- Cooler-than-expected CPI figures today suggest a potential September rate cut.

- Real Estate, retail, and dividend stocks are sectors poised to benefit from easing monetary policy and falling rates.

- Leveraging InvestingPro's tools, investors can identify top stocks to buy with ease.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Inflation came in cooler than expected today, potentially paving the way for a September rate cut. This raises a critical question for investors: Should you recalibrate your portfolio to capitalize on potential rate cuts?

Disinflationary Tailwinds: Sectors to Watch

If the disinflationary trend continues, several sectors could see a boost:

- Real Estate (NYSE:XLRE): Battered by COVID, rate hikes, and the China crisis, Real Estate could rebound with lower mortgage rates.

- Retail (NYSE:XRT): Large investors have already been eyeing this sector, anticipating benefits from easing monetary policy.

- Dividend Stocks: As rates fall, government bond yields decrease, making companies with attractive dividends more appealing.

Finding Winning Stocks in a Changing Market

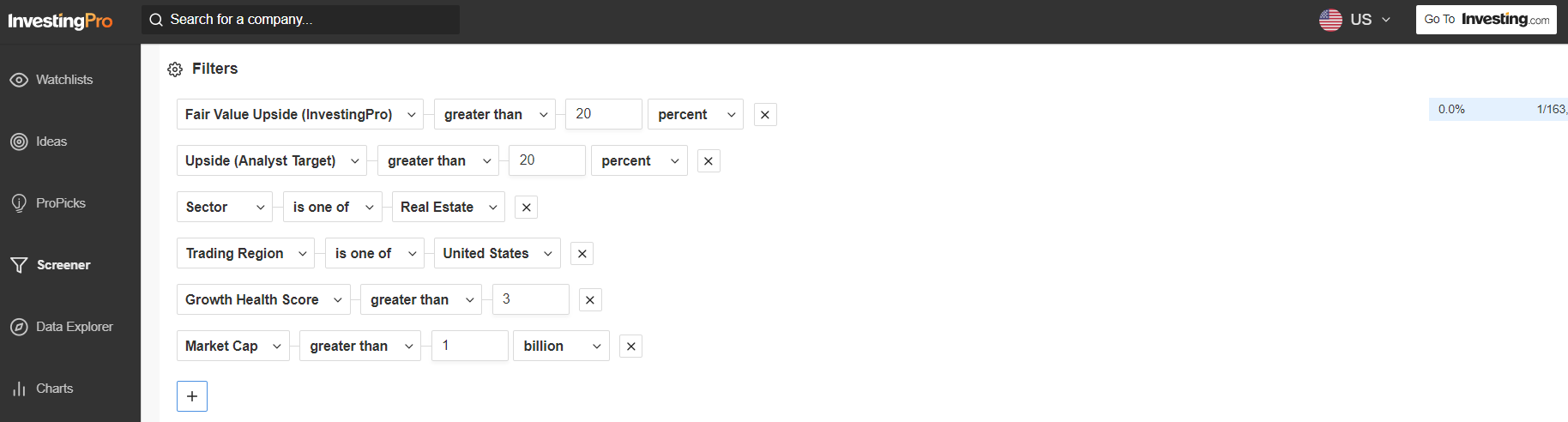

InvestingPro's stock screener can help you identify stocks poised to thrive in this new economic environment. Here's how:

- Target (NYSE:TGT) Benefiting Sectors: Select sectors like Real Estate and Retail that could benefit from falling rates.

- Prioritize Financial Strength: Use the "financial health" filter to find companies with robust balance sheets, mitigating risks in an uncertain market.

- Uncover Undervalued Gems: Look for stocks with high growth potential based on analysts' Fair Value and Target Price estimates.

By leveraging InvestingPro's tools, you can strategically position your portfolio to potentially profit from a potential rate cut and the evolving economic landscape.

Source: InvestingPro

Based on the results from the screener, here are the top three stocks to buy amid falling inflation.

