Investing in the agriculture sector can be a strategic choice for those looking to diversify their portfolio and potentially hedge against inflation. Why?

Well, one of the key components of the Consumer Price Index (CPI) basket is food, a fundamental commodity that directly reflects the health and trends of the agricultural industry.

By going deeper into the food supply chain, we encounter the base agricultural commodities such as wheat, soybeans, dairy, and corn, as well as the companies that specialize in their production and distribution. These elements form the backbone of the agricultural sector, influencing both market dynamics and consumer prices.

For investors considering an emphasis on this industry within their portfolio, it's crucial to understand that while this can offer a degree of inflation protection, the level of effectiveness heavily depends on how the investment is executed.

In this context, the choice between investing in agricultural commodity futures ETFs versus agricultural equities ETFs is particularly significant. Both options provide exposure to the agriculture sector but in fundamentally different ways, each with its unique trade-offs and implications for inflation protection.

Investing in Agricultural Commodities

Agricultural commodities encompass a range of essential goods used in daily life, including staples like corn, sugar, soybeans, and wheat. These commodities are fundamental to global food supply chains and, as such, are significant components of the commodities market.

For most investors, direct physical ownership of these commodities is impractical due to storage, decay, and other logistical issues. Therefore, exposure to agricultural commodities in investment portfolios is typically achieved through futures contracts.

Futures contracts are agreements to buy or sell a specific quantity of a commodity at a predetermined price on a specified future date. These derivatives enable investors to gain exposure to commodities without the need to physically hold them.

However, it's important to note that futures prices do not always align perfectly with the current, or spot, prices of commodities. This discrepancy arises due to various factors, including storage costs, time value, market expectations, and contango/backwardation.

Agricultural commodity futures, especially front-month futures (those closest to their delivery date), are particularly sensitive to inflation. This sensitivity is partly due to speculation by traders who anticipate how various factors, including inflation, supply and demand dynamics, weather conditions, and geopolitical events, will impact commodity prices.

During inflationary periods, commodities are often seen as a hedge, as their prices tend to rise with increasing inflation, driven by higher costs of production and transportation. Consequently, this speculative activity can lead to more pronounced price movements in commodity futures, making them a potentially effective but volatile inflation hedge.

Investing in Agricultural Equities

For investors seeking a more long-term, buy-and-hold approach to the broader agricultural sector, purchasing stocks of companies involved in the production, refinement, and sale of agricultural commodities is a viable option.

Publicly traded agricultural companies, such as Archer Daniels Midland and Nutrien (TSX:NTR), provide an opportunity to invest in the industry without the direct exposure to commodity price fluctuations that futures contracts entail.

However, while agricultural equities have some correlation to inflation, the relationship is not as direct as with commodity futures. This approach places investors one step removed from the direct impact of commodity price movements.

Unlike commodity futures, where the investment thesis often hinges on the anticipation of rising commodity prices, investing in agricultural equities involves a bet on the companies' ability to remain profitable and grow.

The stock prices of agricultural companies are influenced not only by the underlying commodity prices but also by broader market risks common to equities. These risks include fluctuations in the stock market, changes in investor sentiment, and varying economic conditions.

Additionally, the financial performance of these companies – their earnings, revenue growth, operational efficiency, and management decisions – plays a crucial role in determining their stock prices.

Which is Better for Inflation Hedging?

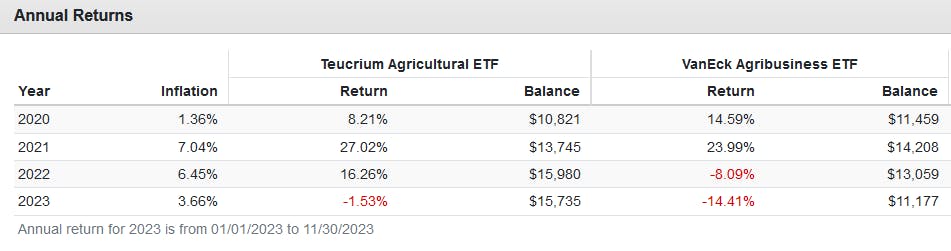

Comparing the performance of the VanEck Agribusiness ETF (MOO) to the Teucrium Agricultural Fund (TAGS) provides a clear picture of this dynamic at play historically.

During the high inflation environment of 2021 and 2022, TAGS recorded consecutive years of double-digit returns. Its portfolio of corn, wheat, soybeans, and sugar futures recorded a low correlation with equities and bonds alike, giving them great short-term diversification potential.

In contrast, MOO did not experience the same upside in 2022, as its companies faced headwinds from higher interest rates and bearish investor sentiment. Its holdings faced the same market risk as most equities did during the 2022 downturn, and subsequently underperformed.

This content was originally published by our partners at ETF Central.