- 2025 looks uncertain after two years of strong growth.

- Dividend stocks could inject security into portfolios.

- In this piece, we'll take a closer look at 6 stocks that offer dividends and upside potential.

- Kick off the new year with a portfolio built for volatility - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

After two back-to-back years of robust gains of over 20% for the S&P 500, investors are now eyeing the year ahead with caution. Many are bracing for a shift, fearing that stocks could face more volatility in the coming months.

With this uncertainty, it might be time to reconsider shifting towards safer bets. One effective strategy? Focusing on dividend-paying stocks. These investments not only offer stability but also provide additional advantages that could help weather a more volatile market.

Firstly, dividend-paying stocks provide regular income independent of share price trends and allow the magic of compound interest to play out as dividends are reinvested.

What's more, dividend-paying stocks benefit from a loyal shareholder base who are more interested in regular payments than in share price trends, making them less susceptible to panic movements and temporary corrections.

A dividend-paying company is by definition profitable since dividends represent the share of profits that goes back to shareholders. While this alone is no guarantee of a company's financial strength, it is a good starting point.

The best S&P 500 dividend stocks to buy and hold

In the rest of this article, we'll focus on identifying the "best" dividend stocks among S&P 500 companies. Specifically, we have filtered out those stocks in the index that combine the following qualities:

- Dividend yield over 5%.

- Bullish potential according to Fair Value greater than +10%.

- Bullish potential according to analysts greater than +10%.

- InvestingPro financial health score above 2.5/5

Remember that InvestingPro Fair Value uses recognized valuation models for each stock on the market, enabling us to determine whether a stock is over- or undervalued.

The Health Score, meanwhile, assesses the financial strength of companies based on several key metrics and peer comparisons.

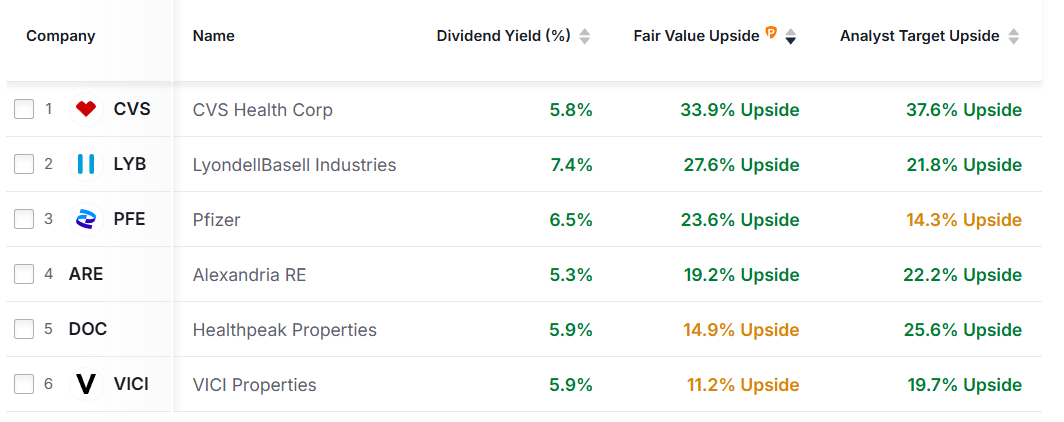

This research enabled us to identify 6 stocks:

Among these stocks, the one with the greatest upside potential according to both analysts and InvestingPro Fair Value is the CVS Health (NYSE:CVS) pharmacy chain, which could rise by 33.9% according to Fair Value and 37.6% according to analysts.

However, basic materials company LyondellBasell Industries (NYSE:LYB) has the highest dividend yield, at 7.4%.

Note that InvestingPro subscribers with a Pro+ plan can access this preconfigured search by clicking on this link.

Investors who are primarily interested in dividend stocks and have an InvestingPro subscription can also turn to the pre-configured "Dividend Quality Champions" screener, which does not take into account criteria relating to stock potential but includes several dividend quality criteria.

This search, currently yielding 552 results, can easily be refined further by leveraging more than 150 available metrics.

Conclusion

As an uncertain 2025 gets underway, dividend stocks could be a choice for injecting security into portfolios while generating passive income, and there's no shortage of opportunities in this area. As we've seen, it's also possible to identify stocks that combine high dividends with strong upside potential, making them doubly relevant.

***

Curious how the world’s top investors are positioning their portfolios for the year ahead?

You can find that out using InvestingPro.

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.