- May has historically been a neutral month for the S&P 500, with an average return of +0.22% from 1950 to 2021.

- But, some stocks on Wall Street have consistently outperformed the S&P 500 during May, with an average return of over 5%.

- Let's delve deeper to see which stocks have done so in the past few years.

If we take 1950 to 2021, May is the eighth-best month of the year, with an average return on the S&P 500 of +0.22%, making it neither a good nor a bad month overall.

The worst month of May was in 1962, with the S&P 500 dropping -8.5%, and the best was in 1990, with a +9.20% rise.

Except for 2022, in the last 20 years, its average return is -0.08%, the last 50 years +0.14%, and the last 100 years +0.05%.

So, a normal month. Neither positive nor negative from a historical point of view.

What if I told you that there are several stocks on Wall Street that, over the last 5 months of May, have not only beaten the S&P 500 but have actually performed very well?

In the last 5 months of May, they have averaged over 5%. And that's while the S&P 500 was down -6.4% in May 2019 and -3.6% in May 2022.

Of course, that doesn't mean it has to do well again this May, but hey, at least it's an argument at the very least to take a look at them, and that's what we're going to do below using the Investing Pro tool.

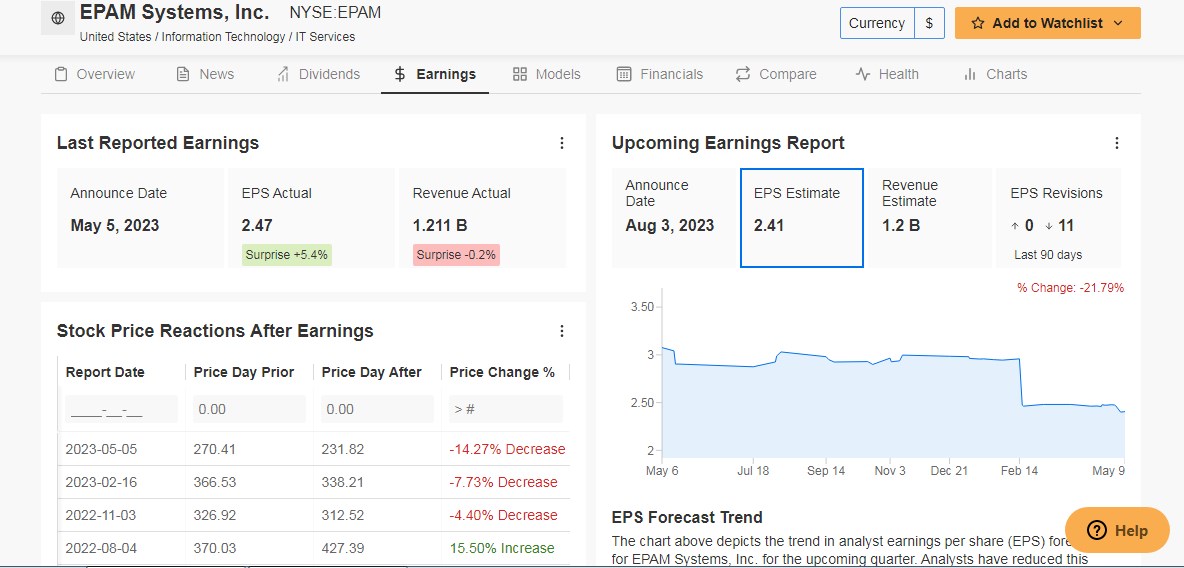

1. Take-Two Interactive Software

Take-Two Interactive Software (NASDAQ:TTWO) is an American developer and distributor of video games, founded on September 30, 1993. It is headquartered in New York, United States, with an international base in Geneva, Switzerland.

Source: InvestingPro

The company reports its quarterly results on May 17 and is expected to report EPS of $0.68 per share and revenue growth of +60% this year. The stock has not fallen in any of the last 5 Mays, with an average return of +9.3%.

The reason is simple, its quarterly results are presented in May, and they are usually good. In May 2022, it gained 14%, and in May 2021, it soared by 105%.

In November, it formed a floor, and from there, it rose strongly, moving within an uptrend channel.

There is no sign of weakness in the short term as long as it remains above $120.28.

