Investing with a conscience has become more attainable than ever, thanks to Sustainably focused ETFs. These investment vehicles provide a unique opportunity to align investment strategies with personal values, by focusing on companies that excel in areas such as environmental sustainability, social responsibility, and corporate governance.

However, the key to successful sustainable investing lies in the selection criteria used to identify suitable companies. Not all sustainable ETFs are created equal; their underlying methodologies and the ESG rating systems they use can differ greatly, leading to varying risk and return profiles. This makes choosing the right ETF provider and ESG index methodology critical.

The best providers will adhere to a transparent and robust selection process, providing investors with the confidence that their investments truly align with their sustainability objectives. Ideally, the right sustainable ETF should deliver both competitive returns and a positive societal impact, making it a win-win for the investor, the fund manager, and the broader world.

In a pioneering move aimed at making sustainable investing more accessible, Mackenzie has collaborated with Corporate Knights, a research firm dedicated to promoting 'clean capitalism.' The product of this collaboration is the Mackenzie Corporate Knights Global 100 Index ETF (MCKG). Let's take a deep dive into this new fund to see what makes it tick and what it has to offer.

MCKG: Methodology

Led by Toby Heaps, Corporate Knights is known for its holistic and comprehensive Global 100 annual rankings of the world's most sustainable corporations. The firm places a great emphasis on transparency, clarity, and conciseness when it comes to the Global 100 rankings in order to give investors the best information possible to act on.

MCKG tracks the Corporate Knights Global 100 Index, which comprises a diverse assortment of global companies that demonstrate solid management, robust financial health, and outstanding performance based on Corporate Knights' comprehensive sustainability evaluation. The Mackenzie Corporate Knights Global 100 Index ETF puts Corporate Knights' philosophy into play..

The Mackenzie Corporate Knights Global 100 Index ETF employs a rigorous, rules-based selection process for eligible holdings. First, MCKG starts by screening all publicly traded equity securities of companies with gross revenue of at least US$1 billion listed on an eligible stock exchange, with a global focus across all sectors.

Following this, the index excludes companies with poor financial health and those that offer products/services counter to a sustainable mandate, which includes industries like weapons, adult entertainment, and those that lobby against climate change policies.

The real work begins with the index's 25 key performance indicators (KPIs) that span four categories: environmental, social, governance, and economic. Each company is scored for multiple metrics in each category, the most notable of which include:

- Environmental KPIs include energy productivity, water productivity, waste productivity, and sustainable revenue.

- Social KPIs encompass paid sick leave, employee turnover, and employee injuries.

- Governance KPIs consist of racial diversity on boards and the representation of non-males in executive management.

- Economic KPIs include pension fund quality and sanction deductions.

A formula is then applied to determine the top-scoring companies to be included, with the index rebalanced annually. For a detailed description of the index process, investors can consult the Corporate Knights Global Index methodology here.

MCKG: Assessment

One of the largest concerns with ESG-focused and sustainability ETFs is the possibility of underperformance or tracking error relative to a traditional broad-market index. This occurred in 2022 when some ESG ETFs underweight energy sector equities and overweight technology sector equities performed poorly during an inflationary market cycle.

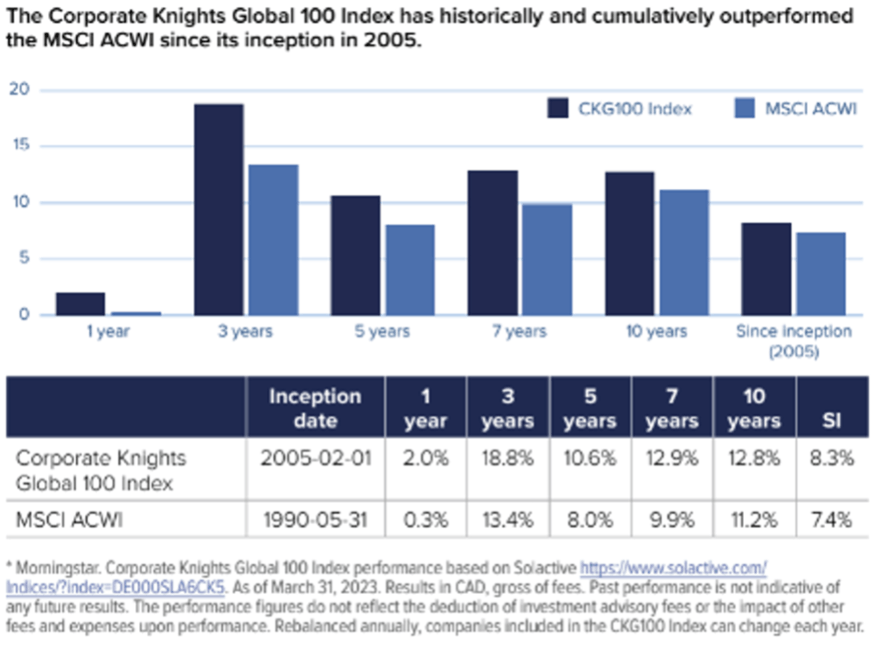

Historically, that fear has not been realized with the Corporate Knights Global 100 Index's performance. When compared to the MSCI All Country World Index, the CKG 100 Index has cumulatively outperformed in all periods since its inception in 2005. This impressive track record underscores Corporate Knights’ belief that sustainable companies can also produce robust returns.

Of course, the actual performance of MCKG will likely diverge from this index due to operational costs associated with ETFs. So far, Mackenzie is keeping the initial management fee reasonable at 0.50%.

Investors will also be reassured with MCKG's familiar roster of holdings, with familiar North American names like Alphabet (NASDAQ:GOOGL), Apple (NASDAQ:AAPL), HP Inc (NYSE:HPQ), BCE (TSX:BCE), Sun Life, Telus (TSX:T), and Tesla (NASDAQ:TSLA) represented. The target weights at annual rebalance are 1% for each stock , leading to a more uniform composition compared to market cap-weighted index ETFs that can be dominated by a few mega-cap stocks.

To sum it up, Mackenzie's collaboration with Corporate Knights gives Canadian investors another tool in their toolbox when it comes to sustainable investing. As an investment product that aligns with the principles of 'clean capitalism,' MCKG provides an opportunity for investors to contribute to a sustainable future without compromising on potential returns.

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.