Adobe (NASDAQ:ADBE) is a powerhouse in the software industry, commanding a global market share of over 80%. The company continues to generate massive subscription revenue while quietly building an AI business that has the potential to be a game-changer. Yet, despite these strengths, the stock has taken a beating, dropping around 22% over the past year. The irony? Nothing is fundamentally wrong with Adobe’s business. It maintains a highly profitable recurring revenue model, benefits from strong operating leverage, and consistently reinvests in top-line growth.AI is undeniably reshaping the software landscape, enhancing capabilities and disrupting traditional workflows. While it’s clear that AI will be a major force, the extent of its impact remains uncertain. Markets rarely get these shifts entirely rightthere will be overhyped losers and long-term winners that are unjustly punished in the short term. I believe Adobe falls into the latter category, as investors seem overly concerned that AI could diminish the need for its software. The stock’s steep decline largely stems from lower-than-expected guidance in its most recent earnings report, but in my view, the market’s reaction has been exaggerated.

ADBE Data by GuruFocus

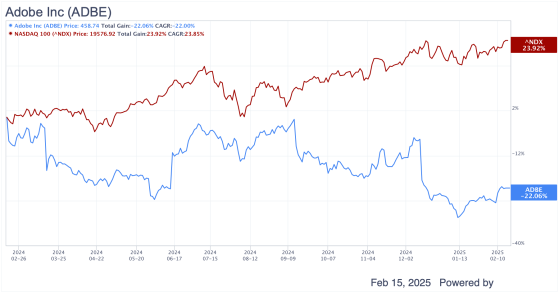

Even with near-term volatility, Adobe’s long-term growth trajectory remains solid. The company is actively investing in AI-powered tools to enhance user productivity and expand its digital offerings. These strategic investments should drive sustainable growth over time. While the stock has underperformed, trailing the NASDAQ 100’s 24% gain, I see this as an overreaction rather than a reflection of any real weakness in the business.

Adobe’s AI IntegrationAdobe is weaving AI deeply into its core product offerings, with Creative Cloud, Document Cloud, and Experience Cloud all seeing significant enhancements. AI-powered tools like Adobe Firefly are revolutionizing flagship applications such as Photoshop, Illustrator, and Premiere Pro. Given that Adobe’s primary user base consists of professional creativesincluding designers, photographers, videographers, and marketersthese advancements only serve to reinforce Adobe’s stronghold in the industry. Firefly alone has already surpassed 16 billion token generations in the most recent quarter, with features like Generative Fill gaining strong traction. Adobe has also introduced an array of new AI capabilities, including text-to-image, text-to-video, scene-to-image, and audio translation, further expanding its suite of creative tools.

Some investors fear that generative AI models like OpenAI’s Sora or DALL-E could erode Adobe’s dominance, but I don’t see this happening anytime soon. While these tools make it easier for the average person to create digital content, they don’t replace the advanced functionality that professionals rely on. Enterprises that have built their digital ecosystems around Adobe’s solutions aren’t going to suddenly walk away just because a new AI tool can generate impressive images. Companies using Adobe Experience Manager (AEM) for their websites, leveraging Adobe’s Martech stack for digital marketing, or relying heavily on PDFs for daily operations aren’t going to drop their contracts overnight. That’s just not how enterprise software works. Adobe’s deep integration into these workflows ensures its long-term relevance, keeping it the go-to platform for creative professionals and businesses alike.

AI-Driven Monetization Is Already Delivering ResultsAdobe’s strategic push into AI isn’t just about enhancing its softwareit’s already translating into strong financial performance. Unlike many enterprise software companies facing spending slowdowns, Adobe has remained resilient. The launch of the Acrobat AI Assistant, offered as an add-on subscription for both enterprise and individual users, has been met with strong demand. Available across desktop, web, and mobile, this feature has played a key role in driving Document Cloud revenue to $843 million, up 17% YoY, with net new Document Cloud ARR hitting a record $173 million. The company closed the quarter with a total ARR of $3.48 billion, reflecting 23% YoY growthclear evidence of the increasing demand for AI-driven features within Adobe’s ecosystem.

During the recent earnings call, Alex Zukin of Wolfe Research inquired about AI’s role in driving Digital Media ARR growth. David Wadhwani, President of the Digital Media segment, explained that AI is helping expand Adobe’s user base, increase subscription value, and create new enterprise revenue streams. In Q4 alone, monthly active users surged over 25% YoY, surpassing 650 million paid and free users. This growth was largely fueled by Acrobat Web, where monthly active users jumped nearly 50% YoY, alongside record-breaking traffic to the adobe.com domain. A major driver of this momentum has been Adobe Express, a suite of free creative tools that serves as an exceptional top-of-funnel vehicle to bring new users into the Adobe ecosystem.

The commercial rollout of Firefly, along with AI-driven features like Generative Fill in Photoshop and enhanced video editing tools in Premiere Pro, signals a strong operational future for Adobe. These innovations are poised to drive free-to-paid conversions for Acrobat, especially as Acrobat Web continues to attract more users. During the latest earnings call, Adobe’s CEO emphasized that the company’s primary focus right now is embedding AI deeply into creative workflows. The idea is simple: once users become reliant on AI for their work, monetization follows naturally through new subscription tiers and premium offerings. With this strategy already showing resultsevidenced by growing user retention and enterprise adoptionit’s clear that Adobe is well-positioned to be a major AI beneficiary.

