1: Introduction

Agnico Eagle Mines Limited (NYSE: TSX:AEM) reported its fourth-quarter and full-year 2024 results on February 13, 2025. This article updates my Gurufocus article from December 6, 2024, in which I analyzed the third quarter of 2024.

In my previous article, I highlighted Agnico Eagle Mines' unique strengths, which make it a standout in the gold mining industry, particularly in the current bullish gold market. In this article, I will reiterate these strengths and explain why my opinion remains unchanged.

A gold miner needs to fulfill several requirements to be successful, and Agnico Eagle Mines not only satisfies these requirements but also goes above and beyond them, guaranteeing that the value of its stock will reflect the success of the metal.

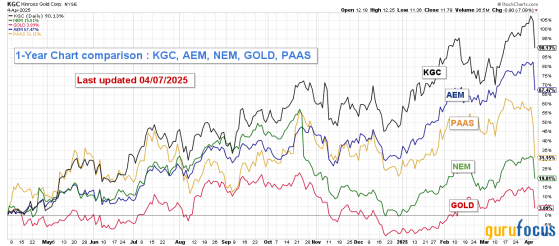

A savvy investor has several gold companies to consider, but I believe we should focus on five strong options: Newmont Corporation (NYSE:NEM), Barrick Gold (NYSE:GOLD), Agnico Eagle Mines (NYSE:AEM), Kinross Gold (NYSE:KGC), and Pan American (TSX:PAAS) Silver (NYSE:PAAS). While some may have different opinions on my selections, these stocks represent a solid choice backed by strong fundamentals. Let's look at the one-year chart and compare:

AEM performed well over the past year, rising 67.5% and surpassed only by KGC. Here are three reasons for this.

1. A successful gold miner requires dependable, high-yield mines in low-risk mining jurisdictions. Agnico Eagle has built a strong portfolio focused on North America, specifically Canada and Mexico. It also has one safe mine in Australia and another in Finland. The company's gold production comes from ten mines, and some residual leaching from La India and Creston Mascotta (near Pinos Altos) mines. It is a testament to its strong operational record. The Canadian Malartic and Detour Lake mines, both located in Canada, are the company's two largest operations. Details of gold production in 4Q24 per mine are shown below:

2. Agnico Eagle delivers a robust mineral reserve and resource base, holding 54.3 million ounces of gold in proven and probable reserves. The company's guided production for 2025 is between 3.3 million and 3.5 million ounces, which aligns closely with its production levels in 2023 and 2024 and provides a sense of security. As the third-largest gold producer in the world, Agnico Eagle has established a long-standing history of solid gold production. Additionally, AEM has one of the lowest AISCs in the industry, with an estimated $1,275 per gold ounce in 2025, down from $1,315 per ounce in 4Q24.

Agnico Eagle primarily produces gold and three by-products, silver, zinc, and copper, which are deducted from costs (by-products). Details below:

Additionally, AEM's 50% stake in the San Nicolas project, which primarily focuses on copper and zinc, is a significant investment opportunity. This project, started in April 2023 in partnership with Teck Resources (TSX:TECKa), holds substantial copper, zinc, gold, and silver deposits in Zacatecas State, central Mexico. With production set to begin in 2026, this project holds great potential for future returns.

3: Agnico Eagle currently offers a dividend yield of approximately 1.61% or a quarterly dividend of $0.40 per share. In April 2023, the company announced a plan to repurchase up to 24,718,919 common shares, representing 5% of its outstanding shares, for $500 million. This share repurchase program was scheduled to end on or before May 3, 2025. Additionally, Agnico Eagle has received approval from the Toronto Stock Exchange to renew its share repurchase program, allowing the buyback of up to 5% of its public float over the year.

The current low dividend yield has raised significant concerns for Agnico Eagle Mines shareholders, who feel the company is not meeting their expectations. I share this concern and believe the company should raise its dividends in 2025, especially considering the expected record-high free cash flow driven by rising gold prices. However, the recent decline in the price of gold might force the business to take a more cautious stance going forward.

In 2024, the company's free cash flow was an impressive $2.127 billion, and 2025 is expected to exceed this figure. I propose that Agnico Eagle raise the quarterly dividend to about $0.65 per share, representing a yield of approximately 2.6%.

I have listed three reasons why AEM is ideal for savvy long-term investors with a low-risk appetite. However, since AEM has experienced significant gains recently, the question remains: Is now the right time to invest?

AEM appears expensive, having increased over 67% in just one year. The chart below shows the 3-year comparison between gold, copper, and AEM:

2: Gold Production in Q4 2024: An impressive performance.

In the fourth quarter of 2024, Agnico Eagle Mines produced 847,401 ounces and sold 824,902 ounces. Production costs per ounce were $881, total cash costs per ounce were $923, and all-in sustaining costs (AISC) per ounce were $1,316, a record high. This was an impressive performance.

Below is shown the production per mine, 4Q23 versus 4Q24.

AEM AISC significantly increased in 4Q24 due to higher sustaining capital expenditures, particularly at the Canadian Malartic and Detour Lake mines. Production costs also rose, as did royalties from higher gold prices. As shown below, AISC reached a record $1,316 per ounce, well above the $850 level from 2016-2017.

