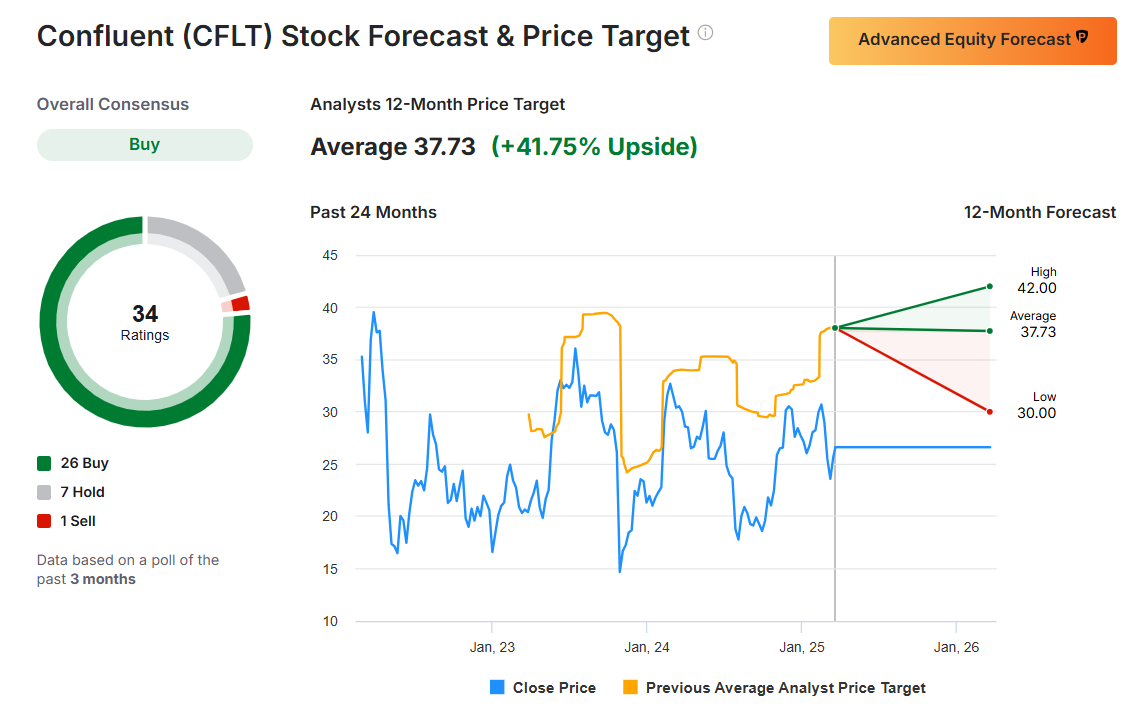

2. Confluent

- Year-To-Date Performance: -4.8%

- Market Cap: $8.9 Billion

Confluent is the creator of the popular open-source data streaming platform, Apache (NASDAQ:APA) Kafka. It provides a cloud service for companies looking to integrate, store, and manage data streams in real-time. Confluent's technology is utilized by major corporations such as Walmart (NYSE:WMT), eBay (NASDAQ:EBAY), and Citigroup (NYSE:C), underscoring its industry relevance.

Source: Investing.com

Down 30% from a recent high of $37.90 reached on Feb. 12, CFLT shares ended Thursday’s session at $26.62, valuing the company at $8.9 billion.

If Confluent maintains its edge over competitors and boosts enterprise adoption, the current discount on shares could be attractive. The company's innovative solutions and strategic partnerships position it as a key player in the future of data management.

Despite the recent market turmoil, Confluent demonstrates remarkable growth potential with analysts forecasting roughly 42% upside and price targets between $30 and $42 (mean: $37.73).

Source: Investing.com

Confluent also maintains a "FAIR" Financial Health score of 2.08.

3. Qorvo

- Year-To-Date Performance: +3.5%

- Market Cap: $6.7 Billion

Qorvo specializes in radio frequency (RF) solutions, serving mobile, infrastructure, and aerospace & defense markets. The company's products are integral to wireless connectivity, including components for smartphones, Wi-Fi and Internet of Things (IoT) devices, as well as 5G communication systems.

Source: Investing.com

QRVO stock has faced headwinds, wallowing near a 52-week low of $72.36 amid the shift in market sentiment. Shares are down roughly 45% since reaching a recent high of $130.99.

Despite the market-wide correction affecting its stock price, Qorvo's strategic position in high-demand sectors such as 5G and IoT remains undiminished. Its strong R&D capabilities and market leadership in RF solutions make it a solid bet for investors looking to ride the wave of the wireless revolution.

Its InvestingPro Fair Value estimate of $92.78 suggests a significant 28.2% upside from current levels. Interestingly, analysts are also optimistic, with a mean price target of $91.12, indicating a 26% upside potential.

Source: Investing.com

Qorvo rounds out the trio with a "FAIR" Financial Health score of 2.20.

Conclusion

In conclusion, while the market dips for Marvell Technology, Confluent, and Qorvo might initially appear as setbacks, they could serve as valuable opportunities for investors to enter or increase positions in these companies.

Each company operates in a sector that is not only essential to today's technology landscape but also poised for significant future growth.

Buying on the dip could be a strategic move for those looking to capitalize on the long-term potential of these innovative tech stocks.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.