The four TSX tech stocks on our list have industry-leading revenue growth figures

SmallCapPower | December 20, 2017: Today, we have discovered four top performers amongst TSX tech stocks, which lead their peers in terms of revenue growth. The stocks on our list have returned 57% on average during 2017, driven primarily by their proprietary software solutions.

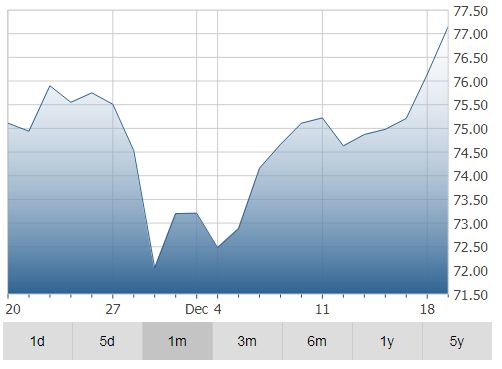

Kinaxis Inc (TO:KXS) – $75.21

Software

Kinaxis provides cloud-based subscription software for supply chain operations. The Company’s RapidResponse software connects data, processes and users onto a single platform, to give a consolidated view of a client’s entire supply chain. As a result, the software allows users to monitor progress in real time, improving operational performance.

- Market Cap: $1,914 Million

- YTD Total Return: 20.3%

- 90 Day Return: 2.4%

- 3 Year Revenue Growth (Last Reported): 89%

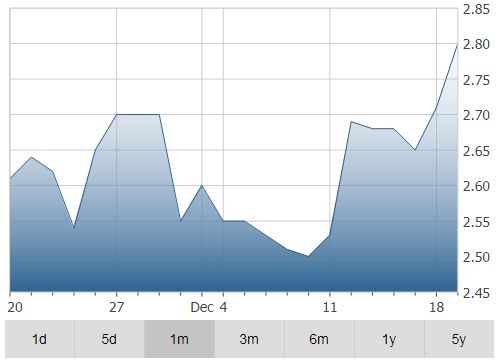

Baylin Technologies Inc (TO:BYL) – $2.65

Communications and Networking

Baylin Technologies manufactures antennas for telecom customers in a handful of jurisdictions. The Company’s products are used for cell towers, mobile devices and home networking devices. Baylin has over 1,000 employees worldwide, including ~100 engineers that work at its three production facilities in Korea, China and Vietnam.

- Market Cap: $81 Million

- YTD Total Return: 32.5%

- 90 Day Return: 36.6%

- 3 Year Revenue Growth (Last Reported): 86%

Avigilon Corp (TO:AVO) – $20.83

Communications and Networking

Aviglion designs and manufactures video surveillance products to a variety of industries. The Company’s products include video analytics, network video management software, along with surveillance hardware (cameras). Aviglion’s customers include school campuses, transportation systems, healthcare centers, prisons financial institutions, casinos and government offices.

- Market Cap: $926 Million

- YTD Total Return: 62.5%

- 90 Day Return: 14.2%

- 3 Year Revenue Growth (Last Reported): 66%

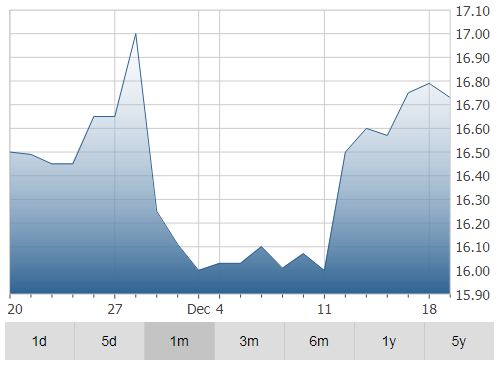

TECSYS Inc. (TO:TCS) – $16.75

Software

Tecsys provides an array of enterprise-wide Supply Chain Management solutions to clients in various industry sectors, ranging from service parts to general high-volume wholesale. The Company’s main focus lies within the healthcare market. Tecsys plans to capture further market share in the healthcare industry by leveraging its unique SCM platform, which was designed specifically for the healthcare sector.

- Market Cap: $219 Million

- YTD Total Return: 79.0%

- 90 Day Return: 20.5%

- 3 Year Revenue Growth (Last Reported): 33%

Disclosure: Neither the author nor any of the principals at SmallCapPower, or their family members, own units in any of the companies mentioned above.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI