- Investors looking to capitalize on the AI boom should consider these three under-the-radar semiconductor stocks.

- All three companies are trading at attractive valuations according to InvestingPro's AI-backed Fair Value models.

- By utilizing InvestingPro's comprehensive research and analysis features, you too can find the next big winners in the stock market.

- Subscribe now to InvestingPro and position your portfolio one step ahead of everyone else!

As the AI boom continues to gain momentum, investors are on the lookout for promising semiconductor stocks that stand to benefit from this transformative trend.

While giants like NVIDIA (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), and AMD (NASDAQ:AMD) often steal the spotlight, there are several under-the-radar semiconductor companies that are making significant advancements in AI and are well-positioned for substantial growth.

Here, we highlight Skyworks Solutions (NASDAQ:SWKS), Qorvo (NASDAQ:QRVO), and Smart Global Holdings (NASDAQ:SGH), three stocks that are not only at the forefront of AI innovation but also trade at attractive valuations according to InvestingPro's AI-backed Fair Value models.

Don’t miss out on the next big opportunity—subscribe to InvestingPro today and unlock the full potential of your portfolio.

1. Skyworks Solutions

- 2024 Year-To-Date: -5.9%

- Market Cap: $17.1 Billion

Skyworks Solutions is a leading semiconductor company that designs, develops, and manufactures high-performance analog and mixed-signal semiconductors. The Irvine, California-based company plays a crucial role in enabling wireless connectivity and is increasingly integrating AI capabilities into its products.

Skyworks' technology enables faster data transmission and enhanced connectivity, making it a vital player in the AI ecosystem. Its advanced RF solutions are essential for AI-driven applications, including 5G technology, IoT devices, and smart home systems.

The company's product portfolio includes amplifiers, attenuators, detectors, diodes, and switches used in various devices, such as smartphones, tablets, laptops, and other consumer electronics.

Tailwinds and Growth Prospects:

- 5G Adoption: The global rollout of 5G networks is a significant tailwind, as Skyworks provides essential components for 5G infrastructure and devices.

- IoT Expansion: The growing demand for IoT devices, which rely on AI for data processing and connectivity, presents a substantial growth opportunity. Skyworks’ technology is integral to smart home systems, industrial IoT applications, and more.

- Strategic Partnerships: Collaborations with leading tech companies to integrate AI capabilities into consumer electronics further bolster Skyworks' market position. The company’s chips are increasingly found in AI-powered devices, from smart speakers to autonomous vehicles.

Valuation:

