Over the last five years, Super Micro Computer Inc. (NASDAQ:SMCI) has experienced exponential growth, fueled by the skyrocketing demand for advanced artificial intelligence rack-scale direct liquid cooling systems, enhancing the performance and efficiency of Nvidia (NASDAQ:NVDA), Intel (NASDAQ:INTC) and AMD (NASDAQ:AMD) technologies.

As a core technology player in the AI revolution, Super Micro Computer is building its leadership position across this burgeoning market.

Super Micro Computer surges with 600% earnings boost, projects $5.5 billion in revenue amid AI boomIn the past five years, earnings have grown by more than 600% and reached a record high of $600 million in its fiscal third quarter of 2023. Therefore, it will be well positioned to deliver strong growth in earnings and revenue for the better part of the year, riding on record settings in demand for AI rack scale direct liquid cooling systems. The high demand for products from Nvidia, Intel and AMD were the key drivers of the company's projected fourth-quarter revenue increase by 133% to 152% to between $5.10 billion and $5.50 billion.

Super Micro Computer is strategically positioned at the forefront of a technological revolution, carving out a significant niche within the burgeoning AI market. As demand for AI capabilities skyrockets across various industries, the company's advanced liquid cooling solutions and its strategic positioning in the server and data center sector should allow it to capitalize on a market poised to grow to $430 billion by 2033.

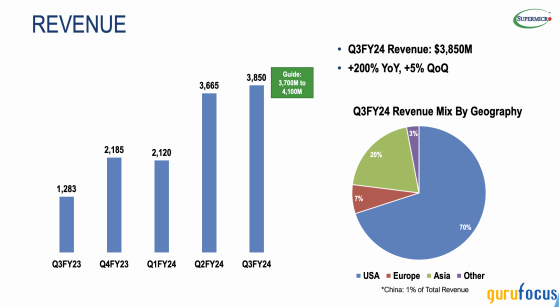

In the fiscal third quarter of 2023, Super Micro Computer reported a staggering 200% increase in revenue, totaling $3.85 billion, up from less than $2 billion in 2021. This explosive growth underscores the company's robust response to increasing demand for data processing capabilities. The company, primarily generating revenue through its servers and storage systems designed for data centers, has successfully tapped into the critical needs of modern computingspeed, efficiency and high-capacity processing. These systems support AI applications, cloud computing and edge computing, which are crucial for handling extensive data operations.

Source: Super Micro Computer presentation

Leading the way with cutting-edge AI and liquid cooling innovationsSuper Micro Computer has utilized advanced technologies from industry leaders like Nvidia, Intel and AMD. It has also used these in its server products, thus making its technological innovation very exciting. Such integration has improved its server products and positioned them accordingly with global technological changes like Nvidia's Blackwell architecture.

Such collaborations have strengthened the market position of Super Micro Computer and given traction to its revenue streams with product offerings like AI rack-scale DLC systems. These are some of the most critical elements that make for data center thermal load management and have witnessed record demand in the face of efficiency and increasing processing demands of AI tasks.

Additionally, the financial results point to the stability and growth potential of the company to the fullest extent. Net income for Super Micro Computer in the third quarter surged 367% year over year to $402 million, with earnings per share jumping from $1.63 to $6.65. This could not have resulted from revenue growth, but more from strategic business operations and cost management.

Finally, like any other technology company, Super Micro Computer could be threatened by economic cycles and heavy competition. However, specialization in hot niches like AI cooling solutions and customized server products protects the former from these disturbances. Thus, continuous innovation and flexibility to adjust according to market demand opens new opportunities for further expansion.

Super Micro unveils game-changing liquid-cooled AI data center solutions with Nvidia partnershipThe total IT solution provider for AI, cloud storage and 5G technology has also reiterated its commitment to creating a ready-to-deploy liquid-cooled AI data center for cloud-native solutions. The new DLC solution is designed to accelerate generative AI adoption for enterprises across various industries as it is optimized for the Nvidia AI Enterprise software platform.

The unveiling of the new data center cooling system is part of the company's push to provide solutions that can reduce energy requirements. Super Micro Computer is closely working with Nvidia to enhance the development of data centers that ensure seamless and flexible transition of AI applications from production to deployment.

The company also inked a strategic partnership with Data Section and Foxconn (TPE:2354) to develop a rack-scale liquid-cooled solution for new data centers that leverage advanced Nvidia GPUs. The new system will support advanced AI enterprise systems while delivering robust performance and generative AI applications.

Finally, according to financial advisor Steven Kibbel, Super Micro Computer's advanced liquid cooling technology enables closer GPU placement for high-demand AI tasks, enhancing data center efficiency by up to 40% and reducing environmental impact. With pre-built racks for rapid AI system deployment, the company supports global AI demand through projects like Japan's AI center, advancing AI technology and maintaining a competitive edge in image generation and high-speed computing. This progress is underscored by impressive growth figures and strategic partnerships that drive demand in the global server market.

Image source: Reuters

High-growth potential with discounted stock - A golden opportunityEven as Super Micro Computer grows revenue and earnings at a double-digit pace, its stock trades at a discount with a price-earnings multiple of 23. In contrast, Nvidia, one of the industry's big players and a poster child of the AI trend in the semiconductor space, is trading at a forward earnings multiple of 46.

While lower than the average earnings multiple of 30 for the Nasdaq 100, the price-earnings ratio is reasonable for a profitable company growing at an impressive rate. Additionally, there is a tremendous opportunity for growth given the artificial intelligence story is just starting, with the market expected to balloon to over $1 trillion by the end of the decade.

Management believes Super Micro Computer has what it takes to reach $25 billion in recurring revenue across all its product lines over the next five years. The race to $25 billion in annual revenue is part of the company's strategy that focuses on enhancing the development of IT rack solutions powered by some of the most sought-after GPUS and CPUs from Nvidia and Intel. The company is also accelerating the development of liquid cooling infrastructure solutions, which should support the growing demand for data centers to host AI applications.

While the current 12-month trailing revenue is $11.8 billion, management expects the company to grow at a compound annual rate of 16%, which is achievable. Considering the current gross profit margin of 15%, the company would quickly generate earnings of up to $1.70 billion. Earnings of more than $1.50 billion would significantly dwarf the current price-earnings multiple of 23 that investors must pay for the stock, considering the company generated $673 million in net income in fiscal 2023.

Source: Super Micro Computer presentation

Bottom lineEven though Super Micro Computer's stock has exploded by over 190% year to date, there is still room for more gains, given the strong demand for the company's AI server solution products. Increasing demand for power and cooling as data centers struggle with mounting AI tasks should present significant growth opportunities for the company.

Therefore, the stock is currently trading at a discount compared to its peers. Further, factoring in the robust revenue and earnings growth rates as the artificial intelligence opportunity in the server market explodes, the stock remains a solid buy despite additional market pullbacks.

This content was originally published on Gurufocus.com