What about the Fundamentals?Adobe is going all in on AI, supercharging its product suite with cutting-edge technology. I firmly believe this strategy will sustain steady sales growth over time, which in turn should translate into continued profit expansion. What makes this even more compelling is Adobe’s highly attractive financial structure. As I mentioned earlier, the company boasts a massive recurring revenue base, coupled with an industry-leading margin profilean 89% gross margin and a 25% net margin. With this level of profitability, I have no doubt Adobe has the financial firepower to ride out any short-term uncertainties and keep reinvesting in top-line growth. Over the past decade, Adobe has consistently grown sales at a double-digit CAGR, and I don’t see the rapid adoption of AI-driven digital content creation disrupting that momentum.

Looking at the numbers, Adobe’s revenue continues to climb every quarter. In its most recent report, the company pulled in $5.6 billion, up 11% YoY. And rather than slowing down, this growth is actually accelerating. Given Adobe’s dominance in creative services, where it holds strong pricing power and seamlessly integrates AI features into its ecosystem, I expect AI innovation to remain a key driver of revenue expansion.

Another aspect that often gets overlooked is just how insane Adobe’s margins are. With an 89% gross margin, the company retains nearly 90 cents of every dollar after direct costs. Even after pouring $3.9 billion into AI development and R&D, they still maintain a 35% operating margin. That level of profitability is rare in enterprise software, and it puts Adobe ahead of major peers like Microsoft (NASDAQ:MSFT) when it comes to top-line and bottom-line growth, as well as free cash flow expansion over the past five years. While many companies are set to benefit from AI-driven efficiency gains, Adobealongside Microsoft and Salesforcehas an edge because of its proprietary AI integrations. Given that Adobe’s high-margin business is built on best-in-class productivity tools, I see AI adoption driving even greater free cash flow generation moving forward. Tools like Firefly are already boosting creative efficiency, which should further accelerate user adoption.

Then there’s the subscription modelone of Adobe’s biggest strengths. Over 90% of its revenue is recurring, meaning customers continue paying on a monthly or annual basis. This makes the business remarkably stable, even in an economic downturn. In fact, Adobe’s latest 10-K filing showed that ARR grew 13% YoY, signaling robust demand rather than any signs of weakness.

The company’s cash flow generation is equally impressive. Last quarter alone, Adobe pulled in over $2.9 billion in operating cash flow and closed the year with $8 billion in free cash flow. On top of that, they’ve been aggressively buying back shares, spending $2.8 billion on repurchases so far this year. To me, this signals confidence in their long-term growth trajectory and a commitment to delivering shareholder value.

The Market Is Sleeping on AdobeI just don’t get the market’s reaction to Adobe right now. We’re talking about a company that’s consistently growing revenue at 10% a year, operates with sky-high margins, has an incredibly stable subscription-based model, and generates absurd amounts of free cash flow. And yet, the stock is trading at a discount.

Adobe’s forward P/E ratio is currently sitting at just 17.7xwell below the sector average of 24.2x. People love to say Adobe is expensive, but in reality, it’s actually cheaper than most of its enterprise SaaS peers. For context, Microsoft trades at a forward P/E of 22.9x, Oracle (NYSE:ORCL) at 20.9x, Autodesk (NASDAQ:ADSK) at 28x, and SAP at 32.1x. Historically, Adobe’s stock has traded at a five-year median forward P/E of 25x and a 10-year median of 32x. If the stock simply reverts to its five-year average, it should be trading around $600without even factoring in the potential upside from AI-driven revenue expansion. If Adobe’s AI monetization strategy plays out as I expect, this could go even higher.

[Alpha Spread]

The market is currently treating Adobe like just another tech stock, but that couldn’t be further from the truth. It’s growing faster than most of its competitors, yet it’s sitting at a lower forward multiple. Meanwhile, its free cash flow generation is massive, and AI is already making a meaningful impact on product adoption. The issue, in my view, is that the market is punishing Adobe because its AI investments haven’t yet translated into a noticeable acceleration in sales growth. But historically, whenever Adobe’s forward multiple has been this low, it has quickly corrected upward in the following months. I see no reason why this time should be any different.

Another key factor to consider is Adobe’s aggressive share repurchase program. Since FY19, the company has retired 37.5 million shares (roughly 7.6% of its float), including 7.3 million shares (1.5% of its float) in just the last twelve months. With a $7.2 billion buyback plan in place, these efforts should continue driving shareholder returns while also reducing the total share count.

[Alpha Spread]

From an alternate valuation standpoint, a simple DCF analysis makes it clearAdobe’s fair value should be around $562 per share, yet the stock is trading closer to $460. That’s an 18% discount, providing a solid margin of safety at current levels. Even under conservative assumptionsa 9% discount rate and a 4% long-term growth rateAdobe’s total enterprise value still lands at $247 billion, significantly higher than what the market is pricing in right now. This is why I see the current weakness as a rare buying opportunity. Adobe isn’t just another tech companyit’s a high-margin, high-growth AI powerhouse that continues to dominate its space. The stock remains deeply undervalued, and as the company’s AI investments start translating into accelerated revenue growth, I expect the market to wake up to its true potential.

Final ThoughtsAdobe is simply too cheap at current levels. The market is overly focused on short-term concerns while ignoring the bigger picture. This is still one of the most profitable, stable, and dominant software companies in the world. Its AI strategy is already driving meaningful adoption, its margins are among the best in the industry, and its recurring revenue stream keeps generating billions in free cash flow every quarter. At $460, the stock is trading at a steep discount, despite strong fundamentals and long-term growth potential. Based on a fair value estimate of $562, I see at least 18% upside over the next 12 months. Given Adobe’s unmatched profitability, AI-driven expansion, and aggressive buybacks, this is a clear opportunity for long-term investors. In my view, Adobe remains a strong buy.

This content was originally published on Gurufocus.com