- While most stocks receive mixed ratings from Wall Street, a select few enjoy unanimous support

- These stocks have recently bounced back and currently trade at a better valuation than most S&P 500 companies

- Airline stocks, for example, have rebounded significantly and feature prominently in the 4 stocks we will discuss below

- InvestingPro Summer Sale is back on: Check out our massive discounts on subscription plans!

We often come across different ratings given to company stocks by various investment banks and agencies. It's only natural that there are usually disagreements and varying viewpoints. For instance, a given company might receive 8 buy ratings, 2 hold ratings, and 2 sell ratings.

However, there are also cases where there is complete unanimity, and the market agrees on the valuation of certain stocks. That's why today, I want to talk about a group of stocks that enjoy the favor and support of Wall Street. To analyze them, we'll use InvestingPro to gather relevant data and information.

By the way, you can now purchase the subscription at a fraction of the regular price, as our exclusive summer discount sale has been extended until 07/17/2023!

Out of the 4 stocks we'll be discussing, 2 belong to the aviation sector, which is performing well due to stable oil prices and strong demand for travel during the summer season. Despite rising inflation and signs of an economic slowdown, the post-pandemic rebound in travel spending has sustained.

In June, airline stocks in the S&P 500 experienced a significant increase, marking the largest gain since February 2021. Furthermore, the shares of United Airlines (NASDAQ:UAL) and Delta are currently trading at a price-to-earnings ratio of 5.2 and 7, respectively, which is considerably lower than the S&P 500 multiple of 19.

1. Targa Resources

Founded on October 27, 2005, with its headquarters in Houston, Texas, Targa Resources (NYSE:TRGP) has established itself as one of the largest natural gas supply infrastructure companies in the United States. Its primary operations are centered around the Gulf Coast. In a significant move last year, the company acquired Southcross Energy Operating for $200 million.

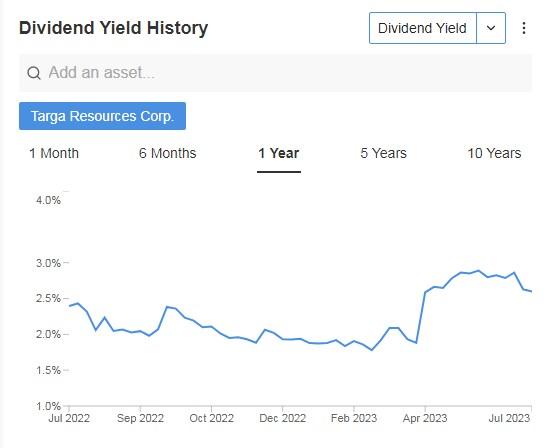

As part of its shareholder benefits, the company distributes dividends on a semi-annual basis. The current dividend yield stands at a promising +2.60%.

Source: InvestingPro

It will report its results for the quarter on August 3. Looking ahead for the year, earnings per share are expected to increase by +33% to $5.17 per share.

Source: InvestingPro

This company has a total of 19 ratings, with 18 of them being buy ratings and 1 being a hold rating. Surprisingly, there are no sell ratings for this company, indicating a positive sentiment among analysts.

Among the ratings, Scotiabank (TSX:BNS) sees significant potential for the company, forecasting a target price of $100.

Source: InvestingPro

The average of the 19 houses that follow the company gives it potential at $98.68.

Source: InvestingPro

The stock has maintained its uptrend and is approaching the resistance that originated in April 2022 at $80.81.

2. AXON Enterprise

Headquartered in Scottsdale, Arizona, Axon Enterprise (NASDAQ:AXON) specializes in the development of technology and weapons products for the military and security forces. It has gained recognition for its flagship product: Tasers. These electric shock weapons disrupt the muscular, nervous system, immobilizing subjects with electric shocks of up to 50,000 volts.

On May 9, the company released its earnings, surpassing market expectations in both earnings per share and revenues.

Source: InvestingPro

On August 8, it will present its next results, and EPS is expected to increase by 15.38% and revenue by 13.12%.

Source: InvestingPro

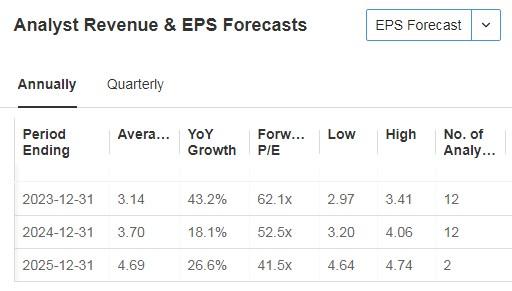

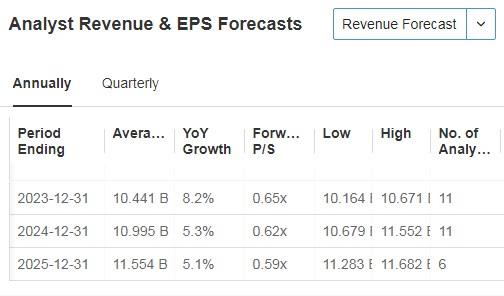

Here you can see the forecast is earnings per share and revenue for 2023, 2024, and 2025.

Source: InvestingPro

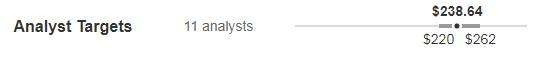

That being the case, the market gives it potential at $238.64.

Source: InvestingPro

After experiencing a significant surge, the stock is currently taking a breather. It is now approaching key levels, including its Fibonacci levels and 50-day and 200-day moving averages. These levels often act as significant technical indicators.

At these levels, there is a possibility of the stock bouncing back and resuming an upward trend.

3. Delta Air Lines

Delta Air Lines (NYSE:DAL), headquartered in Atlanta, Georgia, is a founding member of the SkyTeam alliance. Alongside Aeromexico, Air France, and Korean Air, it offers customers a wide range of global destinations.

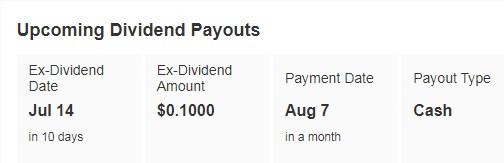

A dividend payment of $0.4025 per share is scheduled for August 7, providing shareholders with a yield of approximately +0.90%.

Source: InvestingPro

After presenting its results on April 13, this company surpassed market expectations as its revenues exceeded predictions. Now, on July 13, the company is scheduled to release its upcoming financial results, and the forecast indicates a positive outlook.

Both earnings per share and revenue are expected to grow.

Source: InvestingPro

Out of the 20 ratings assigned to the company, 19 are buy ratings, 1 is a hold rating, and there are no sell ratings. Among these ratings, Seaport Global stands out as the most optimistic, projecting a target price of $66.

Source: InvestingPro

InvestingPro models give it a potential of $61.

Source: InvestingPro

The stock continues to maintain its bullish momentum and is steadily approaching its resistance level at $51.80.

4. Alaska Air Group

Based in SeaTac, Washington, Alaska Air Group (NYSE:ALK) is an airline holding company in the United States. The group operates two airlines, namely Alaska Airlines, its primary airline, and Horizon Air, a regional airline. It was established in 1985, and in 1987, it merged with Jet America Airlines.

The company is scheduled to announce its quarterly results on July 20. Market expectations indicate a robust 30% rise in earnings per share, reflecting strong performance. Additionally, a nearly 4% increase in revenue is anticipated, further highlighting positive growth for the company.

Source: InvestingPro

In the image below, we can see revenue forecasts for the current year as well as 2024 and 2025.

Source: InvestingPro

Out of the 14 ratings given to the company, an overwhelming majority of 13 are buy ratings, while 1 is a hold rating. There are no sell ratings associated with the company, indicating a positive sentiment among analysts.

Bank of America Corp has recently weighed in on the company, providing a price target of $62, suggesting further upside potential. On average, the market projects a slightly higher potential with an average target price of $65.35.

Source: InvestingPro

The trailing 12-month return on its shares is 28.05%.

Source: InvestingPro

The stock has recently reached its resistance level at $53.58. If it successfully breaks through, it would signal bullish strength.

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by visiting the link and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest nor is it intended to encourage the purchase of assets in any way.