Business in Brief

AAON Inc. (NASDAQ:AAON) is one of the leading manufacturers of HVAC (Heating, Ventilation, & Air Conditioning) systems for industrial and commercial indoor environments. The company sells HVAC equipment with customized and semi-customized rooftop units, data cooling center units, air handling units, energy-recovering units, condensing units, etc across 50 states and internationally. These products are sold to various industries, including but not limited to manufacturing, data centers, supermarkets, medical, pharmaceutical, industrial, commercial, and retail. AAON has three operating segments: AAON Oklahoma, which accounts for 70% of its revenue; AAON Coil Products, contributing 11%; and BASX, accounting for 19% of the total revenue.

Q3 FY2024 Earnings Review

AAON's net sales grew 4.9% year-over-year to $327.3 million due to high double-digit growth in the AAON Coil Products and BASX segments, partially offset by negative growth in the AAON Oklahoma segment. The revenue increase in AAON Coil Products and BASX segments was driven by high demand in the data center market, underpinned by the boom in artificial intelligence and cloud computing. On the other hand, the AAON Oklahoma segment's sales were down 7.1% year-over-year, majorly impacted by the shifts in the refrigeration market and soft macroeconomic conditions.

In the US, the refrigerant market is undergoing a transition given the phase-out of equipment using R-410A as a refrigerant, effective January 1, 2025. AAON has started supplying the alternative of R-410A refrigerant equipment, i.e., R-454B refrigerant equipment. However, dealers have their inventory piled up with R-410A equipment, leading to lower sales of R-454B refrigerant equipment. Macroeconomic conditions were soft during the quarter due to high interest rates, inflation, and uncertainty surrounding the November elections, which could also be seen in the Architectural Billing Index (ABI). Higher interest rates and stagnation in demand led to lower construction of commercial properties.

The gross margins in the quarter declined by 260 basis points year-over-year to 34.9% due to lower volumes in the AAON Oklahoma segment. However, due to a better product mix and improvement in operating efficiencies, the operating margins declined by 70 bps year-over-year to 20%. The diluted EPS in the quarter improved by 8.6% to $0.63 due to the increase in topline and lower share count.

AAON's Financial Analysis and Outlook

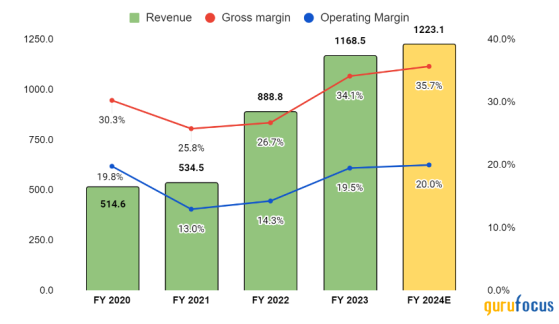

The company's net sales grew at a CAGR of 31.4% in the last three financial years (i.e., 2021 to 2023) due to increased industrial and commercial construction, a focus on energy efficiency and indoor air quality, and a boom in the data center market. However, for 2024, I anticipate sales growth to moderate to 4.67% based on the average growth of the past three quarters of 2024. The reason is negative volume growth in the AAON Oklahoma segment due to moderation in construction activity and slower transition of R-410A refrigerant equipment. The healthy order book in the AAON Coil Products and BASX segments should partially offset this. The backlog at the AAON Coil Products segment was up by 63% year over year in Q3 2024, whereas in the BASX segment, it was up by 100% year over year. As a result, the total backlog increased by 32% year over year to $647.7 million, with most orders being of data center equipment. The bookings associated with the data center equipment contributed 30% to the overall bookings in Q3 2024, compared to 13% in 2023.

Source: Created by Warp Analysis

Over the last three financial years, AAON's gross margin and operating margin increased by 840 bps and 650 bps year-over-year to 34.1% and 19.5%, driven by higher volumes, higher price realization, improved supply chain, and operational efficiency gains achieved through division integration and automation investments. Considering the good profitability in the three quarters of 2024 and the seasonal impact on the fourth quarter's margins, I anticipate the gross margin and operating margin should increase by 150 bps and 50 bps year over year to 35.7% and 20% in 2024.

Given the higher demand in the data center market, AAON has undertaken significant capital expenditures over the past few years to expand its production capacity. The company is working on two major capacity expansion projects at its Oregon and Texas facilities. The operations at the Redmond, Oregon facility (BASX segment) are conducted in a 194,000-square-foot area, with 169,000 sq. ft. utilized for the manufacturing facility and the remaining 25,000 sq. ft. for the office space. In 2024, the company increased the facility's square footage by 15%, reconfigured its manufacturing layout, and added new production equipment. The Longview, Texas facility (AAON Coil Products segment) consists of 466,000 sq. ft. of manufacturing/warehouse space and is currently undergoing a 50% expansion in square footage. Furthermore, to accommodate the incremental production of data center equipment, the company is acquiring a new facility in Memphis with a square footage of 787,000. Given this purchase, management has upped its capex in FY 2024 from $125 million to $215 million.

Should we buy AAON?

Source: Created by Warp Analysis using Alphaspread

For my DCF calculations, I am considering a 4.67% revenue growth rate for FY 2024, a 10% growth rate for the next four years, and a terminal growth of 5% given the increase in demand for data center equipment and completion of the transition from R-410A refrigerant to a sustainable refrigerant. Assuming a discount rate of 6.5%, the intrinsic value of AAON should be $73.62, indicating overvaluation by 46%. These valuations do not accurately justify the growth opportunities, making it an unattractive investment opportunity.

This content was originally published on Gurufocus.com