“It might make sense just to get some in case it catches on.”

-Satoshi Nakamoto

I rarely comment about Bitcoin price anymore, much less write a whole blog post about it. This time is different.

Why?

One reason is that I hate content pieces about Bitcoin price action. “It’s going up”, “it’s going down”, “Here is why we know this is going to happen, unless it doesn’t” followed by “this is not investment advice”.

There are so many opinions about Bitcoin and countless stocks even countless stocks out there that it generally feels like a waste of my time.

I heard of Bitcoin for the first time in 2017 and I’ve been holding and accumulating ever since. My strategy of accumulating more during bear markets has not changed, though my ability to do so has changed from time to time.

Enough about me. Why was I inspired to write this?

In my opinion, the odds of a great 2024 and 2025 for Bitcoin are higher than at any other time. My conviction is so high that I felt I needed to share this.

No one can truly predict the future, but these 5 fact support the conclusion of a strong bull run for bitcoin in 2024 and 2025.

Bitcoin Ordinals are Here to Stay

As of February 2023, there were over 44 million addresses holding a non-zero amount of Bitcoin on the network. The controversial addition of Bitcoin Ordinals on January 21, 2023 during the bear market was a major part of this. Despite criticism from many Bitcoiners, including myself at first, has only brought more users to the Bitcoin network. As the expression goes, Bitcoin doesn’t care what I think!

In last bull market, NFTs exploded, bringing thousands of new users to Ethereum and other smaller blockchain and crypto projects. I covered this in detail with this explainer in March 2021. Bull markets attract a lot of new users, attention and speculation. With Bitcoin ordinals in play, I will speculate that this will attract more artist, collectors, speculators and (sigh) scammers to the Bitcoin network.

The scammers and speculators are part of human nature and will come with any bull market. Increased traffic will add value to bitcoin.

Bitcoin Halving/Halvening and Past Market Cycles

Whatever you call it, it’s coming and I believe current positive market action is attributable in large part to this. Bitcoin is up over 60% in the past 3 months.

In general, investors in any market attempt to predict the future, hence the phrase “buy the rumor, sell the news”. Accumulating in anticipation of a bull run is what I am attempting to do and what many investors have been doing recently.

The Bitcoin Having is currently estimated to occur on April 17, 2024, in just over 4 months of my writing this.

Let’s briefly look deeper into the past.

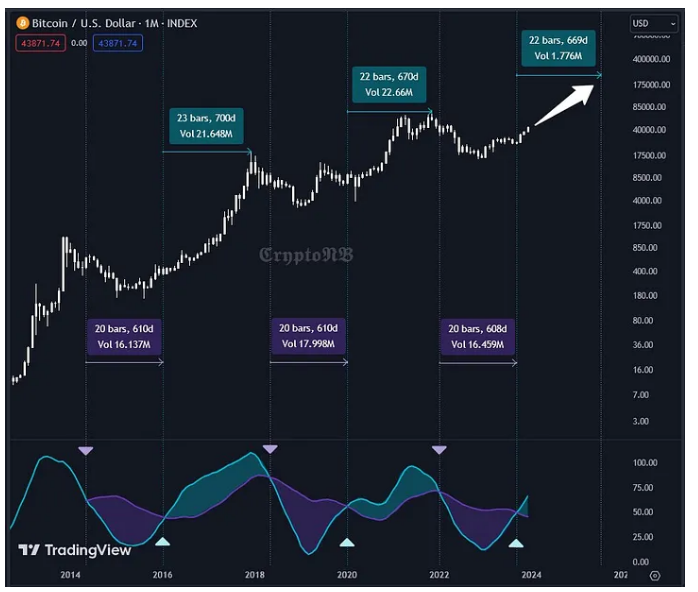

A fast review of past market cycles show a clear picture. I’ve included what a few TradingView users on X have posted.

While I never count on any single analyst for investment advice, there is a notable pattern worth observing.

