-

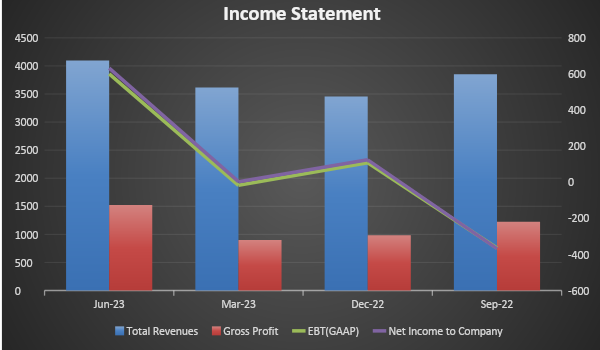

Financial Performance Highlights: Q2 2023 EPS (Earnings Per Share): $1.35, Q2 2023 Revenue: $4.04 billion.

-

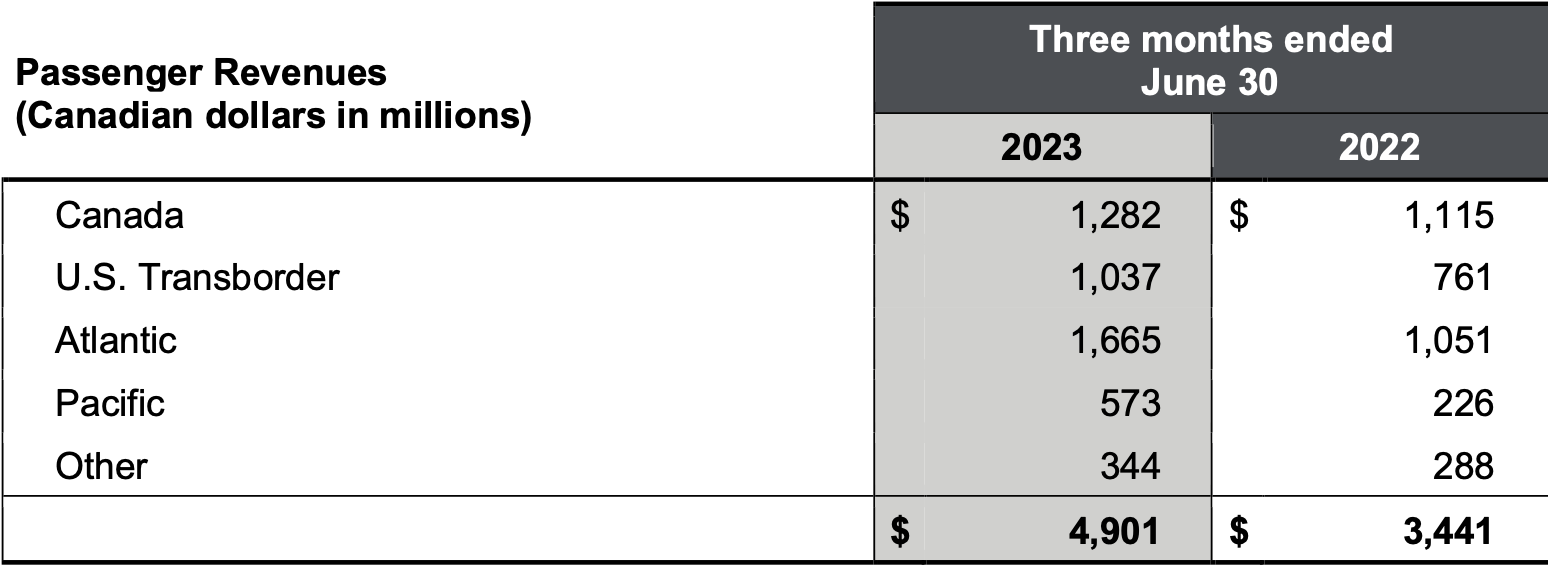

Passenger Revenues and Market Share: 42% growth in premium revenues indicates a successful capture of the premium segment.

-

Operational Efficiency: Canada sector witnessed a 9.9% increase in RPMs, Atlantic sector grew by 32.1%, and Pacific sector saw a substantial 143.5% growth in Q2 2023.

Robust Earnings and Driving Growth International Markets

Air Canada (TSX:AC) Inc., Canada's largest airline, delivered solid financial performance in the second quarter of 2023, surpassing market expectations and showing strong growth potential. The company's impressive earnings report, with an EPS of $1.35 and revenue of $4.04 billion, indicates effective cost management and operational efficiency. Additionally, Air Canada's strategic initiatives, partnerships, and focus on diversification contribute to its growth trajectory and make it an attractive investment opportunity in the airline industry. A key driver of Air Canada's growth is the significant increase in passenger revenues, particularly in international markets, which accounted for nearly 70% of the growth in Q2 2023. The company successfully tapped into the premium segment, with a 42% growth in premium revenues, indicating its ability to capture a larger market share. This growth, coupled with favorable pricing in operating markets and strategic partnerships, strengthens Air Canada's position and potential for further expansion.

