AMD (NASDAQ:AMD) is one of the most exciting chip companies in the world at the moment. Due to its strategic focus on AI, including a diversified approach centred on inference as well as training demand, the stock has a robust medium-term future ahead of it. Moreover, my valuation model posits a 35% margin of safety for investment assessed from a full financial breakdown of its earnings capacity and share count over the next three years. Additionally, my December 2027 price target of $290 is the conclusive reason I am highly bullish on AMD stock at its present valuation.

Operational & financial analysisIn my opinion, there are two semiconductor companies that are both the best-positioned in terms of valuation, financials, and operations to warrant heavy buying of their stock at the moment. However, there is a core difference between the two companies that makes AMD a more stable medium-term investment. I've mentioned extensively in previous analyses on Nvidia (NASDAQ:NVDA) that it is likely to face a revenue decline in the medium term related to lower spend on AI infrastructure graphics processing units for model training. However, AMD is focusing on inference workloads, a potentially larger and more protracted market.

At the moment, AMD's data center segment accounts for about half of its total revenue and grew by 122% year-over-year in Q3 2024. However, Nvidia remains dominant with around a 90% share of the AI graphics processing unit market. Unlike training workloads that require high-end graphics processing units, inference can leverage central processing units, graphics processing units, and even specialized accelerators, providing AMD with multiple avenues to compete as it transitions its focus toward inference to differentiate itself from Nvidia.

In addition, while Nvidia has a comprehensive software ecosystem named CUDA, this is more focused on training utilizing high-performance graphics processing units like the H100. Inference workloads will be less reliant on CUDA, so AMD has an opportunity to compete with its open-source ROCm stack and cost-efficient solutions.

In the next two to three years, AMD is quite likely to achieve an earnings without non-recurring items compound annual growth rate of over 35% due to profit harvesting amid the upcycle of its AI ramp up and other diversified revenue streams. Moreover, this will likely coincide with around a 20% compound annual growth rate in its revenues over the time period. Such growth forecasts are based on my research and analysis of its current growth trends and market position and validated against consensus estimates from Wall Street. To be precise, I forecast $44.5 billion in annual revenue for Fiscal 2027 (ending December 2027), and earnings without non-recurring items of $8.37 for Fiscal 2027.

Valuation analysisFor my valuation model, I provide a full breakdown of the company's profit potential and share issuance. The model is capped at three years, in-line with my estimates above due to this likely being the highest-growth period to hold AMD stock in the foreseeable future.

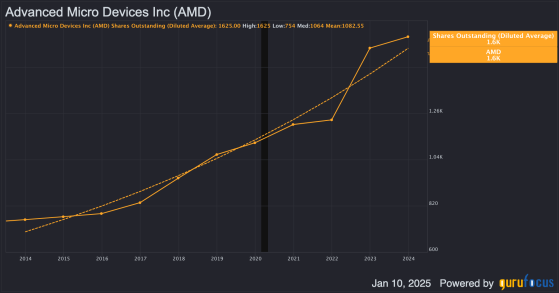

The company's basic average shares outstanding have been increasing at an 8.23% compound annual growth rate over the past five years. If this trend slows due to profit harvesting meaning the company is less reliant on equity financing to fund its operations, a compound annual growth rate of 5% in its share count seems plausible over the next three years. The company's current trailing 12-month shares outstanding equals 1.62 billion, so I forecast it will have 1.88 billion trailing 12-month shares outstanding in December 2027.

As I forecast that the company will have about a 35% trailing 12-month net margin without non-recurring items by December 2027, the company's net income without non-recurring items would be $15.75 billion. Given my forecast that it will have 1.88 billion shares outstanding, this equates to an earnings per share without non-recurring items of $8.37.

AMD stock is currently trading at a much cheaper price-to-earning ratio without non-recurring items compared to its 10-year median of just over 50. The current multiple is almost 40. Moreover, this indication of good value is not just due to cyclical profitability dynamics as the company's price-to-sales ratio of nearly 8 is only moderately higher than its 10-year median of 5.45, despite a three-year revenue growth rate of 19.9% compared to 2.5% as a 10-year median. I therefore consider AMD very reasonably valued right now. Indeed, a terminal multiple of 35 appears both consistent with historical valuations, industry norms (i.e. compared to Nvidia), and conservative given its robust growth horizon with no indication of a medium-term revenue decline for now.

The result of my model is a fair December 2027 price target for AMD stock of $290, indicating approximately a three-year compound annual growth rate of over 35%.

AMD's weighted average cost of capital is 16.83%, composed of 98.6% equity (costing 17.02%) and 1.4% debt (costing 3.75% pre-tax, 3.75% post-tax due to a 0% effective tax rate). When discounting my December 2027 price target back to the present day over three years using the company's weighted average cost of capital as my discount rate, the implied intrinsic value is $180. As the stock is currently trading at $115, the implied margin of safety in my model is 35%.

Risk analysisAMD is not the only company competing in the inference market and attempting to disrupt Nvidia's moat in AI infrastructure. Broadcom (NASDAQ:AVGO) and Marvell (NASDAQ:MRVL) are aggressively entering the AI accelerator market, with Broadcom showing particular promise with potentially $90 billion in AI-related revenue over the next three years. Moreover, there are niche players like Cerebras and Groq which are poised to dominate portions of use-case specific inference through targeting lower latency and higher throughput with tailored chips.

It is also worth considering that though we have Trump in the White House this year for a four year term, likely providing more geopolitical resilience through stronger leadership, tensions between the East and West are still high, especially surrounding Taiwan. If further hot wars break out or trade tensions escalate, supply chains and revenue streams could be disrupted. In a worst-case scenario of a market crash, I believe it prudent for investors to have a robust cash position at this time to mitigate risk and allow themselves to capitalize shrewdly on any major undervaluations that occur. This is the strategy being adopted by Buffett's Berkshire Hathaway (NYSE:BRKa) (BRK.A) (BRK.B), and it appears a shrewd model to emulate.

The greatest risk operationally and financially is that AMD has recently heavily concentrated its resources on AI. I do not consider this a bad thing, given that the AI industry is the highest-growth economic boom most people know of. However, it comes with risks for AMD shareholders if the company falls short of expectations. This could manifest if there is lumpiness in AI spending as enterprises optimize their budgets after initial build-outs, or if customers encounter any errors with its central processing units, graphics processing units, or AI accelerators, as two key examples.

ConclusionI currently have a significant portion of my value trading portfolio in Nvidia shares, and I'm considering adding AMD shares at a higher or equal weight. I expect I will hold my AMD shares for longer than my Nvidia shares, because Nvidia is showing signs of significantly slower growth on the horizon and then, very likely, at least a minor revenue contraction. Therefore, I am only planning on holding Nvidia stock for about a year, but will likely hold my AMD position for two years or more. As my valuation model indicates, holding AMD stock for three years could result in a 35% compound annual growth rate, making it a top investment to consider at this time.

This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI