Meta (NASDAQ:META) Description: Dive into the surge of active ETFs: AUM reaches $535B in 2023, driven by key regulations and investor advantages.

The 2024 Trackinsight Global ETF Survey Report is packed with valuable insights into the global trends shaping ETF markets. In this article, we delve into the latest trends in active ETFs, with a particular focus on the U.S., offering a closer look at what the report reveals.

The investment landscape is witnessing a seismic shift, with actively managed Exchange-Traded Funds (ETFs) emerging as a pivotal force in 2023. Traditionally dominated by index-based strategies, the global ETF sphere is now carving out substantial space for active management. This evolution opens a new frontier for investors aiming for alpha generation, tailored investment outcomes, and effective risk management.

The North American Surge: A Closer Look

Active ETFs within the United States have experienced extraordinary growth, with their total assets under management (AUM) soaring to $535 billion by the end of 2023 from $352 billion in 2022. This remarkable rise is not just in terms of dollars but also in their market share, which has dramatically expanded from a modest 2.2% of total ETF assets five years ago to 6.8%. Such a significant increase highlights a paradigm shift in the investment world, with active management assuming a pivotal role in investors' portfolios.

Further illustrating this trend, U.S. investors poured $138 billion into active ETFs, a substantial increase from $88 billion the previous year. This influx represents nearly a quarter of all ETF inflows into U.S.-listed funds, signaling a strong and growing preference for strategies that prioritize active management. This surge in investment underscores investors' robust appetite for active ETFs and their confidence in these funds' potential to generate alpha in a dynamic market environment.

Why are Active ETFs booming in the U.S.?

Regulatory Milestones: The active ETF landscape underwent a transformative change in 2019, thanks to pivotal regulatory developments. The approval of non-transparent ETFs allowed active managers to shield their strategies, fostering a more conducive environment for active management. In the same vein, the same year also saw the implementation of SEC Rule 6c-11, known as "The ETF Rule." This regulation streamlined the process for launching ETFs by endorsing the use of custom baskets and eliminating the necessity for individual exemptions.

Mutual Fund Conversions: A noteworthy trend is the conversion of mutual funds into ETFs, with over 70 such transitions since 2021. This shift highlights the attractive features of ETFs, such as tax efficiency and trading flexibility, which are increasingly preferred over traditional mutual fund structures.

Active ETFs vs. Mutual Funds

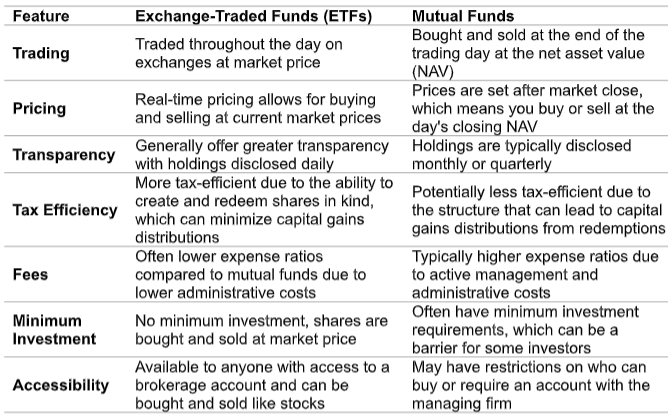

The burgeoning interest in active ETFs stems from their distinct advantages over traditional mutual funds. These include enhanced transparency, superior tax efficiency, liquidity, and ease of trading. As a result, active ETFs are not just a passing trend but a fundamental evolution in investment strategy, offering a versatile and dynamic approach for modern investors.

Bottom line

In summary, 2023 stands as "The Year of Active," marking a significant pivot towards actively managed ETFs in North America. Driven by regulatory advancements, investor benefits, and a strategic shift from mutual funds, active ETFs are setting a new standard for portfolio management. As the landscape continues to evolve, active ETFs will likely play an increasingly prominent role in shaping investment strategies and outcomes.

Interested in learning more about Global ETF trends? Download Trackinsight’s 2024 Global ETF Survey Report titled “Unlock 50+ Charts of Worldwide ETF Trends” to gain access to valuable insights on the global ETF universe, from active and fixed income strategies to the latest trends in crypto, ESG and thematic investing.