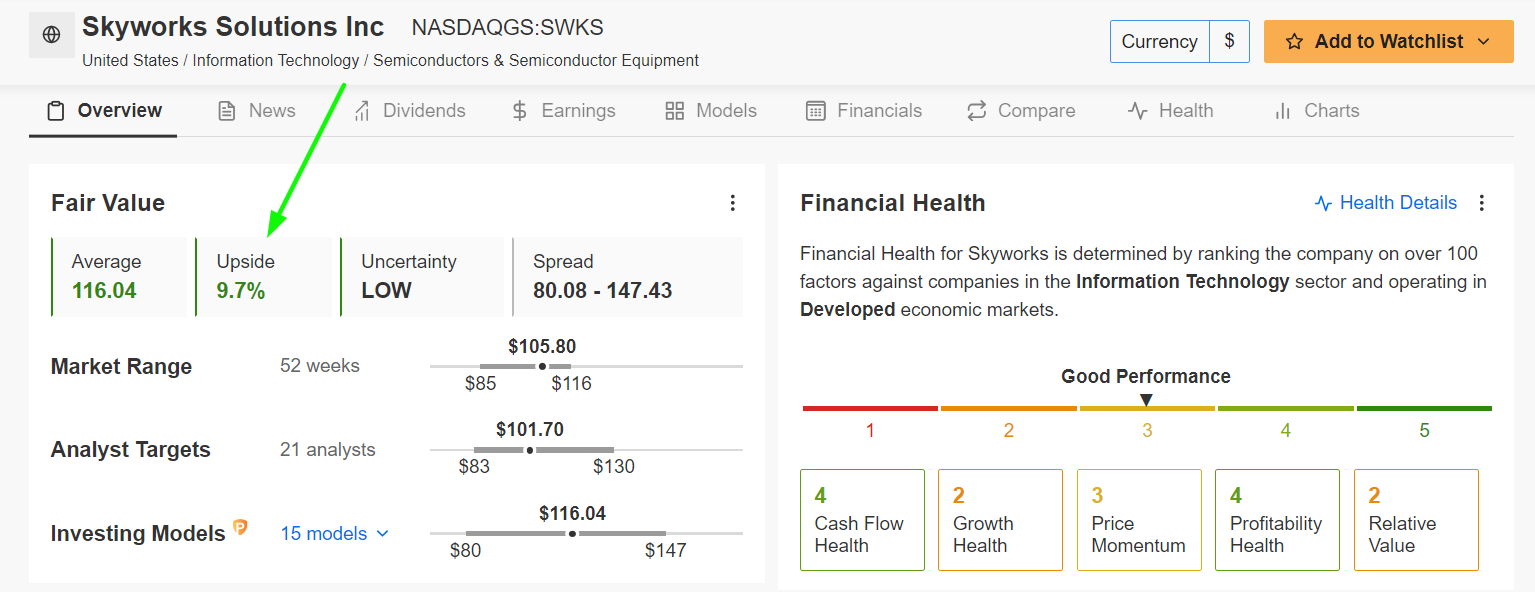

Skyworks Solutions is trading at a discount valuation, with InvestingPro's AI-backed Fair Value model indicating an upside potential of roughly +10% from last night’s closing price of $105.80.

Source: InvestingPro

This attractive valuation, coupled with its strong position in the AI and 5G markets, makes Skyworks a compelling investment amid the current environment.

2. Qorvo

- 2024 Year-To-Date: +0.3%

- Market Cap: $10.8 Billion

Qorvo is a prominent semiconductor company that specializes in providing innovative RF solutions that are integral to AI applications in various sectors, including telecommunications, automotive, and defense.

The Greensboro, North Carolina-based company’s products are designed to enhance the performance of AI-driven technologies by improving signal processing and communication capabilities. It provides innovative RF solutions and technologies for mobile, infrastructure, and aerospace/defense applications.

Qorvo’s products include amplifiers, filters, duplexers, and power management devices, which are essential for wireless communication and advanced radar systems.

Tailwinds and Growth Prospects:

- Telecommunications Growth: As telecom companies upgrade their networks to support AI and 5G applications, Qorvo stands to benefit significantly. The company’s RF solutions are vital for the enhanced connectivity and performance required by modern networks.

- Automotive AI Integration: The increasing integration of AI in automotive technologies, such as autonomous driving and advanced driver-assistance systems (ADAS), drives demand for Qorvo's solutions. The company’s products improve the reliability and efficiency of AI-driven automotive systems.

- Defense and Aerospace: Qorvo's high-performance RF products are crucial for AI-driven defense and aerospace applications, ensuring secure and efficient communication. The company’s solutions support advanced radar, satellite communications, as well as electronic warfare systems.

Valuation:

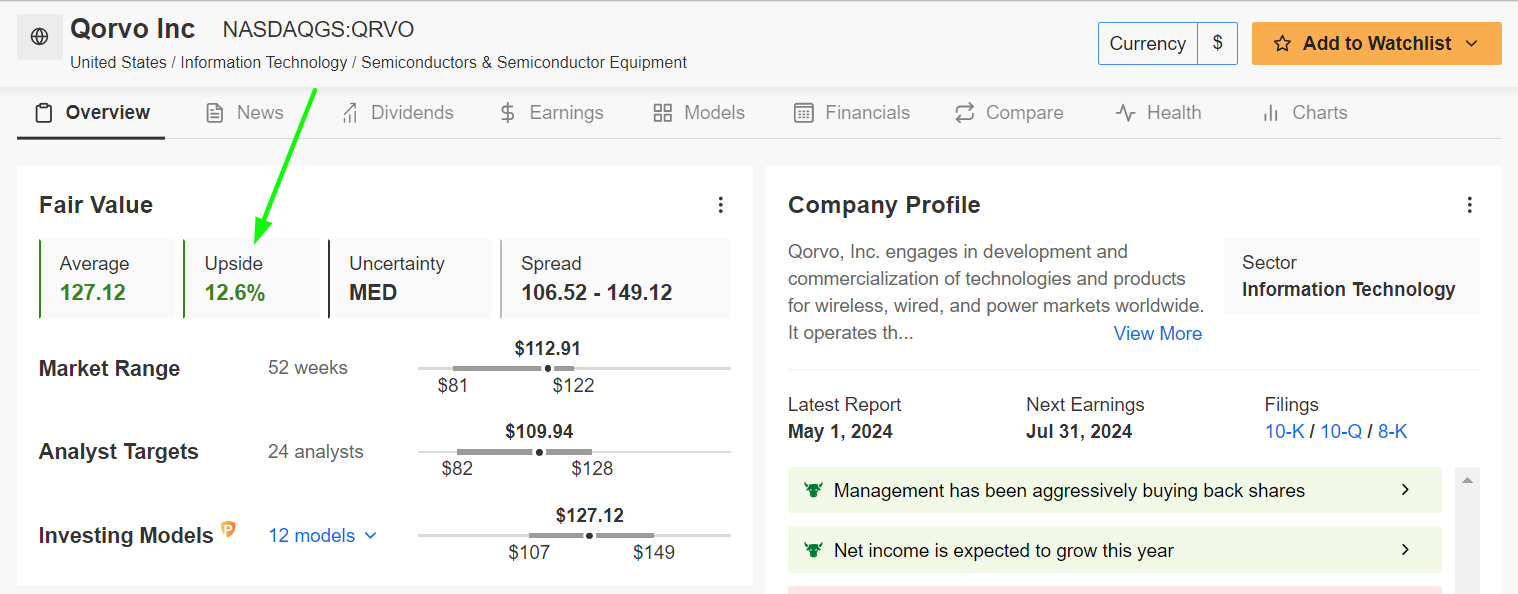

Qorvo is also trading at a discount valuation, with InvestingPro's AI-backed Fair Value model suggesting an upside potential of +12.6% from its current market value of $112.91.

Source: InvestingPro

This, combined with its strategic positioning in AI-related sectors, makes Qorvo an attractive stock for investors.

3. Smart Global Holdings

- 2024 Year-To-Date: +18.8%

- Market Cap: $1.2 Billion

Smart Global Holdings is a diversified company that provides specialty memory, storage, and computing solutions. It offers dynamic random access memory modules, solid-state and flash storage, and other advanced memory solutions for networking and telecom, data analytics, artificial intelligence and machine learning applications

The Milpitas, California-based company operates through three segments: Specialty Memory Products, Specialty Compute and Storage Solutions (SCSS), and Intelligent Platform Solutions.

Smart Global has been making strides in AI through its advanced computing products, which are essential for AI data processing and storage.

SGH’s products are used in various applications, including enterprise, government, education, defense, and cloud computing.

Tailwinds and Growth Prospects:

- AI Data Processing: SGH's high-performance memory and storage solutions are critical for AI data processing, providing the speed and capacity required for complex AI computations. The company’s products enable faster data access and analysis, essential for AI applications.

- Data Center Growth: The expansion of data centers, driven by the growing demand for AI and cloud computing, presents a significant growth opportunity for SGH. The company’s memory and storage solutions are integral to the infrastructure of modern data centers.

- Innovative Product Development: Continuous innovation in developing AI-focused products ensures that SGH remains competitive in the rapidly evolving AI market. The company is investing in new technologies to meet the increasing demands of AI workloads.

Valuation:

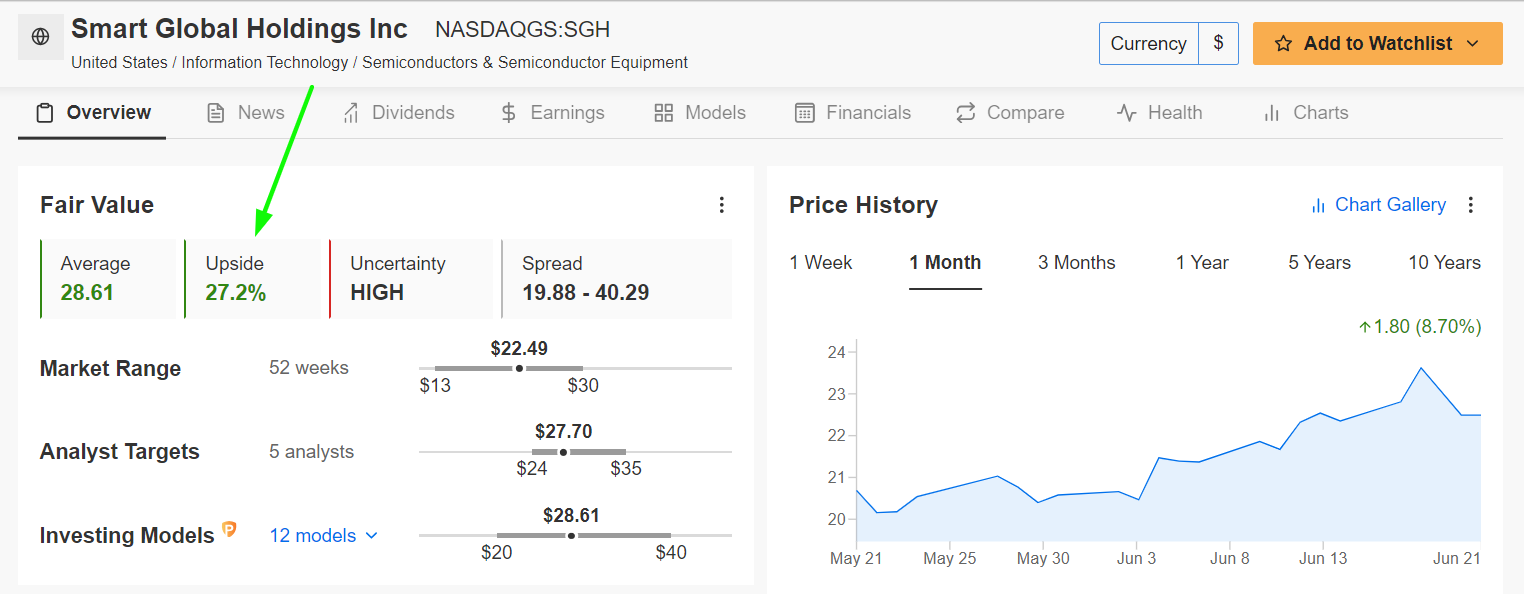

Smart Global Holdings is trading at a significant discount, with InvestingPro's AI-powered Fair Value model indicating an upside potential of +27.2% from Thursday’s closing price of $22.49.

Source: InvestingPro

This substantial upside, along with its strong presence in the AI computing space, positions SGH as a promising investment.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy a limited-time discount of 40% OFF on the yearly and bi-yearly Pro plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Why Invest in an InvestingPro Subscription?

InvestingPro provides invaluable tools for both novice and experienced investors. With a subscription, you gain access to:

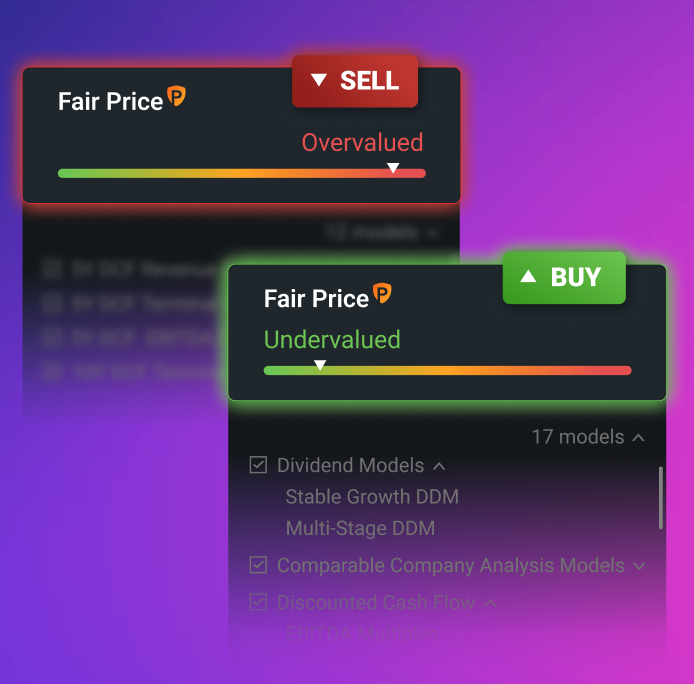

- Accurate Fair Value Estimates: Determine if a stock is undervalued and has room to grow.

- Comprehensive Financial Health Scores: Evaluate a company’s overall financial stability and growth potential.

- Advanced Stock Screener: Quickly find stocks that match your investment criteria and have high return potential.

- ProTips: Benefit from actionable insights and professional-grade analysis to make better investment decisions.

- ProPicks: AI-selected stock winners with proven track record.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Start using InvestingPro today and discover the next big winners in the stock market!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI