- In this piece, we will take a look at 5 catalysts that could ensure Nvidia's stock price keeps climbing.

- After its stock split on Friday, Nivdia's stock will start trading at a new price next week.

- We will also analyze the potential impact of the stock split on the price.

- Want to invest by taking advantage of market opportunities? Don't hesitate to try InvestingPro. Sign up HERE and get almost 40% discount for a limited time on your 1 year plan!

Nvidia's (NASDAQ:NVDA) market value has exploded, surpassing $3 trillion and rocketing the chipmaker past Apple (NASDAQ:AAPL) to become the world's second most valuable publicly traded company.

The demand for Nvidia stock shows no signs of slowing down. Despite years of a staggering rally, investors continue to pile in, seemingly unfazed by the sky-high share price.

This unrelenting bullishness can be attributed in large part to Nvidia's dominant position in the booming artificial intelligence (AI) sector.

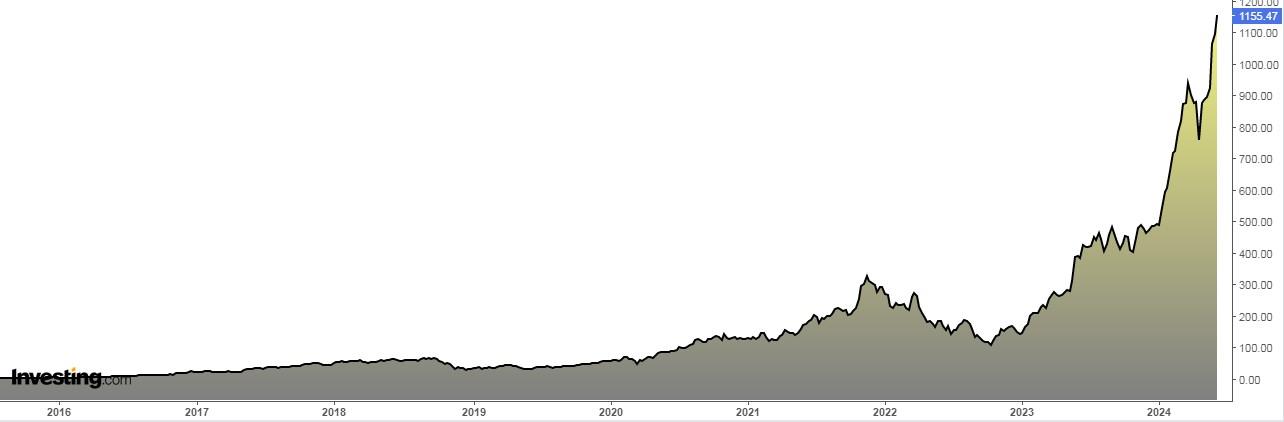

Imagine turning $10,000 into a cool $2 million – that's the magic of compound interest at work for Nvidia investors over the past decade.

No other S&P 500 company comes close to this phenomenal growth. In fact, the entire index has only managed a 177% increase during the same period.

This begs the question - can the stock continue to rally from current levels? Below, we will take a look at 5 key catalysts that could continue to fuel the stock's rise in the medium and the long term.

1. Rising Dividends

Nvidia recently announced a 150% dividend hike. However, the current yield remains very low at around 0.4-0.5%, making it a minor perk compared to the massive capital appreciation. In fact, over 400 S&P 500 companies offer a higher dividend yield.

2. AI Chip Pipeline for Continued Dominance

Nvidia is strategically planning its future with the upcoming launch of next-generation AI chips. The company intends to release annual updates to its AI accelerators, with the Blackwell Ultra chip slated for 2025 and the Rubin platform arriving by 2026. This proactive approach reinforces investor confidence in Nvidia's ability to sustain its impressive growth trajectory beyond the current fiscal year.

3. Explosive Revenue and Earnings Growth

Nvidia reported a staggering 260% year-on-year increase in revenue, reaching $26 billion. Earnings per share also surpassed expectations, coming in at $6.12 compared to the market's prediction of $5.65. This translates to $14.881 billion in earnings, a significant 21% increase from the previous quarter and a mind-blowing 628% jump year-over-year.

4. Raised Revenue Guidance for Q2

Nvidia has further bolstered investor confidence by boosting its revenue expectations for the second quarter to $28 billion, exceeding analyst estimates of $26.8 billion.

5. Incoming Stock Split

This week, Nvidia will execute a stock split, distributing 9 new shares for every 1 share currently held. This split will take effect at the close of trading on Friday and the new shares will begin trading on Monday, June 10th. To be eligible for the split, investors must hold Nvidia shares before the June 6th deadline.

Nvidia Stock Split: What You Need to Know

This Friday, Nvidia is undergoing a stock split. This means the company will increase the number of outstanding shares while reducing their individual value.

Stock splits don't change a company's overall value. However, they can make the stock more attractive to investors in a few ways:

- Psychology: A lower share price can entice more investors, especially those with smaller portfolios.

- Accessibility: Now, investors with less capital can afford to buy whole shares of Nvidia, allowing for better portfolio diversification.

- Liquidity: A lower share price often leads to more frequent trading, increasing the stock's liquidity.

A stock split consists of reducing the value of a company's shares and increasing the number of shares outstanding.

In other words, with a split, the capital stock and equity of the company remain the same, but what happens is that the number of outstanding shares is increased while the par value of those shares is reduced, but the shareholders continue to maintain the same proportion.

How Could the Stock Price React to the Split?

While a split itself doesn't guarantee a price hike, Bank of America (NYSE:BAC) reports a 25% average increase for companies within a year of a split. However, long-term performance depends on company fundamentals and overall market conditions.

Nvidia to Enter Dow Jones Soon?

Nvidia's upcoming stock split could pave the way for its inclusion in the Dow Jones.

The Dow Jones, composed of just 30 blue-chip companies, undergoes changes infrequently (only 7 in the past 15 years). Inclusion and removal are based on a strict set of criteria.

While Nvidia qualifies as one of America's fastest-growing companies, its current high share price (around $1140) exceeds a key requirement. The DJIA limits the most expensive stock to being no more than ten times the price of the cheapest one.

The upcoming stock split will address this hurdle, potentially clearing the path for Nvidia's entry into the Dow Jones and satisfying all the index's inclusion criteria.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.