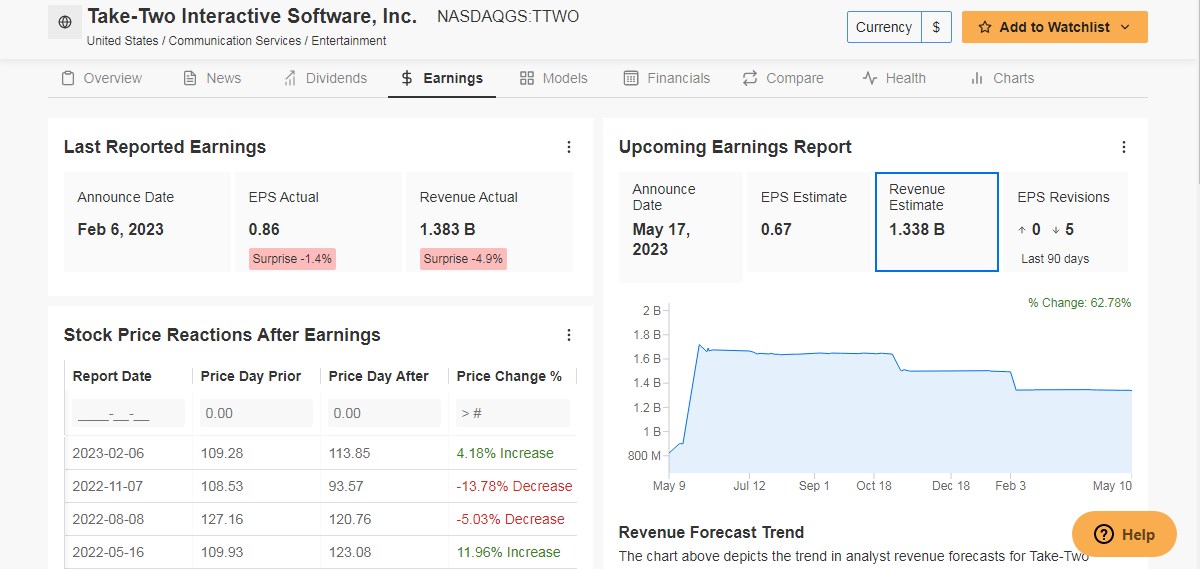

2. EPAM Systems

EPAM Systems (NYSE:EPAM) is a U.S. company specializing in software engineering services and digital product design that operates from Newtown (Pennsylvania). It was founded in 1993 in New Jersey (USA).

Source: InvestingPro

It reports results on August 3 and is expected to report earnings per share of $2.41 per share.

The company rose in 4 of the last 5 Mays by an average of +8%.

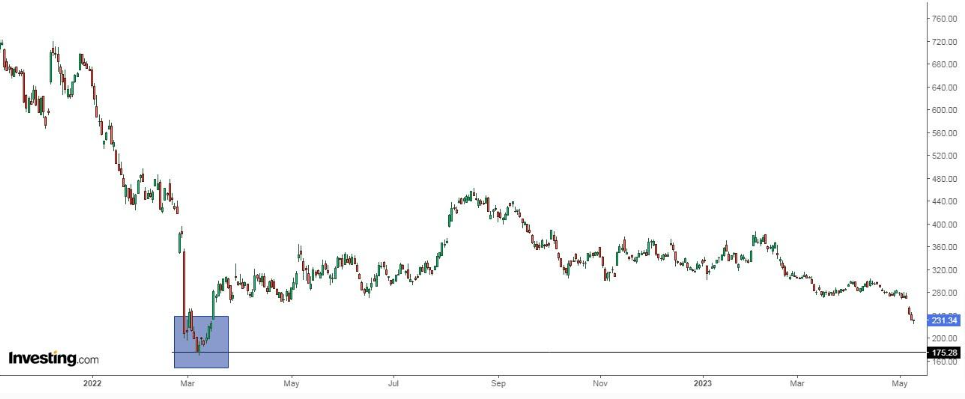

Source: InvestingPro

The bearish weakness continues, but it is close to a key support level at $174.80, which could be an area where buyers enter to look for a bounce.

