Alibaba (NYSE:BABA) Group Holding Ltd. (NYSE:BABA) is an incredibly impressive business when considering its operational scope. It can be likened to Amazon (NASDAQ:AMZN), but with a primary focus on Chinese markets.

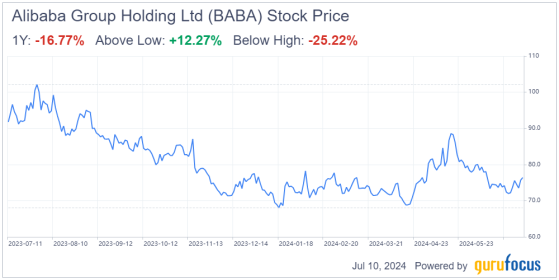

While Alibaba is less developed than Amazon, it holds significant value due to its diversified offerings and technological foundation catering to Chinese consumers. However, the stock has been in a near free-fall over the past three years, currently trading at only 30% of its value at the start of 2021. In recent years, the company has struggled to create meaningful shareholder value. Negative sentiment surrounds the stock, fueled by speculation about a potential delisting, an unfriendly business environment in China and a slowdown in Chinese gross domestic product growth. Geopolitical tensions between the United States and China further weigh on the share prices of Chinese companies. So the question remains: Can Alibaba become a valuable investment for the foreseeable future?

Considering that Chinese-American relations show no signs of improvement, the political risks within China remain high and Alibaba's revenues are no longer growing at a double-digit rate, I continue to believe that investing in the company is not worthwhile due to the lack of meaningful growth catalysts that could drive a recovery. While Alibaba might not be the fastest-growing company today, key parts of its business are performing well and its shares remain cheap.

Despite the stock reaching new lows at the beginning of 2024 and retracing a bit over the past month, it seems a bottom may have formed. However, there has been no improvement in the latest earnings report. The Chinese government is currently experiencing a period of heightened socialism. Thus, Alibaba shareholders are subject not only to capitalist interests, but also to the interests of a more socialist China compared to recent history, which was more favorable to globalization and Western-influenced capitalist ideals. Despite these challenges, Alibaba remains a strong business with a robust balance sheet and high profit margins, although it has recently lagged in growth. I reiterate my hold rating due to the significant uncertainty surrounding how geopolitics will unfold.

Navigating a shifting political landscapeChina's journey from embracing globalization and capitalist ideals to focusing on nationalism and a unique blend of communism and capitalism has had significant implications for its major companies. Once the poster child of Chinese entrepreneurial success, Alibaba now faces increased scrutiny and regulatory pressure from the Chinese government. In 2020, Jack Ma's criticism of Chinese financial regulators resulted in significant regulatory actions against the company, including a $2.75 billion fine for antitrust violations and the suspension of Ant Group's initial public offering, which was poised to be the largest in the world.

Although the regulatory environment has eased somewhat, Alibaba's focus on international operations might face further constraints if tensions between China and the West escalate. The ongoing U.S.-China trade tensions and broader geopolitical dynamics continue to add to skepticism. The Biden administration's policies, along with actions by allies in Europe and Asia, have increasingly scrutinized Chinese companies. Even if Alibaba can deliver higher growth in its international segments, its larger Chinese domestic operations might experience stagnation or contraction due to the Chinese Communist Party's policies.

Competitive positionAlibaba is gradually losing its dominant position in the Chinese e-commerce market to newcomers. In the fourth quarter, Alibaba's Taobao and Tmall Group revenues were $12.91 billion, while its international digital commerce business generated $3.80 billion.

In contrast, PDD Holdings Inc. (NASDAQ:PDD) has seen its revenue grow by 131% year over year to $12.02 billion, almost matching Alibaba's figures. If this trend continues, the company's e-commerce platforms might lose their dominant position in China and abroad due to the lack of major growth catalysts. The competitive landscape is becoming fiercer, with JD.com (NASDAQ:JD), Pinduoduo and even Amazon posing significant threats. JD.com excels in logistics, Pinduoduo attracts budget-conscious consumers and Amazon continues to innovate globally. The uncertainties in Alibaba's profitability, coupled with intensifying competition and macroeconomic uncertainties in China, make its dominance less assured.

AI and cloud businessHowever, the company does continue to have a strong presence in artificial intelligence and cloud computing. Alibaba is the largest cloud computing company in the Asia Pacific region and the fourth-largest globally, trailing behind Microsoft (NASDAQ:MSFT), Amazon and Alphabet (NASDAQ:GOOGL)'s (NASDAQ:GOOG) Google.

Source: Statista

The cloud computing market is expected to grow significantly, from around $680 billion this year to $1.44 trillion by 2029. Alibaba, as the leading local Chinese cloud company, is well-positioned in the Chinese AI industry. Forecasts suggest the country's AI industry will represent 30% of the global market by 2035.

While this might be optimistic, the AI industry in the world's second-largest economy holds bright prospects. Being the top cloud company in China puts Alibaba in a favorable position. Despite the challenges, the company's robust balance sheet and high-profit margins provide a solid foundation for growth in AI and cloud computing. As the AI industry in China continues to expand, Alibaba is likely to benefit significantly, reinforcing its long-term growth potential.

