- Although it is a classic to invest in stocks that are part of the index S&P 500, there is much more life outside of it

- It should be noted that not all large-cap companies are in the S&P500, as they have to meet a number of requirements

- Today we will look at 5 stocks that are not in the S&P 500 but are still rising strongly

When we talk about investing in the US market, most people automatically assume we're talking about S&P 500 stocks.

However, this year has seen the emergence of several stocks that do not belong to the S&P 500 but have delivered impressive returns, outperforming the benchmark index itself.

These stocks boast a substantial market capitalization but don't have a place in the S&P 500. This is because the index doesn't solely consist of the top 500 companies by market capitalization. The eligibility criteria for inclusion in the index are determined by multiple factors, periodically reviewed and updated by a committee when necessary.

These criteria include:

- Having a market capitalization greater than $13 billion.

- Being listed on a U.S. exchange, with no listing on OTC markets.

- Maintaining a listing for at least one year.

- Recording positive earnings in four consecutive quarters.

- Ensuring that at least 50% of fixed assets and sales are generated within the United States.

- Maintaining a share price greater than $1.

Let's take a look at some of these stocks and in order to provide interesting data and information we will use the InvestingPro tool.

1. Dell Technologies

Founded by Michael Dell in 1984, Dell Technologies (NYSE:DELL) is engaged in the development, manufacturing, sale, and support of personal computers, servers, software, and various other technology-related products.

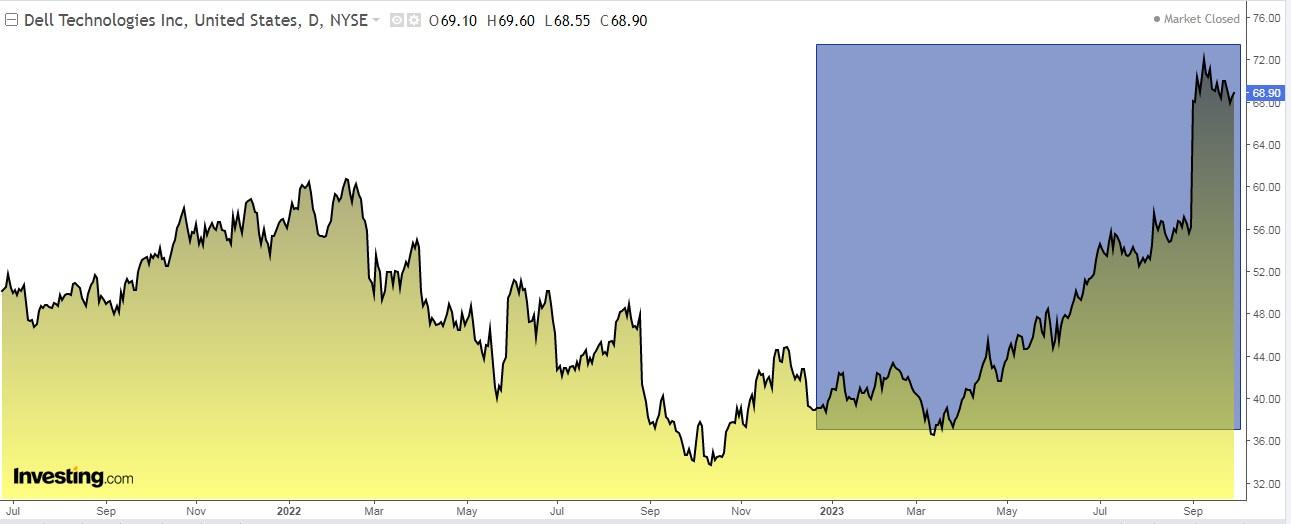

This Texas-based behemoth will distribute a dividend of $0.37 per share on November 3. To be eligible for this dividend, shares must have been acquired prior to October 23. The dividend yield stands at +2.15%. Source: InvestingPro

Source: InvestingPro

In the past 12 months, it has garnered $1.9 billion in net income. The upcoming quarterly results are scheduled for November 21, following the previous positive report on August 31, which surpassed all expectations with actual revenue exceeding projections by 10.1% and EPS soaring by 53.1%.