In fact, this has been said so many times that it has become almost cliché. But the data still points to the obvious fact that Bitcoin bull runs coincide with the Bitcoin halving.

Here’s another graph that shows it clearly.

As I said, this review was fast, I just looked it up on Twitter and picked some graphs that showed the point clearly.

Bitcoin Past Annual Performance

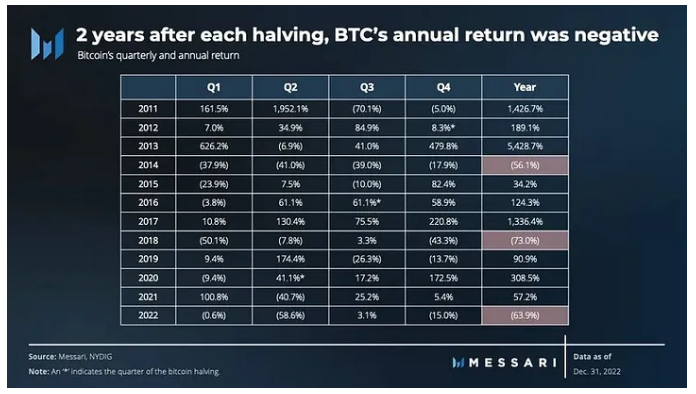

This is another way of stating the same thing, but it paints another clear picture.

This is a good time to communicate that past performance does not guarantee future results, and you should not invest what you aren’t willing to lose. That goes for bitcoin or any other investment.

This chart from Messari is from the end of 2022, and it still shows this clearly. YTD, bitcoin is up over 150%.

The brown squares are the years bitcoin price is down, and it’s 2 years after the Bitcoin halving. If this pattern continues, bitcoin would be down again in 2026.

Bitcoin Spot ETF Approval

I put this near the end but I believe this is by far the strongest factor.

The odds of approval of a Bitcoin Spot ETF are higher than ever.

This would open the door for retirement funds to invest in bitcoin. This is over $40 trillion that would have access to bitcoin for the first time.

BlackRock (NYSE:BLK) is the leading ETF application. There are 12 others. Odds are, at least one gets approved in the next approval window in January 2024, if not more. SEC Chairman Gary Gensler has been very negative on the subject in the past, but as Bitcoin Magazine reports, he has recently shifted his tone in favor of an approval.

So then what happens? James Van Straten, the Lead Analyst Crypto Slate, offered this estimate.

New US Accounting Rules Support Bitcoin

Next, the boring reason. Let’s dive into accounting. Ok, but I promise to keep this simple.

The Financial Accounting Standards Board, known as FASB, is an independent organization that establishes accounting and financial reporting standards for US-based companies.

The latest FASB vote on Bitcoin opens the door for companies to buy and hold bitcoin in corporate treasuries without balance sheet penalties. This will make it easier for more companies to buy and hold bitcoin.

MicroStrategy, Square (NYSE:SQ) and Tesla (NASDAQ:TSLA) were notable examples up to now. How many more corporations will hold bitcoin in the future?

Veteran hedge fund manager and Bitcoin analyst James Lavish breaks down the importance of this event on X.

Again, this is good for Bitcoin.

Interest Rates

Last but not least. This is good for bitcoin and it’s good for the stock market.

The Fed raised interest rates 10 times from March 2022 to May 2023, from 0% to 5.25%. Raising rates is generally bad for any investments in the category of risk-on which includes the stock market and of alternative investments like Bitcoin. Other major banks the like European Central Bank, The Bank of Canada and the Bank of England made similar news.

The timing of this phase occurred in the heart of a bear market for stocks and bitcoin, as can be expected.

Most likely the Fed will lower interest rates several times in 2024. It’s so likely that Fed Chairman Jerome Powell announced their plans to do so three times in 2024.

Conclusion

I am going to do my best to accumulate more Bitcoin before April 2024. You do you.

I don’t have a snappy call to action, so I’ll leave you this message from Satoshi Nakamoto.

“If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.”