Strategic Expansion in Freight Operations and Rise in RPM

Air Canada has strategically addressed the decline in cargo revenues by expanding its freighter operations and increasing its fleet from two Boeing (NYSE:BA) 767 aircraft in Q2 2022 to six in Q2 2023. This adaptive approach demonstrates the company's ability to effectively manage market shifts and enhance its revenue prospects. Air Canada's operational efficiency is highlighted by its impressive rise in revenue per miles (RPMs) across its sectors. The Canada sector witnessed a significant recovery with a 9.9% increase in RPMs, while the Atlantic sector experienced a remarkable ascent with a 32.1% growth in Q2 2023. The Pacific sector displayed substantial growth, with RPMs skyrocketing by 143.5%. These figures indicate Air Canada's ability to optimize its operations and efficiently address the growing demand.

Revenue Per Miles & Available Seat Per Miles breakdown

|

Sector |

Metric |

Q2 2023 |

Q2 2022 |

% Change Q2 |

H1 2023 |

H1 2022 |

% Change H1 |

% Contribution to Total (Q2 2023) |

|

Canada |

RPMs |

4,673 |

4,252 |

9.9% |

8,465 |

6,754 |

25.4% |

21.6% |

|

Canada |

ASMs |

5,455 |

5,217 |

4.6% |

10,061 |

8,864 |

13.5% |

22.2% |

|

U.S. transborder |

RPMs |

3,793 |

3,682 |

3.0% |

7,536 |

6,674 |

12.9% |

17.5% |

|

U.S. transborder |

ASMs |

4,436 |

4,655 |

-4.7% |

8,976 |

7,536 |

19.2% |

18.1% |

|

Atlantic |

RPMs |

8,345 |

6,314 |

32.1% |

13,366 |

9,226 |

45.0% |

38.6% |

|

Atlantic |

ASMs |

9,291 |

7,838 |

18.5% |

15,193 |

11,991 |

26.7% |

37.8% |

|

Pacific |

RPMs |

2,966 |

1,218 |

143.5% |

5,747 |

1,788 |

221.3% |

13.7% |

|

Pacific |

ASMs |

3,202 |

1,544 |

107.3% |

6,302 |

2,444 |

157.9% |

13.0% |

|

Other |

RPMs |

1,840 |

1,663 |

10.6% |

5,081 |

3,367 |

50.9% |

8.5% |

|

Other |

ASMs |

2,222 |

2,050 |

8.4% |

5,981 |

4,655 |

28.5% |

9.0% |

|

System |

RPMs |

21,617 |

16,371 |

32.0% |

40,195 |

25,852 |

55.4% |

100% |

|

System |

ASMs |

24,606 |

20,331 |

21.0% |

46,513 |

34,628 |

34.3% |

100% |

Capacity Expansion and Plans for Revenue Enhancement

Air Canada's total operating expenses rose by 9% while operating capacity surged by 21% in Q2 2023. Although there was a decrease in aircraft fuel expenses, other expenses such as salaries, wages, and benefits increased, reflecting the company's growth in full-time employees. Cost management remains in focus for Air Canada to optimize its operations amidst inflation and capacity expansion. Looking ahead, Air Canada is strategically positioned to leverage future growth opportunities. The airline's commitment to maximizing sixth freedom traffic, enhanced customer engagement through the Aeroplan program, and a novel distribution strategy incorporating advanced NDC technology are expected to boost revenue and reduce distribution costs.

Diversifying the Fleet and Customer Attraction

Air Canada's fleet expansion plans, including the addition of Airbus A321XLRs, A220-300s, and Boeing 737 MAX 8s, highlight the company's efforts to modernize and diversify its fleet for global reach. The incorporation of freighters further demonstrates Air Canada's commitment to cargo operations and sustainable growth. Industry recognition, such as being named North America's Favorite Airline, enhances Air Canada's credibility and reputation, attracting and retaining a broader customer base. Strategic diversification through subsidiaries, Air Canada Rouge and Air Canada Vacations, allows the company to cater to a wide range of travelers and tap into the tourism sector.

Conclusion

In conclusion, Air Canada's strong financial performance, strategic initiatives, operational efficiency, and growth opportunities make it an attractive investment option in the airline industry. The company's ability to adapt to market shifts, expand its network, and enhance customer experiences are key factors contributing to its long-term success. Considering the given factors, the stock currently priced appears cheap and merits a buy rating with a target price of $32.50 over a reasonable time frame of over a year.

Disclosure: We don’t hold any position in the stock.