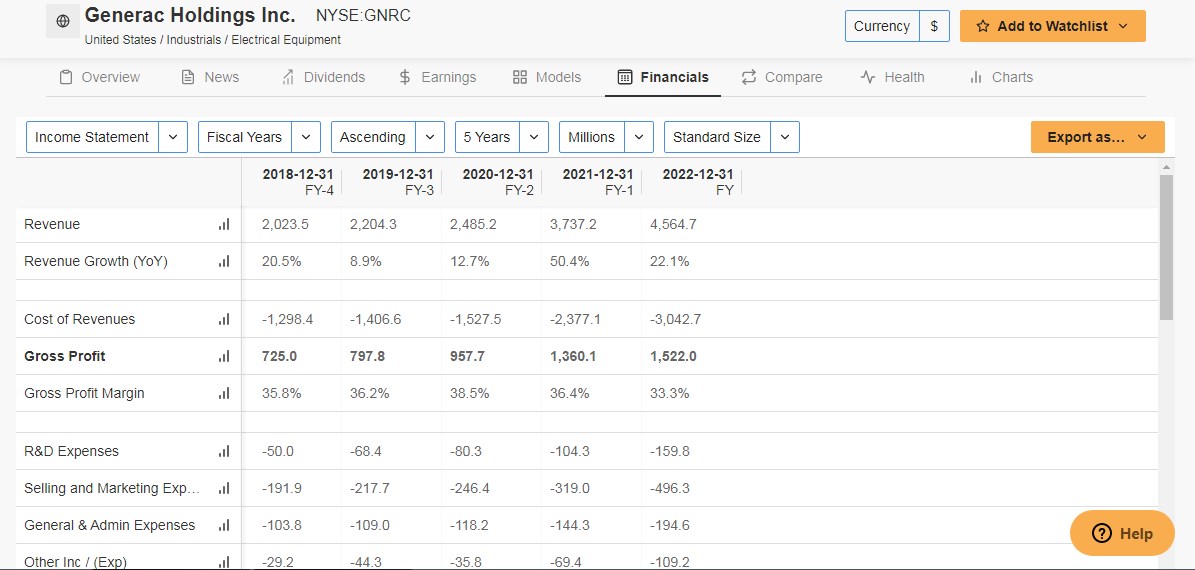

3. Generac Holdings

Generac Holdings (NYSE:GNRC) is a U.S. manufacturer of standby power generation products for residential and commercial markets. It was founded in 1959 and is headquartered in Waukesha, Wisconsin.

Source: InvestingPro

It releases earnings on July 26 and is expected to report earnings per share of $1.18.

The company rose an average of +6.6% in the last 5 Mays and only fell in one of them, which was in 2019, with a -0.3% loss.

The drop has caused the stock to form a floor for the time being, from which it is bouncing back. A return to $89.79 could be in the cards. It would need to break above $135.70 to see some buying strength.

4. ConocoPhillips

ConocoPhillips (NYSE:COP) is an international energy company headquartered in Houston, Texas, although it has offices in several countries. It is the third-largest oil company in the United States. It was created after the merger of Conoco and Phillips Petroleum Company on August 30, 2002.

Source: InvestingPro

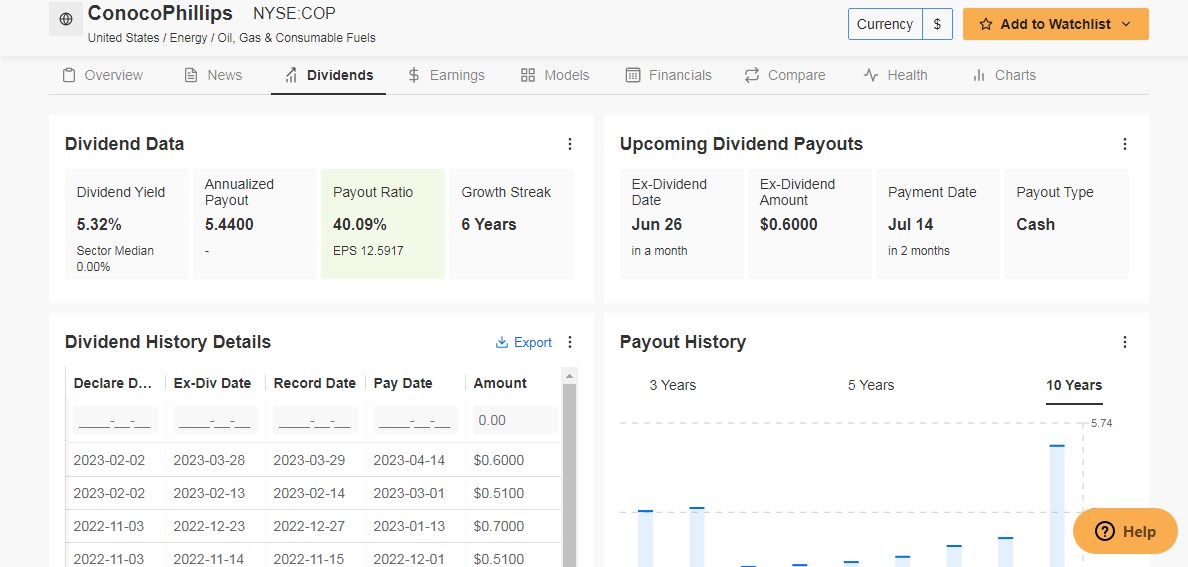

It pays a dividend on July 14, of 0.60 dollars per share, and to be entitled to receive it, shares must be held before June 26.

It presents results on August 1, and earnings per share are expected to be $2.27. In the last 5 Mays, it has had an average return of +5.5%.

It has been falling since November and has a level to watch at $92 if there is a rebound to the upside.

Are you seeking more actionable trade ideas to navigate market volatility? The InvestingPro tool helps you easily identify winning stocks at any given time.

Start your 7-day free trial to unlock must-have insights and data!

Here is the link for those who want to subscribe to InvestingPro and start analyzing stocks.

Disclosure: The author does not own any of the securities mentioned.