Introduction

Agnico Eagle Mines Limited (NYSE: TSX:AEM) is one of the top long-term gold miners I have owned and traded for over a decade. On October 30, 2024, the company released its third-quarter 2024 results. This article is an update to my Gurufocus article from February 29, 2024, in which I analyzed the fourth quarter of 2023.

Agnico Eagle Mines has significantly outperformed its peers over the past year and appears to be on track for even better results as we approach 2025. This success is mainly due to the company's long-term strategy of developing assets such as Melladine and Meadowbank. Additionally, specific acquisitions have contributed to its success, including the recent purchase of the remaining 50% of Canadian Malartic from Yamana Gold (TSX:YRI) and the merger with Kirkland Lake. These acquisitions and long-term projects were well-timed and benefitted the company and its shareholders. Unfortunately, this is not true for several of Agnico Eagle's peers.

This expansion strategy was critical to the company's production growth because it aligned capital expenditures with cash flow and prioritized gold.

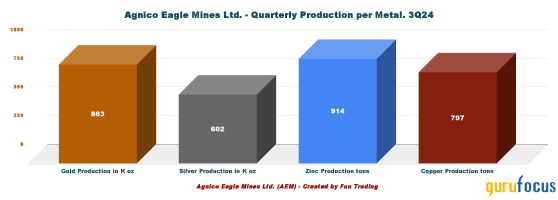

Gold ProductionIn the third quarter of 2024, gold was Agnico Eagle's primary revenue source, accounting for roughly 98.8% of total revenue. The remaining revenue came from selling copper, silver, and zinc, treated as by-product metals.The chart below shows the 3Q24 production by metal.

However, when we compare Agnico Eagle to Barrick Gold (NYSE:GOLD) and Newmont, we can see that Agnico Eagle is the true gold miner, with only a small residual revenue from byproducts like silver, copper, zinc, and lead.

Barrick Gold is ramping up copper production at its three copper mines, with Lumwana being the primary site. Additionally, there is a significant copper-gold project in Pakistan called Reko Diq.

Newmont significantly boosted its copper production after acquiring Newcrest, a deal finalized last November.

Agnico Eagle Mines may have lower revenues than Barrick Gold and Newmont, but its income is more reliable thanks to the strategic locations and quality of its mines. This reliability sharply contrasts with the technical challenges Newmont faces from the mines acquired mainly from GoldCorp in January 2019, along with ongoing issues regarding Barrick Gold's operations in Africa and Papua New Guinea.

The following chart compares the revenue generated from AEM, GOLD, and NEM based on metal production.

Newmont shows the highest revenue for gold and copper but at greater costs.

Agnico Eagle Mines currently owns and operates twelve mines. However, the La India and Creston Mascotta mines in Mexico are scheduled to close in 4Q24 after producing 4,529 and 9 ounces of gold, respectively, in 3Q24. The total production was 863,445 gold ounces, and the company sold 855,899 gold ounces in 3Q24.

Production this quarter has been disappointing, as shown in the chart of production history below.

The chart below shows gold production in 3Q24 for each producing mine. A significant move for Agnico Eagle Mines was the addition of three mines from the merger with Kirkland Lake in February 2022. The three minesDetour Lake and Macassa in Canada and Fosterville in Australiahave performed well; however, Canadian Malartic production fell short of expectations this quarter.

This expansion strategy remains effective as long as the gold price remains above $2,600, despite a significant drop today as the cease-fire between Israel and Hezbollah approaches. The company sold its gold at a record price of $2,492 per ounce this quarter, and the future projections are expected to be higher. I estimate around $2,650 per ounce in 4Q24, representing a 6% increase quarter over quarter.

Many gold producers face significant challenges in effectively managing costs. Barrick Gold and Newmont Corporation have struggled in this regard, with rising costs and all-in sustaining costs (AISC) reaching unsustainable levels above $1,500 per ounce.

Agnico Eagle Mines has successfully maintained its AISC below $1,300 per ounce this quarter, an impressive feat despite reaching a new record high, as shown in the chart below:

Trading gold stocks

The gold industry is currently facing challenges with rising costs, and this trend is likely to persist. If gold prices can maintain their recent levels, gold miners should be able to generate a satisfactory amount of free cash flow, and gold stocks will deliver a decent return.

