For all the myriad hazards that have occurred so far in 2020, astonishingly, it's turned out to be a blockbuster year for initial public offerings. So much so that some are comparing the current frenzy to the IPO boom of 1999.

Indeed, last week's much-anticipated, Snowflake debut as a publicly listed company made the tech firm the most highly valued software IPO ever, after its first day of trade. Not surprisingly, the Renaissance IPO ETF (NYSE:IPO), which tracks a basket of U.S. companies that have recently listed, has rallied nearly 65% this year. The S&P 500, for its part, is up roughly 3% over the same period.

The busy month for new listings is on track to continue, with data-analytics company Palantir Technologies (NYSE:PLTR) and workplace software provider Asana (NYSE:ASAN) scheduled to go public later this month. Home rental company Airbnb, on-demand delivery provider DoorDash, and OpenDoor, a real estate marketplace, are some of the other startups that are expected to go public before the end of 2020.

Below we’ll focus on a trio of tech unicorns, which, thanks to rapid growth, have the potential to become market leaders in their respective fields.

1. Snowflake

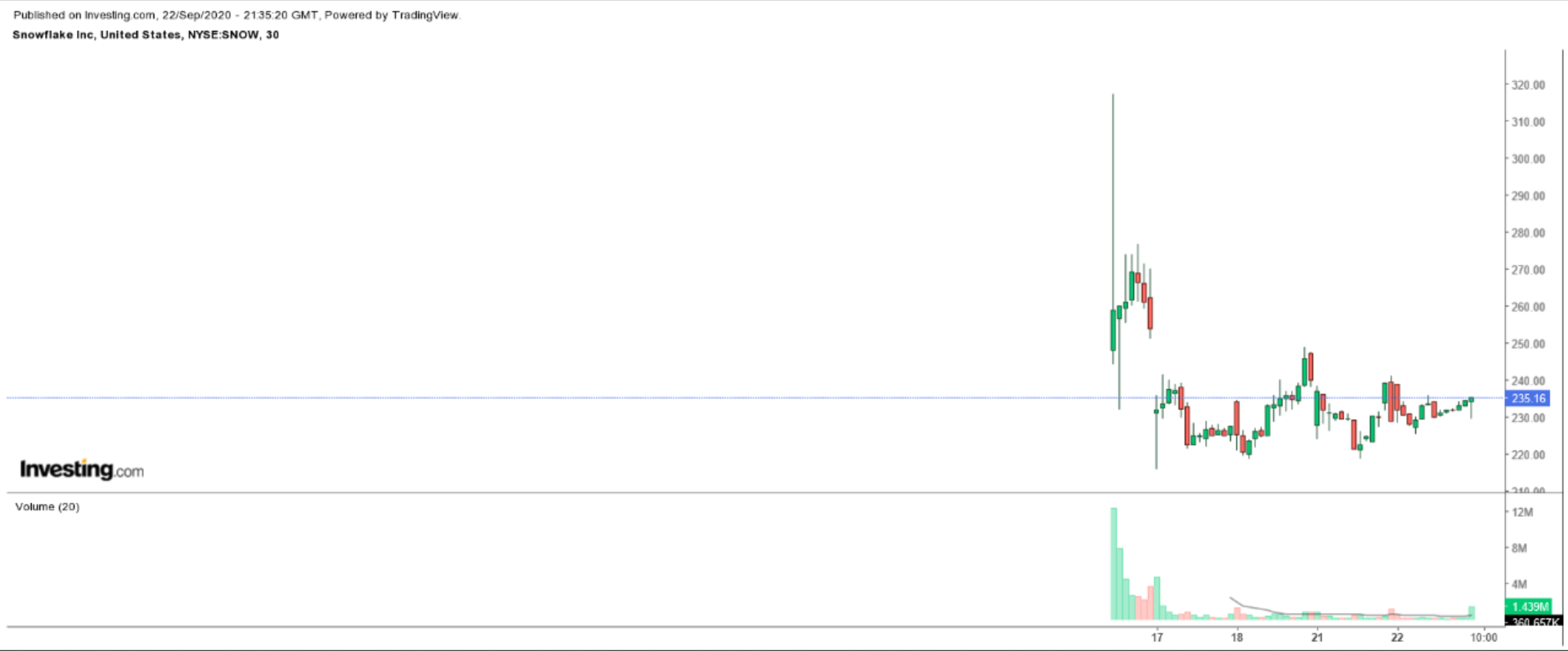

Snowflake (NYSE:SNOW) made a splash on Sept. 16 when it became the biggest tech IPO of the year. The cloud-based data storage and analytics provider priced at $120 per share—well above the original listing price range of $75 to $85 a share.

Shares of the cloud database vendor more than doubled in their first day of trading, ending up 112%, at $253.93. At one point, they soared as much as 166%, reaching a high of $319.

In total, Snowflake raised nearly $3.4 billion from its offering, making it the largest software IPO in history, easily topping the 2007 market debut of VMware (NYSE:VMW), which raised about $1 billion.

The stock, which has cooled a bit in the days following its debut, closed at $235.16 on Tuesday, giving the San Mateo, Calif.-based software-as-a-service company a market cap of around $65 billion.

