- While major US stock indexes focus on large-cap companies, the Russell 2000 offers insight into the health of small-cap businesses.

- The Russell 2000 is significant as it comprises small companies that provide a unique perspective on the nation's economic well-being.

- In this piece, we will examine five highly rated stocks within the Russell 2000.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The three main stock market indexes in the country, the S&P 500, Dow Jones Industrial Average, and Nasdaq, primarily include large-cap companies. However, there are also other indexes composed of small-cap companies, such as the S&P 600 and the Russell 2000.

The Russell 2000 holds particular significance because small companies within it often provide a more accurate reflection of the country's economic health.

These businesses focus on internal and domestic operations, primarily within the US.

To be included in the Russell 2000, companies must meet three requirements:

- Size: The market capitalization of the company seeking entry must exceed $30 million.

- Liquidity: The company must have a daily average trading volume of at least $130,000.

- Float: The float, representing the available outstanding shares for purchase, must be greater than 5% of the total shares in the market.

Small market capitalization companies, commonly referred to as small caps, fall within the $300 million to $2 billion market cap range.

Those above $2 billion are considered medium caps, and the largest are known as large caps or big caps.

Investors interested in small-cap stocks can choose from various specialized vehicles, including mutual funds and ETFs.

But in this piece, we will take a look at five stocks within the Russell 2000 that are highly rated by the market, and we will utilize InvestingPro as our primary source of information.

1. Karyopharm Therapeutics

Karyopharm Therapeutics (NASDAQ:KPTI) is a pharmaceutical company that develops and markets drugs aimed at treating cancer and other diseases.

The company was incorporated in 2008 and is headquartered in Newton, Massachusetts.

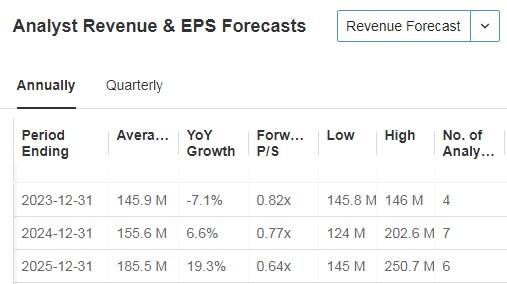

It reports quarterly results on February 15. Looking ahead to 2024 the forecast is for earnings per share (EPS) to increase +6.6%, with the increase being +19.3% by 2025.

Source: InvestingPro

Its shares closed the week at $1.04. The potential the market gives it is tremendous, at no less than around $6.

Source: InvestingPro

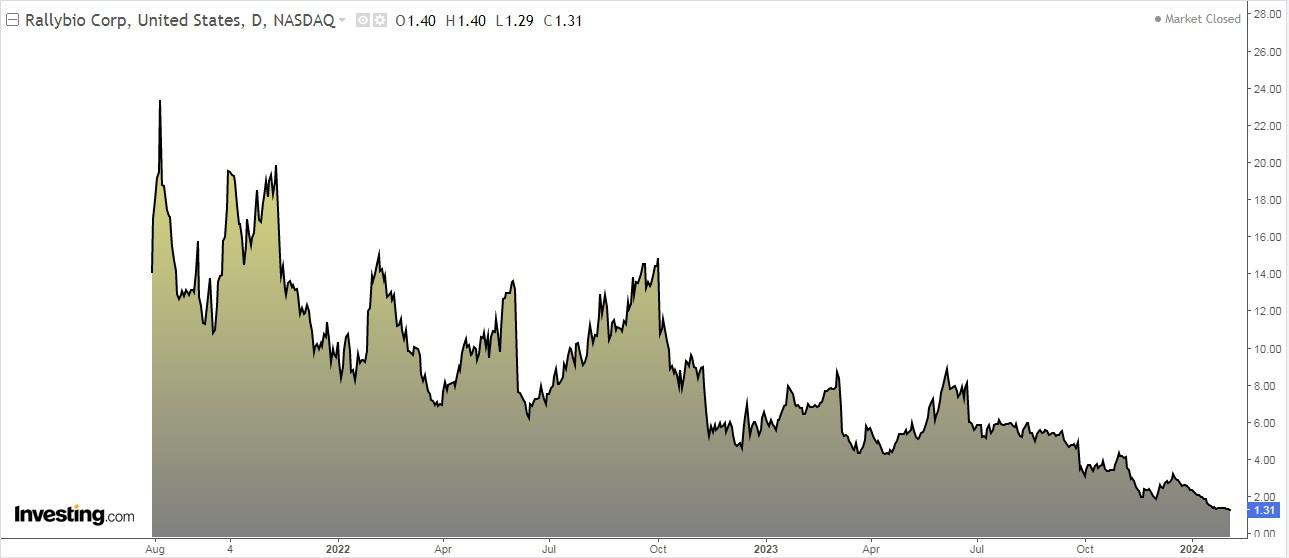

2. Rallybio

Rallybio (NASDAQ:RLYB) is a biotech company that is dedicated to developing life-transforming therapies for patients suffering from serious and rare diseases. It was founded in 2018 and is based in New Haven, Connecticut.

On March 12, we will know its accounts for the quarter. The forecast is that in the computation of 2023, it will have increased its earnings per share (EPS) by +13.4%.

Source: InvestingPro

In 2023 some of their research passed phase 1 and now in 2024, they expect everything to go well and achieve important milestones.

Its shares closed the week at $1.31. The potential the market gives it is stratospheric at $13.80.

Source: InvestingPro

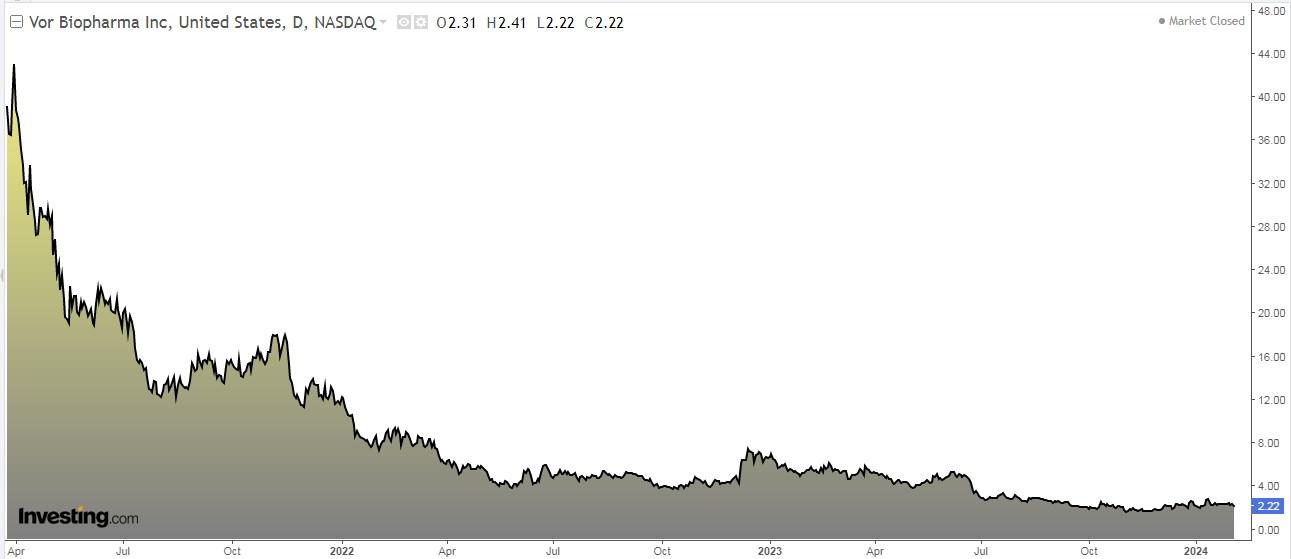

3. Vor Biopharma

Vor Biopharma (NASDAQ:VOR) is engaged in the development of engineered stem cell therapies for cancer patients. The company was formed in 2015 and is based in Cambridge, Massachusetts.