Source: InvestingPro

Dell currently holds 20 analyst ratings: 14 Buy, 3 Hold, and 3 Sell. InvestingPro models project its medium-term potential to reach $84.25.

The stock is currently up 67.18% year to date.

Source: InvestingPro

2. VMware

VMware (NYSE:VMW) is a leading provider of services for all applications that fosters digital innovation with enterprise control. It helps customers modernize application development to accelerate the digital innovation process. It also connects and protects applications and data, regardless of where they run. It was founded in 1998.

The latest earnings report released on August 31 showed +6.6% EPS beat over what the market expected. The next results will be released on November 30. In terms of actual revenues, for 2023 an increase of +5% is expected and for 2024 +7.2%.

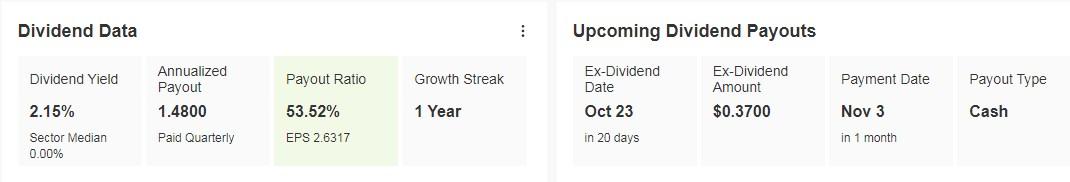

Source: InvestingPro

VMware currently presents 16 analyst ratings, of which 4 are Buy, 12 are Hold and none are sell.

VMW shares are up +51.4% over the last 12 months and +15.58% over the last 3 months.

InvestingPro models give it a potential of reaching $179.20.

Source: InvestingPro

3. The Trade Desk

The Trade Desk (NASDAQ:TTD) is a California-based company that specializes in real-time programmatic marketing automation technologies, products and services designed to personalize the delivery of digital content to users.

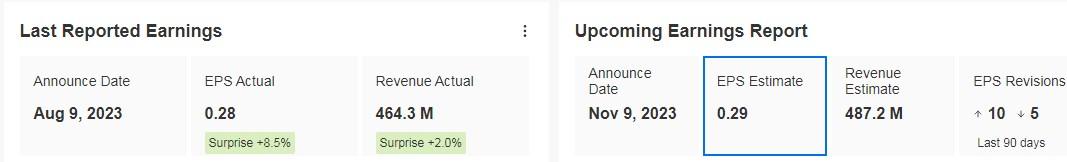

It has earned $129 million in net revenue over the past 12 months. Moreover, the good numbers on the latest earnings report (EPS beat forecasts by +8.5% and actual revenue by +2%), will continue to improve in the following results on November 9 expecting a +8.08% increase in EPS. For the 2023 computation the forecast is for an increase of +19.6% and for 2024 +19%.