Snowflake, whose data warehouse software helps companies manage and share vast amounts of information, received a vote of confidence from Warren Buffet’s Berkshire Hathaway (NYSE:BRKb), (NYSE:BRKa) as well as cloud giant Salesforce (NYSE:CRM) via two separate $250 million investments shortly before going public.

The cloud data warehousing company saw its revenue surge 133% in the first six months of 2020 to $242 million, thanks to robust expansion in customer additions, which increased 101% to 3,117. It currently counts seven of the Fortune 10 as customers and 146 of the Fortune 500 firms.

However, like many of its peers, Snowflake is not yet profitable. It lost $171.3 million in the first half of the year.

We expect Snowflake to continue to prosper thanks to powerful growth. Stll, its sky-high valuation leaves it little room for error.

2. JFrog

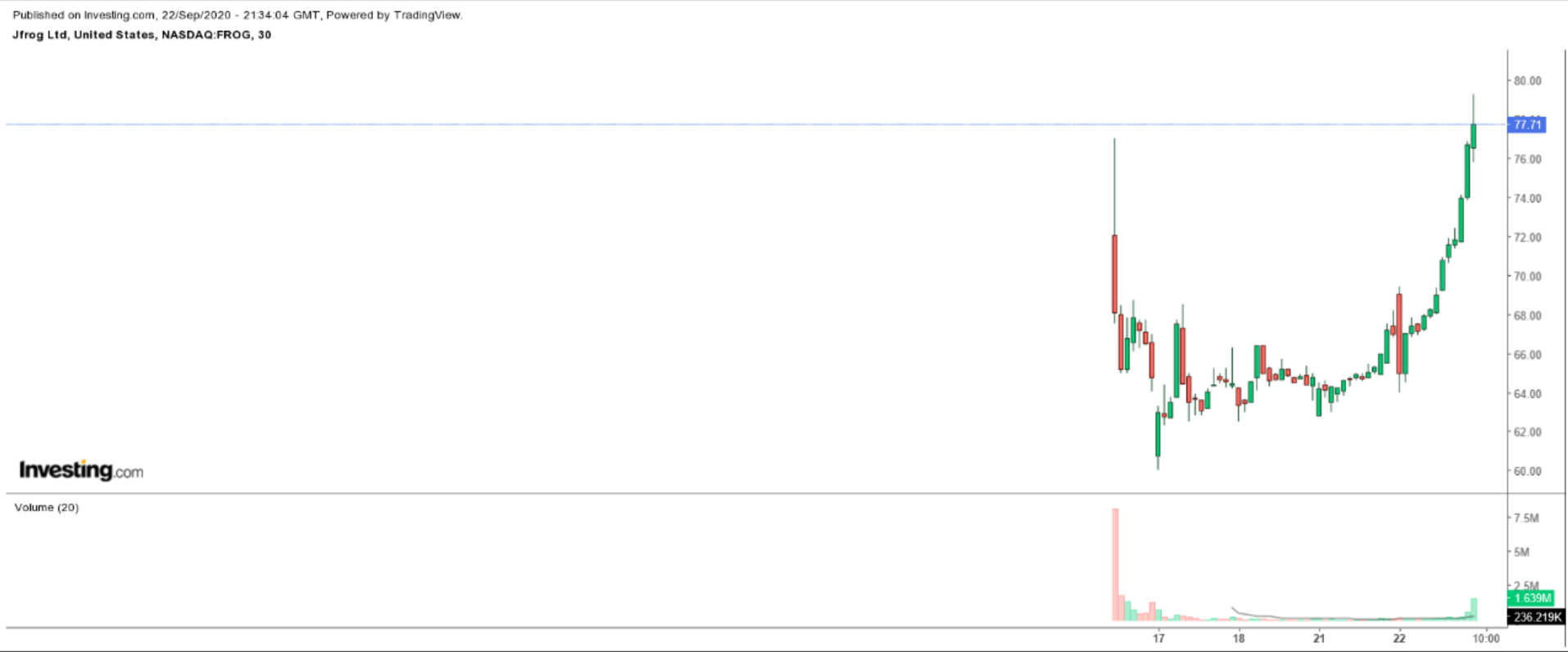

JFrog (NASDAQ:FROG) added to the tech IPO hysteria this month when it made its market debut on Sept. 16. The cloud-based software tools developer priced at $44 per share—up from its original listing price range of $33 to $37 a share.

The enterprise software company saw its shares briefly climb 75% to $77.00 in their first day of trading, before closing higher by 47.2% at $64.79. JFrog raised more than $350 million in the process.

The stock, which has continued to rally in the days following its IPO, settled at $77.71 last night, giving the Sunnyvale, California-based automatic software updating company a valuation of roughly $6.9 billion.

The DevOps platform helps companies and developers roll out software updates, and already counts a number of high-profile clients which include Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), Adobe (NASDAQ:ADBE) and American Express (NYSE:AXP).

Jfrog’s revenue rose 50% year-over-year to $69.3 million in the first half of 2020. Although the software company is still not profitable, its losses have been narrowing—from $2.1 million in the first half of 2019 to just $426,000 in the first half of 2020.

