From the looks of things, Warren Buffett appears to be getting fairly “fearful while others are greedy.”

Let's take a look at the 3 key reasons why the legendary investor is building up his cash pile.

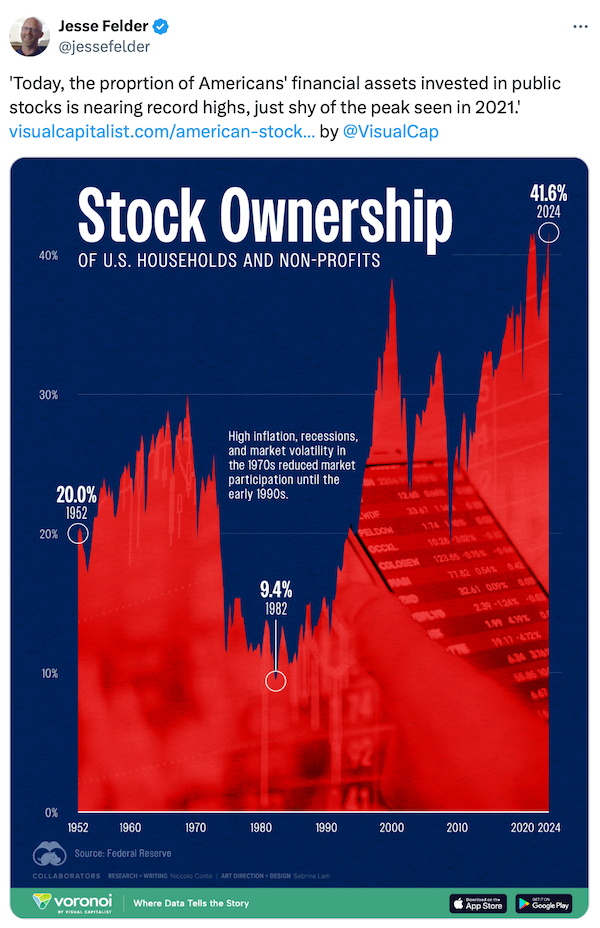

1. Household Equity Allocation

Evidence of the greed in markets can be seen in the largest-ever allocation to equities on the part of households.

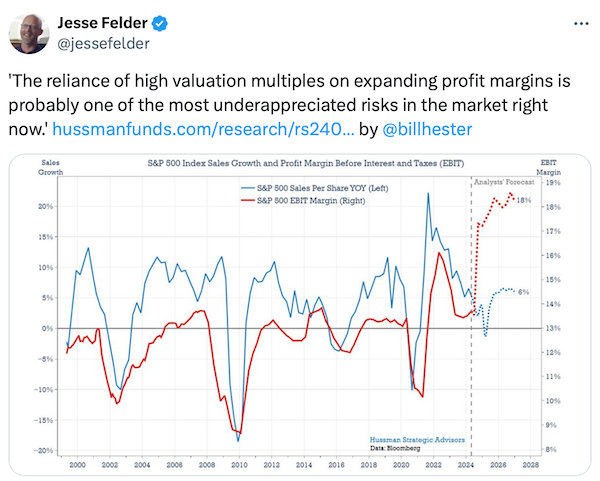

What these investors may fail to appreciate that Mr. Buffett certainly doesn’t is that not only are valuations extreme but they are also entirely dependent upon already extreme profit margins actually expanding the future.

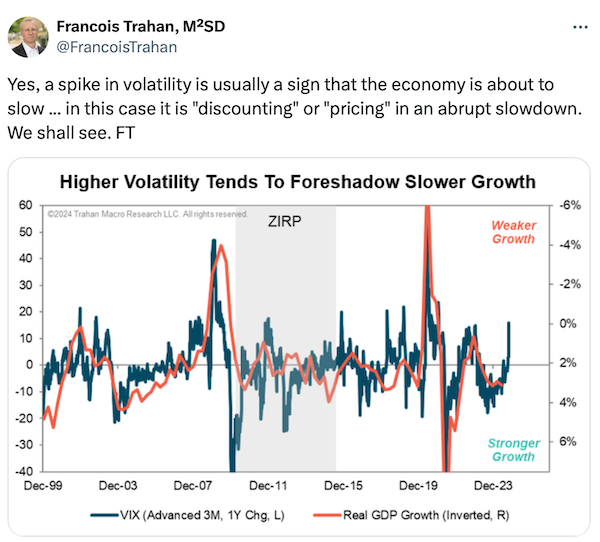

2. Volatility Spike Doesn't Bode Well for the Economy

In addition, elevated valuations have also discounted a soft landing in the economy, an outcome this week’s spike in volatility suggests may soon prove pollyannaish.

3. AI Narrative Faces Scrutiny

At the same time, the narrative around the driving force of both the expansion in profitability and productivity in the economy has taken a turn.

As such, investors may want to consider following Mr. Buffett’s lead by playing a little defense.