Financial reviewAlibaba reported robust revenue growth for fiscal 2024, with total revenue reaching $130.35 billion, an increase of 8.30% from $120.31 billion in 2023. However, this growth has been sluggish, with no significant improvement over the last two quarters, and the recent earnings report did little to instill optimism.

Source: Alibaba

Fourth-quarter revenue increased by 7% year over year to $30.73 billion, beating estimates by $310 million, but net income plummeted by 96% to $127 million. This decline was primarily attributed to stagnant performance in the China Commerce segment, influenced by reduced take rates and a shift in customer preferences toward price-competitive products.

Despite the revenue beat, Alibaba is gradually losing its dominant position in the Chinese e-commerce market to new entrants disrupting the digital sales landscape. On a positive note, Alibaba's Cloud segment showed promising growth, with high single-digit quarter-over-quarter growth on a trailing 12-month basis, positioning it as one of the few growth catalysts for the company moving forward.

Two of the three key profitability metrics also showed improvement for the quarter. Net income rose from $10.04 billion to $11.04 billion, while Ebitda increased from $24.34 billion to $26.55 billion. However, operating cash flow decreased from $27.67 billion to $25.29 billion.

This positive annual performance contrasts sharply with the latest quarterly results, which indicate a weakening trend. Fourth-quarter net profits fell from $3.26 billion to $453 million, operating cash flow dropped from $4.35 billion to $3.23 billion and Ebitda declined from $4.45 billion to $4.27 billion, suggesting challenges as the year concluded. The stagnation in profitability is likely due to domestic customers' preference for price-competitive products and lower take rates, both of which are expected to continue weighing on margins.

However, the Cloud segment showed steady margin improvement from 1.90% in the second quarter to 3.70% in the fourth quarter. Despite these gains, Alibaba's cloud business still lags behind its international peers. For the quarter, the cloud intelligence business saw only a 3% revenue increase to $3.55 billion despite price reductions for over 100 products.

Regardless, Alibaba's strategic shift toward focusing on high-quality revenue from increased public cloud adoption, while reducing low-margin project-based contracts, is noteworthy. This strategy is expected to drive future growth in public cloud and AI-related products, potentially offsetting the current weak growth in the core e-commerce business.

Alibaba's balance sheet also remains robust with $137.82 billion in cash and investments. The company has $19.64 billion in long-term debt and $1.77 billion in short-term borrowings, leaving a net liquidity of $116.42 billion. This substantial liquidity, which represents more than 50% of the market cap, coupled with $130.35 billion in revenue and $25.38 billion in Ebitda, underscores Alibaba's financial strength.

Overall, 2024 was a mixed year for Alibaba. While the company continued to expand, albeit marginally, several operational challenges persisted. The limited growth catalysts and the ongoing impact of the government-led crackdown pose significant hurdles. Analysts already expect a decline in Alibaba's earnings this year, with revenue likely to grow only at a single-digit rate in the foreseeable future.

A potential value trapAlibaba's stock appears to be undervalued at first glance, with a lower price-sales ratio compared to peers like Microsoft, Amazon and Alphabet. These companies also have significant exposure to the cloud market and e-commerce. Despite this apparent undervaluation, Alibaba's shares have significantly underperformed, failing to generate meaningful shareholder value.

While Alibaba's fundamentals are solid, with stable revenue streams and robust financial health, its single-digit growth rate starkly contrasts with the double-digit growth rates of its international competitors. This disparity highlights the challenges the company faces in maintaining its competitive edge and expanding its market share.

The ongoing geopolitical tensions and capital outflows from China further complicate the investment landscape for Alibaba, making it a risky proposition despite its attractive valuation. In comparison, American tech giants, although trading at higher multiples, have consistently demonstrated robust growth trajectories and substantial shareholder returns. Companies like Microsoft, Amazon and Alphabet continue to capitalize on strong growth catalysts, retaining their momentum and expanding their businesses aggressively. These growth catalysts provide a stark contrast to Alibaba's situation, where political and geopolitical risks loom large. Political risks, both domestically and internationally, have been significant detractors for the company and continue to cast a shadow over its growth prospects.

From a discounted cash flow perspective, Alibaba's stock appears undervalued, with an intrinsic value of $117 per share, suggesting 63.10% upside from current levels.

Source: valueinvesting.io

This valuation underscores the potential attractiveness of Alibaba's stock. However, despite this, the company's shares have continued to depreciate over the years, failing to keep pace with American peers.

The persistent undervaluation, coupled with the lack of significant growth catalysts, makes it challenging to envision a near-term turnaround for Alibaba's stock. Even though current valuations indicate potential upside, the realization of this potential remains uncertain, especially without new growth catalysts to drive a meaningful rebound in revenue. In light of these factors, I believe the stock remains a value trap without clear catalysts to reverse its gradual underperformance. A key catalyst I have been waiting for is a rebound in revenue growth, but the latest data shows no improvement in this regard.

Bottom lineAlibaba's expansive business model, financial strength and market position in China's e-commerce and cloud sectors highlight its potential. However, the company faces significant headwinds from regulatory pressures, geopolitical tensions and fierce competition. Despite appearing undervalued, its shares have consistently underperformed, failing to generate meaningful value. The lack of clear growth catalysts and ongoing uncertainties suggest caution. As such, maintaining a hold rating on Alibaba is prudent until there is more clarity on its growth prospects and geopolitical dynamics.

This content was originally published on Gurufocus.com