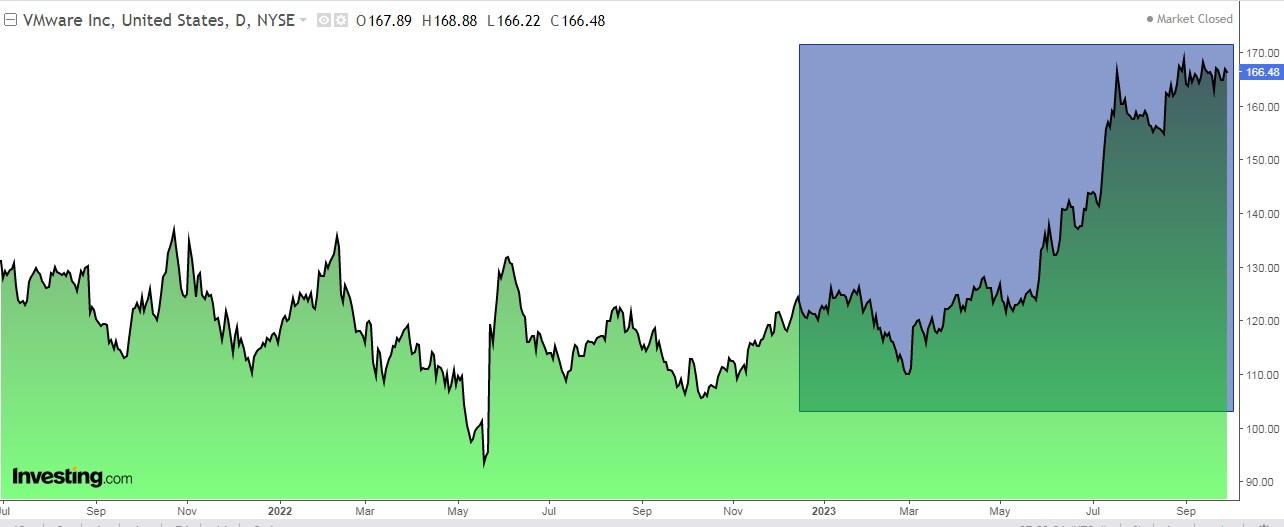

Source: InvestingPro

Shares are up roughly +25% over the last 12 months but nearly stagnant over the last quarter.

InvestingPro models give it a potential of $86.25, although UBS has recently raised it to $100.

Source: InvestingPro

4. Apollo Global Management

Apollo Global Management (NYSE:APO) is a private equity firm specializing in investments in the credit, private equity and real estate markets. Founded in 1990 by Leon Black, who previously worked at the investment bank Drexel Burnham Lambert, it is based in New York.

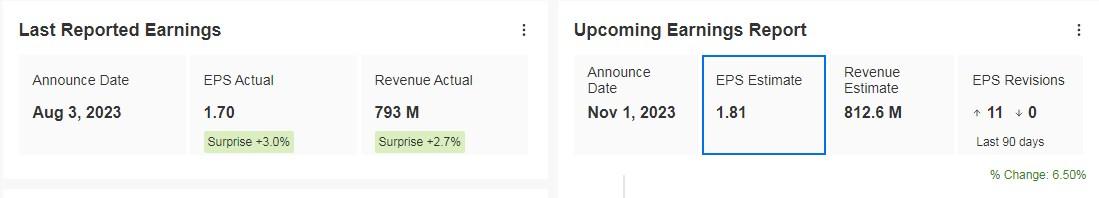

The company posted positive numbers in its latest earnings report on August 3 with increases in EPS (+3%) and real income (+2.7%). The next report is scheduled for November 1, with an expected increase in EPS of +6.50%. For 2023 the forecast is for an increase of +29.7% and for 2024 +19.4%.

Source: InvestingPro

Currently, APO has 16 ratings, of which 10 are Buy, 6 are Hold and none are sell.

Shares are up +76% over the last 12 months and +17.09% over the last 3 months.

InvestingPro models give it a potential at $96.39, while Jefferies expects it to reach $97.

Source: InvestingPro

5. KKR

KKR (NYSE:KKR) is a U.S. multinational private equity and venture capital management company. The company, which specializes in leveraged buyouts, is based in New York and was founded in 1976 by Jerome Kohlberg, Henry Kravis and George R. Roberts. All of them had previously worked at Bear Stearns Bank, where they made some high-profile deals.

Its latest earnings results on August 7 were good, beating market forecasts (EPS +2.3% and real income +6.3%). The next results will be published on October 31. 2024 is the year in focus, with real revenues expected to increase by +42.8%.

Source: InvestingPro

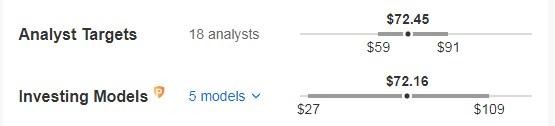

The market gives it potential at $72.45, about the same as InvestingPro models peg it at $72.16.

Source: InvestingPro

Shares are up +34% over the past 12 months and +6% over the past 3 months.

***

Disclosure: The author holds no positions in any of the securities mentioned in this report.