- The last earnings season of 2023 has been somewhat mixed

- And, this year is about to end with investors already eyeing 2024

- So in this piece, we will discuss five stocks that can deliver strong earnings in Q1 2024

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

As 2023 draws to a close, investors are already directing their attention to 2024, honing in on stocks anticipated to deliver robust earnings results in the first quarter of the upcoming year.

The market is actively seeking companies poised to demonstrate substantial revenue growth, marking them as significant players in the current economic landscape.

With the assistance of InvestingPro, let's analyze some stocks positioned for stellar earnings in the first quarter of the next year.

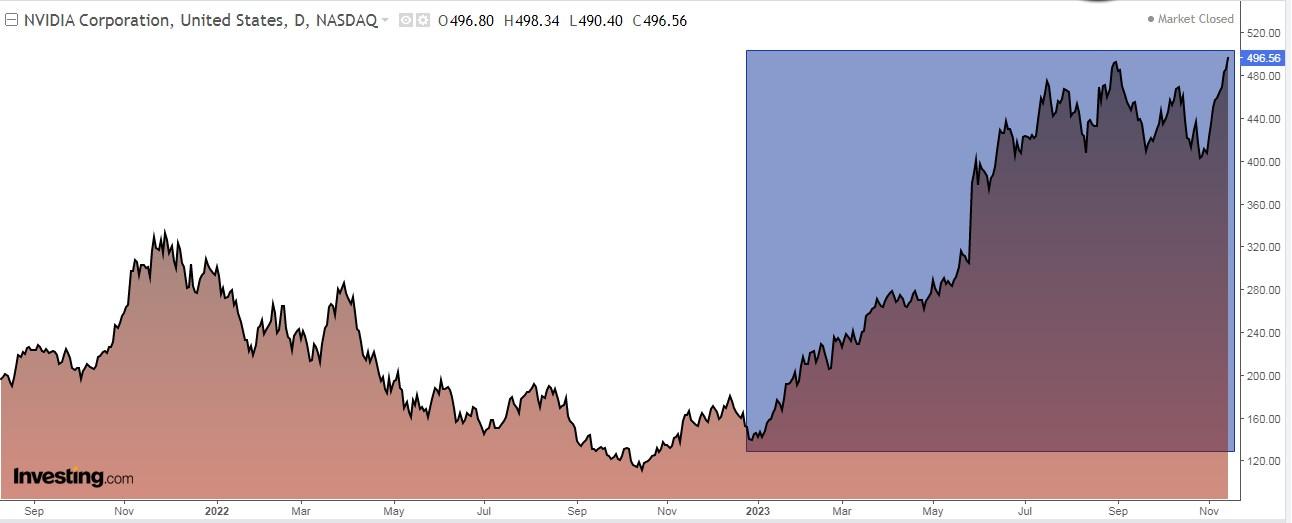

1. Nvidia

Nvidia (NASDAQ:NVDA) will present its next results on November 21 and is expected to increase actual revenue by +101.908% and EPS (earnings per share) by +186.72%.

For the first quarter of 2024, revenue is expected to increase by +153.6% compared to the first quarter of 2023.

The stock is up +198.13% in the last year and +19.02% in the last 3 months.

The market gives it a potential of $640.

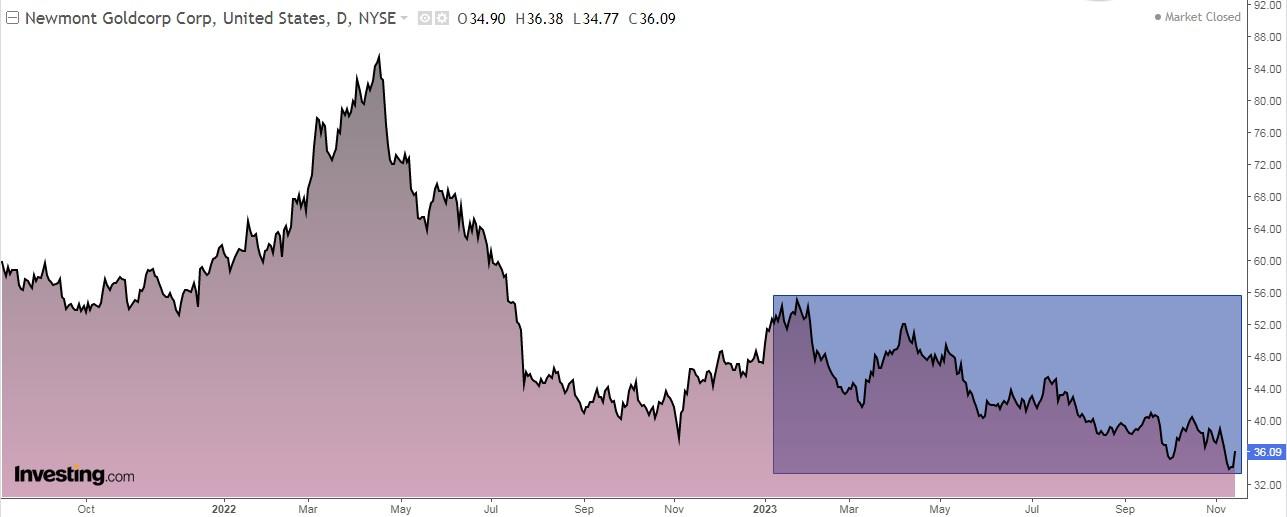

2. Newmont Goldcorp

Headquartered in Denver, Colorado, Newmont Goldcorp (NYSE:NEM) is one of the largest gold miners in the world, with active mines in Australia, the United States, Indonesia, Ghana, New Zealand, and Peru.

Founded in 1921, it remains the only gold mining company in the S&P 500 index.

The gold mining company pays a dividend of $0.40 per share on December 22 and shares must be held prior to November 29 to be eligible to receive the dividend. The anal dividend yield is +4.43%.

On February 22 it will present its numbers and real revenue is expected to increase by +20.78% and earnings per share (EPS) by +28.92%. For the first quarter of 2024, the forecast is for a revenue increase of +61%.

Its shares are down -5.20% in the last 3 months, but the market sees potential at $50 and InvestingPro models at $41.35.

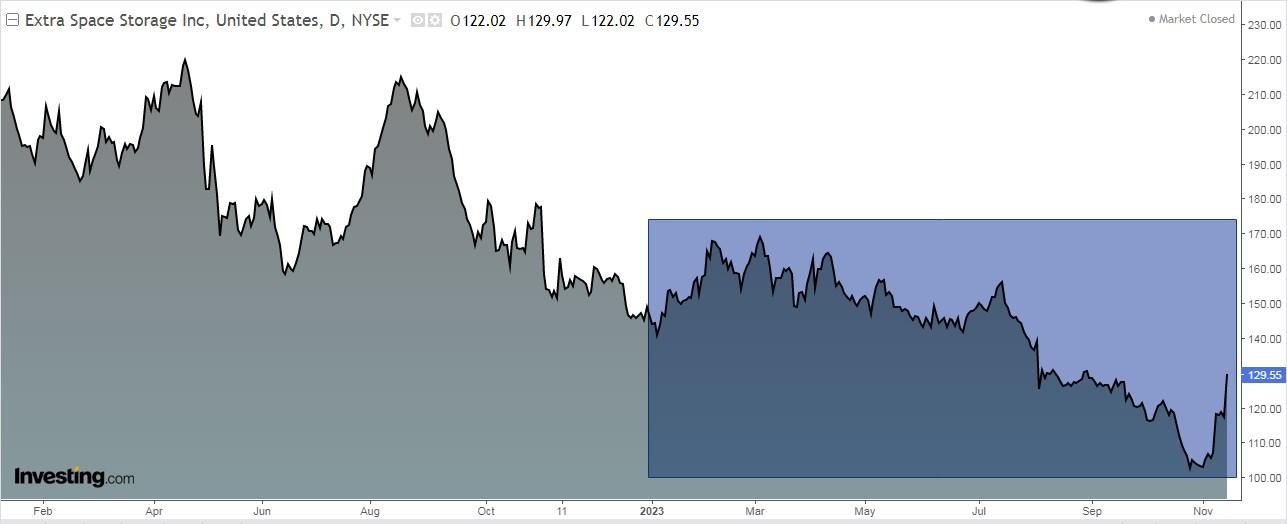

3. Extra Space Storage

Extra Space Storage (NYSE:EXR) is a Salt Lake City-based real estate investment trust that invests in storage facilities. It is the largest owner of storage units in the United States.

On February 21 the company will present its accounts and is expected to increase actual revenues by +57.78%. Expectations for Q1 2024 are for a revenue increase of +72% over the same period last year.

It has 16 ratings, of which 8 are buy, 6 are hold and 2 are sell. Its shares are up +1% in the last 3 months and +8.42% in the last month.

The market assigns it a potential at $142.47.

4. Oneok

Oneok (NYSE:OKE) is an American corporation mainly focused on the natural gas industry and headquartered in Tulsa, Oklahoma.

It was founded in 1906 as Oklahoma Natural Gas Company but changed its corporate name to Oneok in December 1980.

The company pays a dividend of $0.95 per share and the annual yield is +5.81%. It has shown an average annual dividend growth of +10% over the last decade.

It will present its accounts on February 26 and is expected to increase real revenues by +7.54% and EPS (earnings per share) by +6.01%. For the first quarter of 2024, revenues are expected to increase by +55.3% compared to the first quarter of 2023.

Oneok has demonstrated solid earnings growth at an annual rate of +26% over the past five years.

The stock is up +6.70% over the past year.

The market sees it at $73.12, while InvestingPro models are more bullish and go for $80.10.

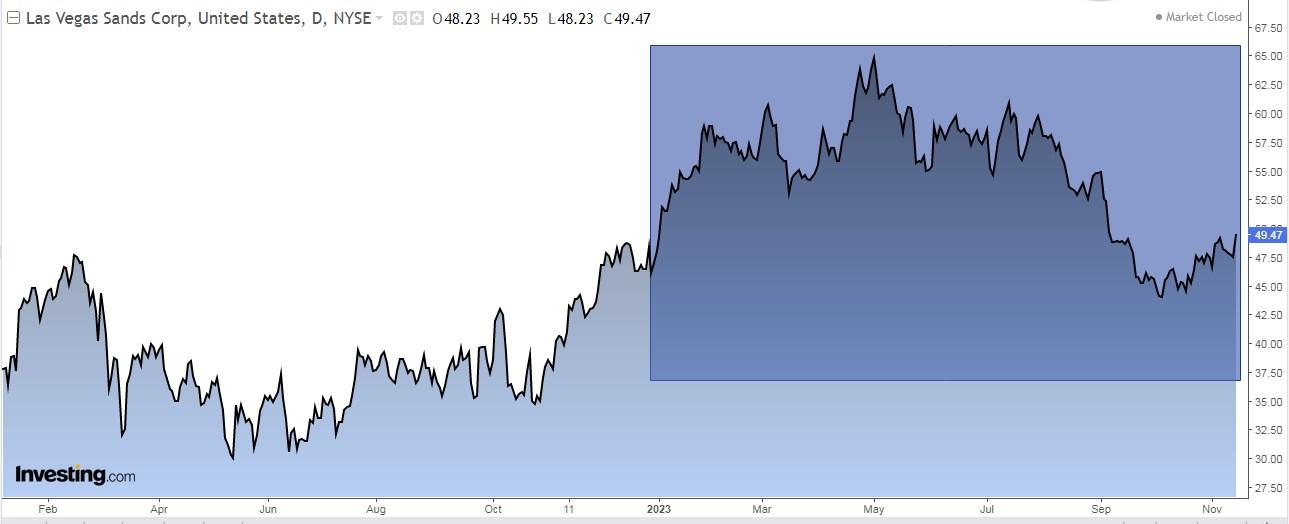

5. Las Vegas Sands

Las Vegas Sands (NYSE:LVS) will present its results on January 24 and is expected to increase real revenues by +30.15% and EPS (earnings per share) by +46.5%.

For the first quarter of 2024, revenues are expected to increase by +38.7% compared to the first quarter of 2023.

It pays a dividend with an annual yield of +1.62%.

Its shares are up +13.47% in the last year and +9.44% in the last month. The market gives it potential at $66.25, and InvestingPro models at $60.84.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclosure: The author holds no positions in any of the stocks mentioned in this report.