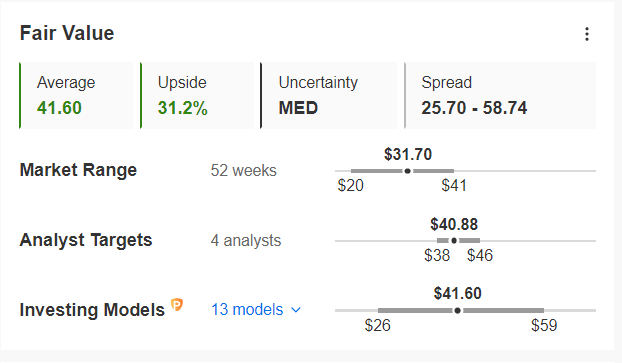

1. Forestar: Real Estate Stock Set to Soar (Upside: 31.2%)

Leading the pack is Forestar (NYSE:FOR), a U.S. residential lot developer with a market cap of $1.6 billion.

Source: InvestingPro

Analysts surveyed by InvestingPro predict a surge exceeding 30% in the next 12 months, pushing the stock price above $40. Even Fair Value analysis confirms its undervalued status, indicating a potential upside of 31.2%.

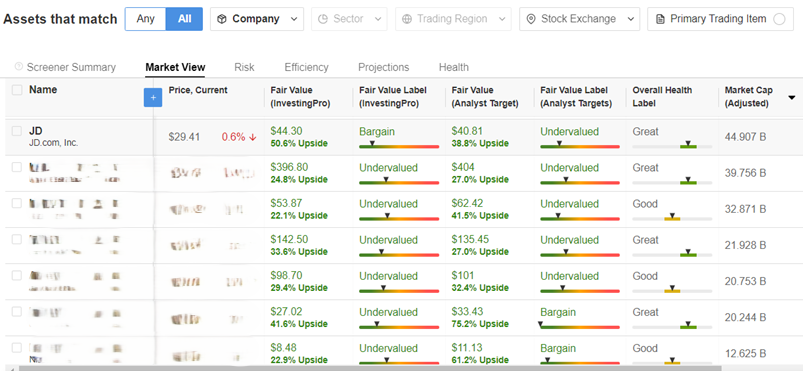

2. JD.com: E-commerce Giant Poised for Growth (Upside: 50.6%)

In the retail sector, JD.com (NASDAQ:JD) stands out as a prime beneficiary of potential interest rate cuts. The Chinese e-commerce giant is poised for significant growth.

Source: InvestingPro

Analysts are bullish, predicting a 38.8% increase from its June 11th price of $29.41. Our Fair Value analysis is even more optimistic, with an intrinsic value of $44.30, suggesting a potential upside of over 50%.

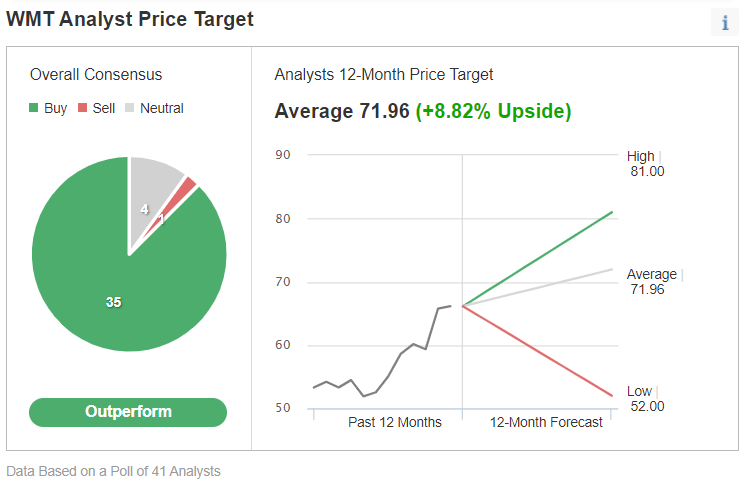

3. Walmart: Dividend King Offers Stability and Growth (Target Price: $71.96)

While growth is exciting, stability is crucial during volatile times. Enter Walmart (NYSE:WMT), a "Dividend King" with 29 consecutive years of dividend increases, favored by big investors like Bill Gates and Ray Dalio.

Source: InvestingPro

The recent investments from heavyweights like Bill Gates and Ray Dalio further solidify Walmart's strong position. Additionally, a potential decrease in borrowing costs could boost sales for the retail giant.

Analysts overwhelmingly favor Walmart, with 35 "Buy" ratings compared to just 1 "Sell" rating. Despite its recent 30% growth, experts expect further appreciation, with a target price of $71.96 – nearly 9% higher than the June 11th closing price.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor. The author owns shares in the company mentioned.