- Stocks with a dividend yield higher than the S&P 500, and decent fair value upside are tough to find.

- This piece will look at what fair value is and how it is used to determine whether a company's stock is undervalued or overvalued.

- We will leverage the power of InvestingPro to find these stocks and analyze them.

- Want to invest by taking advantage of market opportunities? Don't hesitate to try InvestingPro. Sign up HERE and get almost 40% discount for a limited time on your 1 year plan!

Finding stocks that boast a healthy discount, have the market's support and pay outsized dividends compared to the S&P 500 is every investor's dream. Today, we'll explore how InvestingPro's fair value can help you find these hidden gems.

Fair value, calculated using various methods, aims to estimate a stock's objective worth independent of its current market price. This discrepancy is key:

- Market Price > Fair Value: The stock is likely overvalued.

- Market Price The stock is potentially undervalued, presenting a buying opportunity.

Fair value is dynamic, adjusting to market conditions, economic data, and a company's financial performance.

For example, Imagine a stock trading at $50. Our fair value calculation reveals a true value of $60. This suggests a potential 20% undervaluation based on fundamentals, making it a compelling buy with the expectation that the price will rise toward fair value over time.

Leveraging InvestingPro, we'll identify a selection of companies that meet these criteria: market support, attractive fair value, and dividend yields exceeding the S&P 500.

1. Cisco Systems

Cisco Systems (NASDAQ:CSCO) is engaged in the manufacture, sale, and maintenance of telecommunications equipment. It was incorporated in 1984 and is headquartered in San Jose, California.

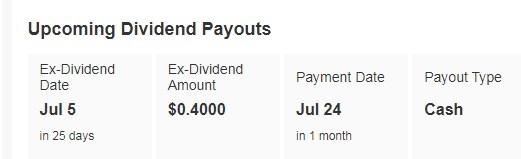

On July 24 it will distribute a dividend of $0.40 per share and to receive it you must have shares before July 5. The company's dividend yield is 3.46%. Note that it has increased its dividend for 13 consecutive years.

Source: InvestingPro

On August 14 it will present its results. In the previous ones presented on May 15, earnings per share (EPS) beat forecasts by 7.9%.

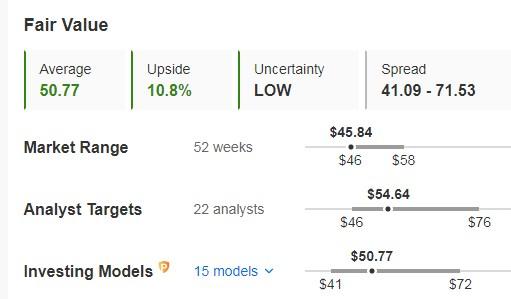

Source: InvestingPro

Its fair value or fundamental price target is 10.8% above the closing price for the week, namely $50.77. The average price given by the market is at $54.64.

Source: InvestingPro

2. Skyworks Solutions

Skyworks Solutions (NASDAQ:SWKS) is an American semiconductor company based in Irvine, California, and founded in 1962.

Its dividend yield is 3% and it has been increasing its dividend for 10 years.

Source: InvestingPro

On July 25 it will present its accounts.

The CEO of Skyworks Solutions recently invested in the company's stock, buying shares worth about $1 million.

He purchased 11,142 shares at an average price of between $89.91 and $90.04. The total investment amounted to about $1,002,780, reflecting confidence in the company's future prospects.

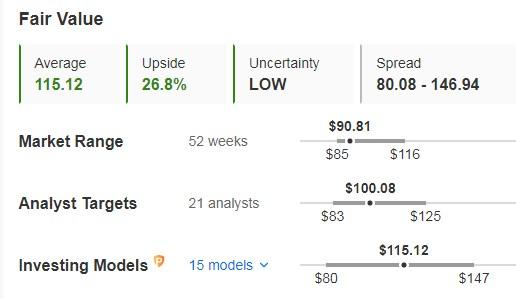

The fundamental fair value is 26.8% above the closing price for the week, at $115.12. The market assigns it an average potential of $100.08.

Source: InvestingPro

3. Juniper Networks

Juniper Networks (NYSE:JNPR) designs, develops and sells networking products and services worldwide. It was incorporated in 1996 and is headquartered in Sunnyvale, California.

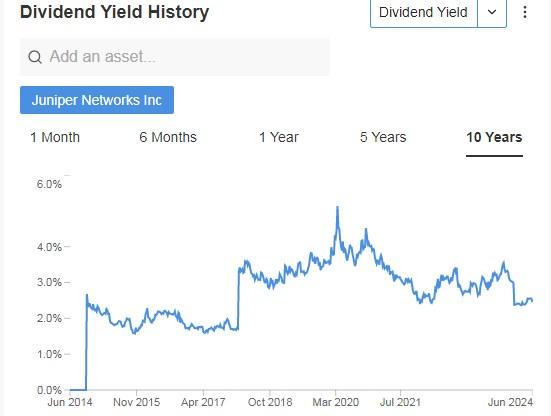

Its dividend yield is 2.48%. That yield has been declining these past 4 years from 5%.

Source: InvestingPro

It will release its numbers on July 25.

The CEO sold a total of 16,665 shares. The transactions, which occurred over three days, were valued at over $588,000.

The sales took place on June 4, 5, and 6, and the sale prices ranged from $35.17 to $35.49. Following the transaction, it retains ownership of 970,099 shares.

The company has made improvements to its platform and is the only vendor with a single native AI platform that reduces operating expenses, by as much as 85% in some cases.

The market gives it an average price target of $40.11.

Source: InvestingPro

4. Gen Digital

Gen Digital (NASDAQ:GEN) is in the business of providing cybersecurity solutions for consumers in the United States, Canada, Latin America, Europe, Asia Pacific, and Japan.

It was formerly known as Norton LifeLock and changed its name in November 2022 and was founded in 1982 and is headquartered in Tempe, Arizona.

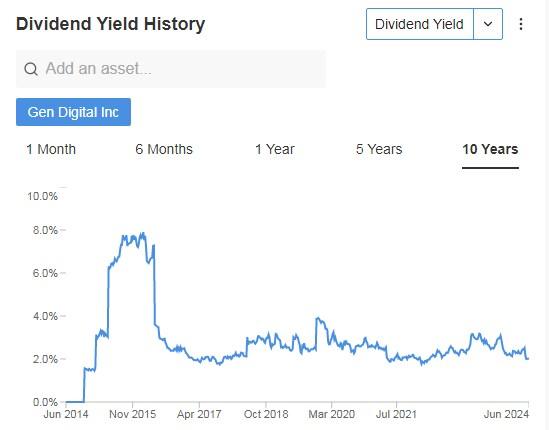

Its dividend yield is 2.02%. A far cry from the 8% it had in 2015.

Source: InvestingPro

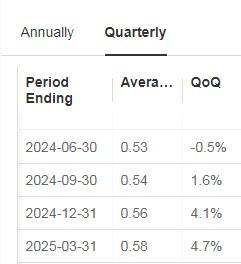

On August 1, it will present its earnings report. Here you can see its earnings per share (EPS) forecasts for the coming periods.

Source: InvestingPro

The company expects to add new products to enhance the value of its cybersecurity subscriptions, including new AI-powered services, and become the dominant player in consumer cybersecurity.

New product launches such as the AI-powered Norton Genie app and Total Radius, a reputation defense tool, were key highlights.

Its fundamental fair value was 17.2% above the stock's closing price for the week, at $28.97.

Source: InvestingPro

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.