- AI boom will continue to benefit tech companies.

- In this article, we will discuss stocks that are set to ride the AI wave apart from Nvidia.

- We will harness the power of InvestingPro to delve deep and analyze these picks.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Nvidia's (NASDAQ:NVDA) stock surge and consistent outperformance make it the poster child for AI's rise. However, its sky-high valuation, with a price-to-sales ratio of nearly 23, can be cause for concern.

A Bernstein study shows companies exceeding a 15x P/S historically underperform the market over the next three years. While Nvidia's future remains bright, investors are seeking a broader AI play.

The focus is shifting from pure AI component suppliers to companies across the entire AI ecosystem. Apple (NASDAQ:AAPL)'s recent "Apple Intelligence" announcement fueled interest in "Edge AI," computing intelligence at the network's edge.

Diversification is key. Below are some top contenders beyond Nvidia to consider adding to your long-term portfolio.

1. Arista Networks

Arista Networks (NYSE:ANET) is a networking company based in Santa Clara, California.

When data centers are growing at a fast pace, networking hardware is in desperate need, and that is where this company comes in, earning almost 50% of its sales from Microsoft (NASDAQ:MSFT) and Meta (NASDAQ:META).

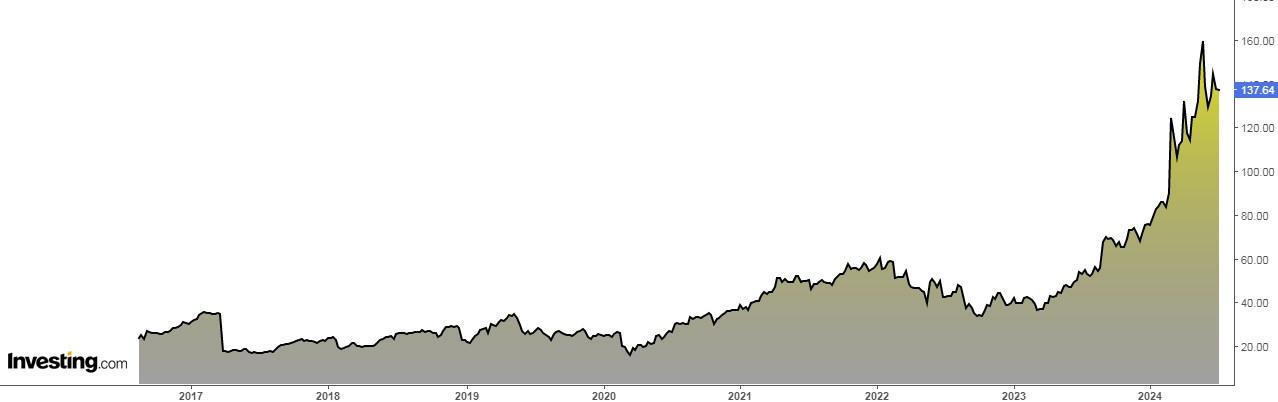

The company is celebrating ten years since its IPO (it debuted in June 2014 on the New York Stock Exchange) with impressive revenue growth. It reports its financials on July 29 and is expecting EPS growth of 14.3% and revenue of 14.7% by 2024.

The potential at $385 is based on a price-to-earnings ratio (P/E) of 38x applied to revised EPS estimates for fiscal 2025.

It will also benefit from the expansion of the AI networking market, especially through its participation in the Ethernet segment. And also highlights the solid liquidity position, as it holds more cash than debt.

Its beta is greater than 1, so it indicates that its stock moves more than the S&P 500. Its financial health as measured by 100 factors shows a score of 4 out of 5 which is the maximum.

2. Oracle

Oracle (NYSE:ORCL) is a company that specializes in developing cloud solutions and offers products and services that address all aspects of corporate technology environments. It is headquartered in Austin, Texas.

Oracle is a serious competitor to Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) and Microsoft in the cloud. After going through a period where growth stalled for several fiscal years, that's behind it now and double-digit growth is on the horizon. In addition, it has sealed an agreement with OpenAI as a customer.

Oracle's partnerships with OpenAI and Google Cloud are expected to expand its cloud infrastructure offering to a broader customer base. These recent developments, along with the company's ambitious investment plans, suggest a promising outlook for Oracle's continued revenue growth.

It will pay a dividend of $0.40 per share on July 25, and you must own shares by July 11 to be eligible to receive it. It has increased its dividend for 10 consecutive years. It presented results on June 11, so it will not receive its dividend until September 9.

Its beta is greater than 1, so its stock has higher volatility than the S&P 500. Its financial health as measured by 100 factors shows a score of 4 out of 5, which is the maximum. The average price target assigned by the market is $160-170.

3. Dell Technologies

Dell Technologies (NYSE:DELL) is an American multinational company, a provider of information technology solutions, located in Round Rock (Texas). In 2016 Dell completed the acquisition of EMC) to create Dell Technologies, the merger between Dell (manufactures and sells computers and servers) and the company's (data center).

The company is seeing growing demand for its Nvidia-based AI servers and is also poised to benefit from the next wave of AI-enabled PCs. On August 2 it delivers a dividend of $0.4450 per share and to receive it you need to own shares before July 23.

On August 29 it will release its earnings statements and EPS is expected to increase by 18.09Ç% and revenue by 6.94%.

Dell Technologies has been meeting all the necessary requirements to join the S&P 500 for the past year and we will see when it happens, as the technology sector is already heavily represented in the S&P 500.

Thos may indicate that future additions could be from other sectors. Its beta is slightly less than 1, so it moves slightly less than its index. The market's average price target is $157-160.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.