However, analysts at Bank of America (NYSE:BAC) predict that the gold price could skyrocket to a staggering $3,500 per ounce by the end of 2025, significantly offsetting the cost increase. Despite the recent drop, gold is still above $3,000 per ounce.

However, last week's significant decline in gold prices raises the question of whether expectations need to be revised. If the Fed maintains higher rates for an extended period, gold could swiftly drop below $2,800 per ounce, which would be bearish for AEM. Additionally, depending on the dollar's strength, gold could experience considerable fluctuations.

In contrast to Barrick Gold, Newmont Corporation, Kinross Gold, and Pan American Silver, AEM has better control over its AISC. Of the five miners I chose, Agnico Eagle AISC is the lowest, followed by Barrick Gold, as the chart below illustrates.

In the fourth quarter of 2024, Agnico Eagle Mines reported an average realized gold price of approximately $2,660 per ounce, up from $1,982 per ounce during the same period the previous year. Additionally, the company sold its silver at $30.31 per ounce, zinc at $2,955 per ton, and copper at $9,183 per ton.

Analysts predict that gold prices will stay high in the first quarter of 2025, estimating an average price of approximately $2,900 per ounce or an increase of approximately 9% quarter over quarter. Based on 61 trading days, I have computed an average price of $2,894 per ounce for 1Q25.

3: Agnico Eagle Mines financial analysis, 4Q24.

AEM's quarterly revenues reached $2.224 billion, a substantial increase from the previous year. The company achieved adjusted earnings of $1.26 per share, a significant increase from $0.58 per share in the same period last year. This result surpassed analysts' expectations.

Agnico Eagle Mines has seen a significant improvement in its financial health over the past year, as evidenced by a reduction in net debt from $1.5 billion to just $216.53 million.

This substantial debt repayment has greatly strengthened the company's balance sheet. In its fourth-quarter financial results for 2024, AEM reported strong operational performance and effective cost management, positioning itself favorably within the competitive landscape of the gold mining industry. The company's decision to repay $700 million in debt during 2024 enhances its financial stability and opens the door for a potential increase in dividend payouts, reflecting a positive outlook for shareholders. Looking at the chart below, it is probable that AEM will turn net cash in 1Q25.

4: Conclusion

Agnico Eagle Mines is regarded as one of the leading gold producers globally, not solely based on reserves, production, or revenue, but due to its execution, investment quality, and safety standards.

Agnico Eagle operates 10 mines across four countries: Canada, Finland, Australia, and Mexico (excluding La India and Creston Mascotta). Additionally, the company owns the Upper Beaver Project in Ontario, Canada, which is expected to achieve commercial production between 2028 and 2029. According to the chart below, AEM's mines show consistent production.

Recently, Agnico Eagle reported a record high in its gold mineral reserves, totaling 54.3 million ounces. The company's stock has been trading at a premium valuation, often close to or even exceeding its valuation based on its reserves.

In 4Q24, Agnico Eagle reported a net profit margin of 22.9%. Although this margin is relatively low, it is expected to increase in 1Q25. The all-in sustaining costs were $1,316 per ounce in 4Q24, which is low compared to its peers. With gold priced at over $3,000 per ounce and 502.86 million diluted shares outstanding, combined with a premium for the location of its reserves, my estimated stock valuation ranges between $95 and $103 per share, depending on the premium applied.

Thus, AEM has reached its peak valuation, which may result in challenges for future significant growth. Additionally, the company has a substantial tax payment of $400 million due in 1Q25. This obligation could affect cash flow next quarter and may hinder AEM's ability to increase dividends, which could be drivers for a correction unless gold continues its rapid advance. However, it is becoming less likely as a result of the disastrous effects of the Trump administration's tariff policy, which raises the likelihood of a recession from 40% to 60%, according to JP Morgan Chase (NYSE:JPM).

Hence, a prudent strategy would be to sell 50%60% of your position and allow the other 40%50% to benefit from the ongoing rally or a spike if AEM decides to increase its dividends, which are very low with a net of 1.15% after the 25% Canadian tax withdrawal.

5: Technical Analysis: Ascending Channel.

Note: The chart has been adjusted for dividends.

Agnico Eagle follows an ascending channel pattern, with resistance at $111 and support at $99.7. The relative strength index (RSI) is 42, indicating a slightly bearish trend.

Although an ascending channel is generally viewed as a bullish pattern, it can sometimes result in a bearish breakdown. The stock has formed weak support around $99.5 (50 MA), making it sensible to consider increasing your position or buying more shares at this level.

It may also be prudent to sell a portion of your position once the stock price exceeds $109. However, if gold prices continue to fall due to the recent crisis, AEM could decline to as low as $92.2. Please take a look at my chart above for more information.

Taking partial short-term profits using the LIFO (Last In, First Out) method is essential. Consider selling roughly half of your position for short-term trading while keeping a core long-term investment. This strategy lets you take advantage of potential significant gains while earning dividends.

Warning: The technical analysis chart needs regular updates, especially because we are encountering a gray swan event.

This content was originally published on Gurufocus.com