However, this situation partially explains why gold stocks tend to perform poorly when the price of gold is strongly rising, as we have seen in the past few quarters. Worse, they often experience a rapid decline when gold prices undergo any slight consolidation.

One possible reason for the dissatisfaction is that the industry needs to provide satisfactory dividends.

Gold stocks have an average yield of 2.3%, while oil stocks boast a full percentage point higher yield and more. This suggests that shareholder well-being is not the primary focus. Management decisions often involve high risks for investors, even if they seem justifiable for the business (synergies). For example, acquiring or merging with a company at the market's peak, as when Newmont acquired GoldCorp, can result in poor outcomes, including the need to reduce dividends.

To invest in the gold industry, you must understand how things work really. Investing blindly and waiting for a large return is not the solution. It is rarely the case, even with the best companies.

My solution is to trade using LIFO, which should cover a significant portion of your position and could range up to 70%, depending on the overall risk associated with the stock. You will need to manage a short-term position that yields small returns and a long position that you will hold until the stock reaches your long-term target. Always watch your cash position and diversify.

Trading LIFO requires a solid understanding of technical analysis (short-term) and, above all, selecting the right stocks. AEM is the perfect candidate.

A quick look at the 3Q24: A beat.Agnico Eagle Mines reported third-quarter 2024 adjusted earnings of $1.14 per share, up from $0.44 in the year-ago quarter. The company's revenues were $2,155.6 million, up 31.2% from the same quarter a year ago, even if gold production was up only 2%.

AEM reported a net income of $567 million for the quarter, driven by a higher mine operating margin due to rising gold prices and increased sales volumes. This represents a significant increase from $179 million last year.

Additionally, gains from derivative financial instruments and lower amortization expenses contributed to this result. However, increased mining tax expenses and higher production costs somewhat offset the overall benefits.

The third quarter's free cash flow totaled $616 million, a significant increase over the amount earned in the same quarter last year ($71 million). Cash flow from operations was $1,085 million, while capital expenditures were $468 million. This level of free cash flow should have prompted the company to raise dividends, but management decided otherwise.

Agnico Eagle Mines closed the third quarter with $983.1 million in cash, cash equivalents, and marketable securities, up from $364.86 million in 3Q23. Long-term debt was approximately $1,467 million (including current debt), substantially decreasing from $1,943 million in 3Q23.Total (EPA:TTEF) cash from operating activities increased to $1,084.5 million in the third quarter, up from $502.1 million the previous year.

The debt profile improved significantly in 3Q24, with a net debt of about $0.5 billion.

What does AEM expect for 2024?Agnico Eagle Mining expects to produce 3.35 to 3.55 million ounces of gold in 2024, and it is on track to meet the midpoint of that estimate. It is quite disappointing because if we add what has been produced so far (2,635,935 ounces) and subtract it from 3,450,000 ounces, we get a low production for 4Q24 of approximately 814k ounces, which will be the weakest quarter in 2024.

AEM expects to achieve its 2024 projections, estimating total cash costs per ounce to be between $875 and $925 and all-in-sustaining costs (AISC) per ounce to range from $1,200 to $1,250.

Excluding capitalized exploration, total capital expenditures for 2024 are projected to be between $1.6 million and $1.7 million.

I am glad the AISC remains below $1,250. While the capex appears reasonable, it is difficult to determine what is included in this estimate and draw meaningful conclusions.

Technical Analysis

Note: The chart has been adjusted for dividends.

Agnico Eagle Mines follows a descending channel pattern, with resistance at $85 and support at $76.20. The relative strength index (RSI) is 52, indicating a slightly bullish (ascending) trend. Although a descending channel is typically considered a bearish pattern, it can often lead to a bullish breakout.

The stock has established support of approximately $76.20, making it a reasonable point to consider adding to your position or purchasing more shares. It may also be wise to sell part of your position once the stock price rises above $83.50. However, if the price of gold declines from its all-time highs, AEM could drop as low as $70.30, coinciding with the 200-day moving average.

Please refer to my chart above for more information. Taking partial short-term profits using the LIFO (Last In, First Out) method is essential. Consider selling about half of your position for short-term trading while maintaining a core long-term investment. This approach allows you to benefit from potential significant gains while collecting dividends.

Warning: The technical analysis chart must be updated regularly.

This content was originally published on Gurufocus.com