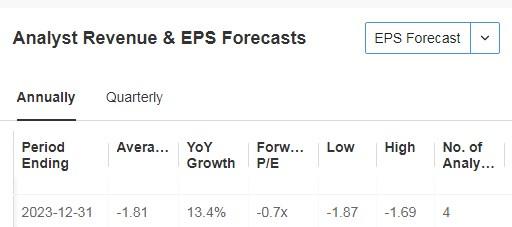

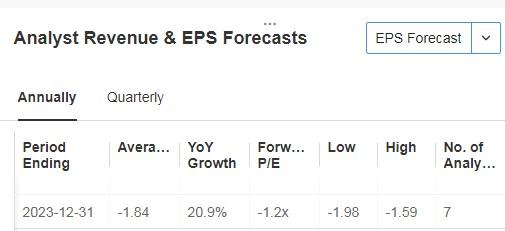

It will release its numbers for the quarter on March 21 and is expected to increase earnings per share (EPS) by +15.74% and end 2023 on its computation with an increase of +20.9%.

Source: InvestingPro

Its shares closed the week at $2.22. The potential given by the market stands at $15.07.

Source: InvestingPro

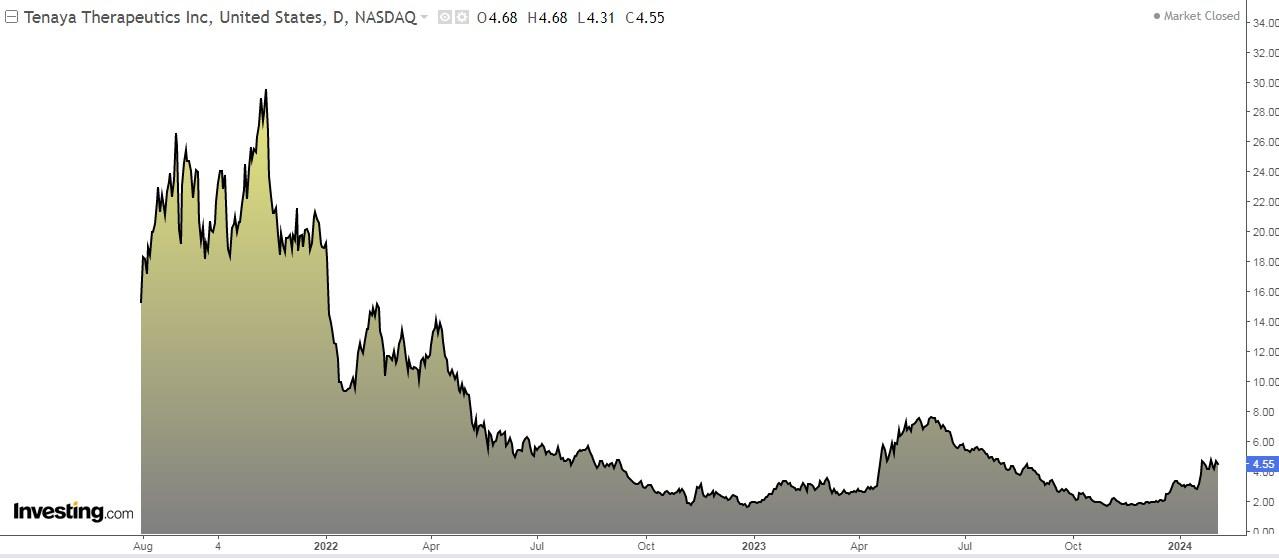

4. Tenaya Therapeutics

Tenaya Therapeutics (NASDAQ:TNYA) is a biotechnology company that develops and offers therapies for heart disease. It was incorporated in 2016 and is headquartered in South San Francisco, California.