Despite lofty valuation levels, we expect Jfrog to remain one of the best-performing enterprise software names in the market thanks in large part to its accelerating growth in sales and customer wins.

As of the end of June, JFrog counted about 5,800 businesses and organizations as clients, including 75% of the Fortune 500 companies.

3. Unity Software

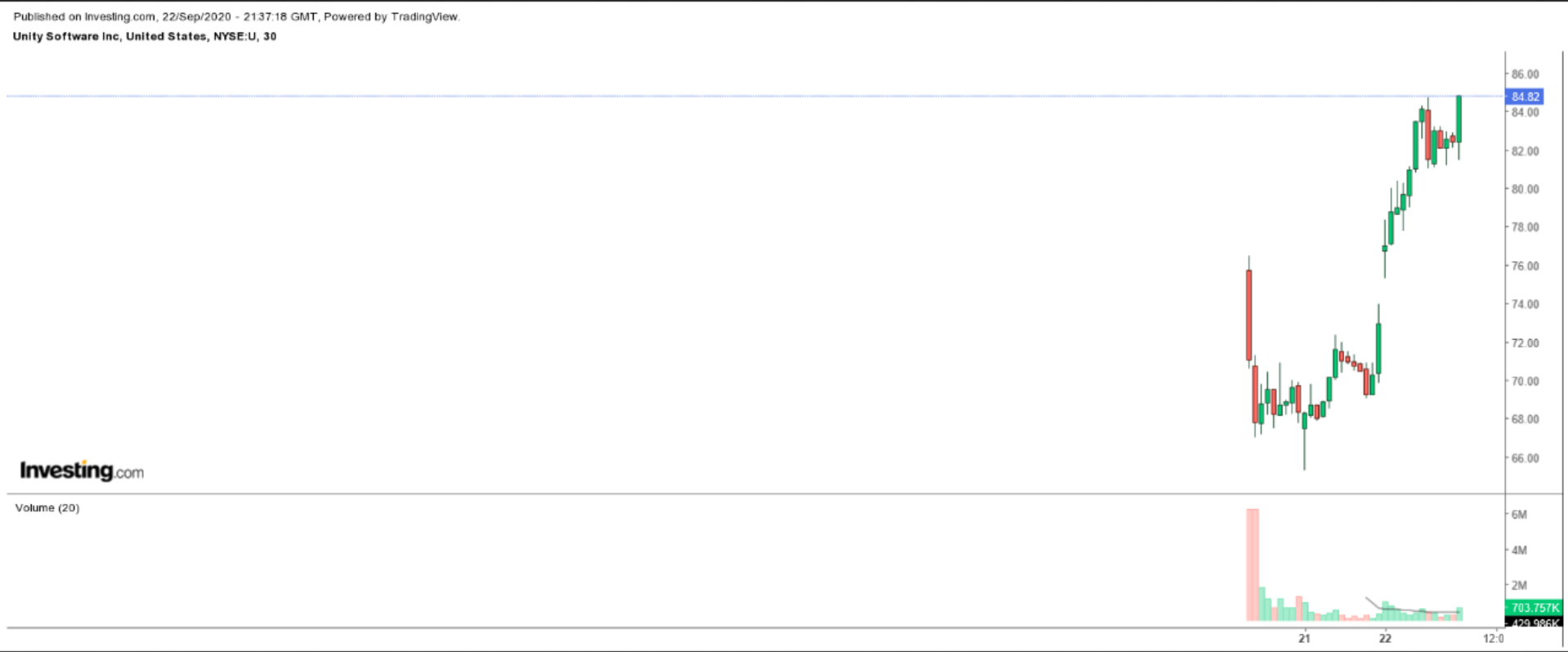

Unity Software (NYSE:U), which provides tools for creating videogames, made its public market debut on Sept. 18. The San Francisco, California-based company priced at $52 per share, which was higher than its original listing price range of $34 to $42 a share.

On the first day of trading, shares of the video game software developer jumped by as much as 44%, before ending up 31.4% at $68.35, raising $1.3 billion in proceeds.

The stock, which has stayed hot in the days following the IPO, closed at $84.82 yesterday, pushing its market cap to $22.3 billion.

Unity’s revenue in the first six months of 2020 increased 39% from the year-ago period to $351.3 million, reflecting growing demand for its video game development platform. The number of customers spending $100,000 or more as of the end of June hit 716, while this figure stood at 515 a year ago.

The company said that more than half of the top 1,000 mobile games on Apple’s App Store and Google Play in 2019 were made using its platform. “Pokemon Go,” "Call of Duty: Mobile," and “Iron Man VR” are among some of the most well-known games developed using Unity’s software.

Like many of the red-hot tech names debuting on Wall Street recently, Unity is not a profitable company yet. It made a net loss of $54.1 million in the first half of this year, narrowing from losses of $67.1 million in the same period a year earlier.

Unity Software’s stock still looks attractive going forward, considering the strong demand it has seen for its video game development tools. The company’s platform had 1.5 million monthly active users worldwide as of the end of June 2020.