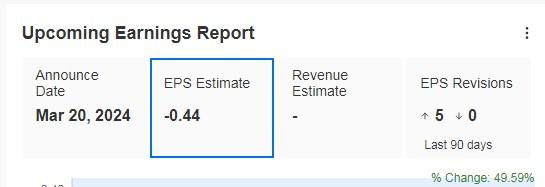

On March 20 turn for quarter accounts with a forecast of an earnings per share (EPS) increase of +49.59%.

Source: InvestingPro

It presents 7 ratings, of which all are buy.

Its shares closed the week at $4.55. The potential given by the market stands at $19.14.

Source: InvestingPro

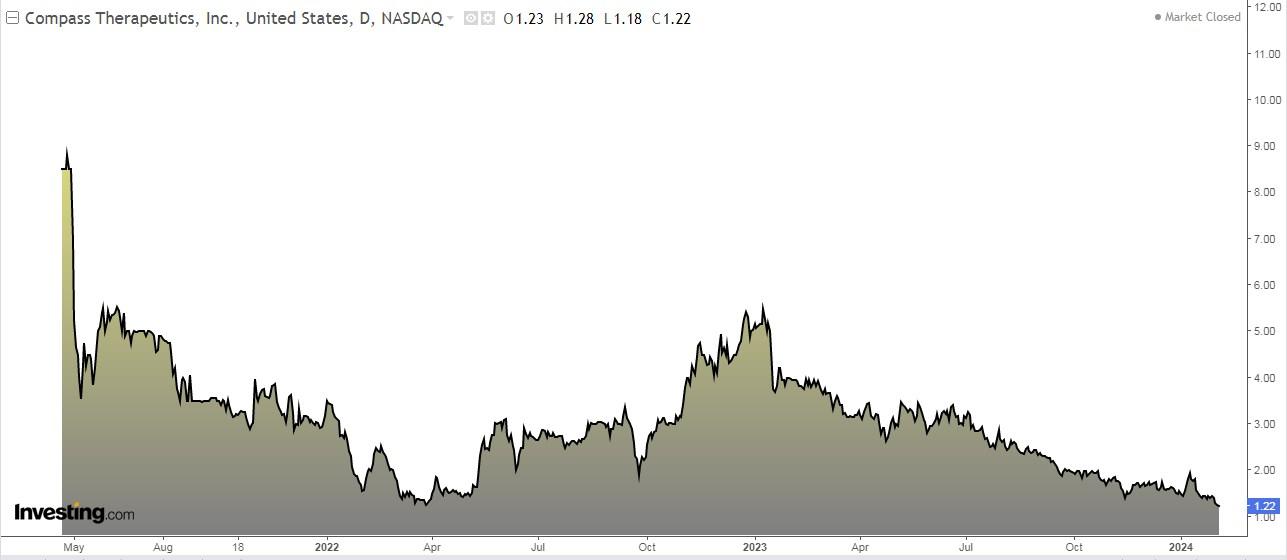

5. Compass Therapeutics

Compass Therapeutics (NASDAQ:CMPX) is a biopharmaceutical company engaged in the development of antibody-based therapeutics to treat various diseases. It was founded in 2014 and is based in Boston, Massachusetts.

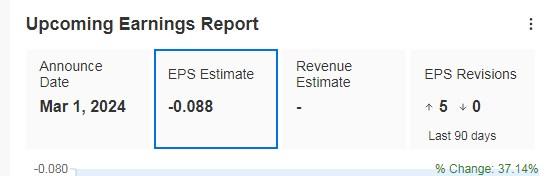

On March 1, we will get the quarterly numbers, and they're expected to show an increase in earnings per share (EPS) of +37.14%.

Source: InvestingPro

Its shares closed the week at $1.22. The potential given by the market stands at $9.40.

Source: InvestingPro

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code OAPRO1 at checkout for a 10% discount on the Pro yearly plan, and OAPRO2 for an extra 10% discount on the by-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.