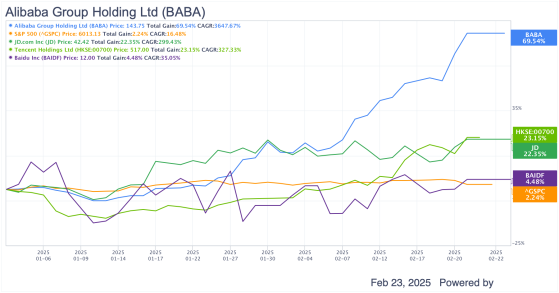

Alibaba (NYSE:BABA) Group Holding Limited recently delivered earnings that surpassed expectations, sending its stock soaring. With this rally, Alibaba is no longer the deeply undervalued, overlooked stock it was in past years. At the time of writing, shares trade at $138.50a massive 67% jump from the $83 level at the end of January. This YTD performance is remarkable, with the stock up 69.5%, significantly outpacing both its Chinese peers and the broader market. In comparison, JD has climbed 22.3%, Tencent is up 23.5%, Baidu (NASDAQ:BIDU) has risen just 4.5%, and the S&P 500 has gained a mere 2.2% over the same period.

BABA Data by GuruFocus

With Alibaba’s most recent earnings released on February 20th, the stock’s explosive move makes it clear that sentiment has shifted. Given this, I believe it’s time to reassess my stance, as the valuation dynamics have changed. The company is no longer trading at rock-bottom levels, so it’s worth evaluating whether it still presents the same compelling investment case. That said, Alibaba’s outlook remains promising, and this comes at a time when the broader Chinese market appears to be rebounding. If China is once again investablesomething I argue herethen Alibaba is one of the best ways to gain exposure.

Strong Revenue Growth Signals MomentumAlibaba’s revenue growth has picked up meaningfully compared to the past few years, with an 8% increaseits strongest growth rate since the December 2021 quarter. For context, the company had only managed around 5% growth in the last two quarters, so this acceleration suggests some solid momentum. A key contributor to this was a 9% rise in customer management revenue from Tmall and Taobao. Given that these platforms are already massive, I see this growth rate as quite impressive.

Alibaba’s cloud business, while still smaller than its core retail operations, also delivered solid growth. Cloud revenue climbed 13% YoY in Q3, driven by increased adoption and the rollout of a new AI model. I believe this segment holds the most long-term potential for Alibaba, especially as AI monetization efforts ramp up. Management expects its proprietary open-source Qwen modelalready outperforming global peers on key benchmarksto drive further gains. The company is also investing heavily in AI infrastructure, including computing power and storage, which will impact margins in the near term. However, I think these investments make sense, especially with Alibaba’s partnership with Apple (NASDAQ:AAPL) adding legitimacy to its AI business in China.

[CRN]

Despite competing against global giants like Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOGL), Alibaba’s cloud division is making progress. While its global cloud market share has held steady at 4%down from 6% in 2021it’s worth noting that the company managed to retain its position despite regulatory headwinds and the impact of COVID-19. This stability suggests significant upside potential as Alibaba continues expanding its cloud and AI capabilities. Unlike its U.S. peers, Alibaba doesn’t need to match their growth rates due to its much lower valuation, which makes it an even more attractive investment, in my view.

Expanding International Presence Adds Another Growth DriverAnother key bright spot was Alibaba’s International Digital Commerce (AIDC) segment, which saw a remarkable 32% YoY revenue jump. While this business is still significantly smaller than its domestic operations, it generated about $5 billion in Q3, highlighting its strong growth trajectory. Alibaba has been actively expanding in regions like the Middle East and parts of Europe, and these investments seem to be paying off. Management also reiterated confidence in AIDC’s path to profitability, emphasizing that the focus remains on gaining market share rather than immediate profits. AliExpress continues expanding globally, which I see as a smart strategy given the massive untapped market potential.

Free Cash Flow and Shareholder Returns Remain StrongAlibaba remains one of the most free cash flow-profitable large-cap Chinese companies, thanks to its dominance in e-commerce. The company generated 39.0B ($5.3B) in free cash flow during Q3, with a 14% FCF margin. While that’s down from 21% a year agoprimarily due to increased CapEx on cloud and AI infrastructureI see these investments as necessary for long-term growth. If current trends hold, Alibaba is on track to generate roughly $20B in annualized FCF this year.

Another positive is that Alibaba continues returning cash to shareholders. The company repurchased 9.1B ($1.3B) worth of stock in Q3, and over the past two years, it has averaged $3.2B in annual buybacks. I expect this trend to continue, reinforcing Alibaba’s appeal as a capital return play.

Profitability Still Holds Up Despite Heavy InvestmentsDespite increased spending on cloud and international expansion, Alibaba remains highly profitable. Over the trailing twelve months (TTM), the company posted a 38% gross margin, a 9% net margin, a 9% FCF margin, and an 8.6% return on equity (ROE). While these figures aren’t as high as they once were due to Alibaba’s ongoing investments, I still find them solid. In my view, the company is striking the right balance between fueling future growth and maintaining profitability, which keeps me bullish on the stock.

Valuation: Still Discounted, but Not as Much as BeforeAlibaba was once a market favorite, with investors willing to pay a hefty premium for a stake in the company. However, concerns surrounding China’s economy and the fallout from the failed Ant Group IPO led to a steep decline in its valuation. Just six months ago, Alibaba was trading at an ultra-low 9x earnings, translating to an earnings yield of 11%a rare bargain for a company of this scale. Things have changed quite a bit since then. With Alibaba’s share price climbing to around $138.5, its forward P/E ratio now stands at 16x. While this is still reasonable, it’s a significant jump from the rock-bottom valuations seen in recent years. I’m not bearish on Alibaba, but I’m admittedly less bullish than I was when it was trading at single-digit earnings multiples. Buying at 9x forward earnings was a no-brainerit was low-risk with high-reward potential. Even at current levels, though, I believe Alibaba remains undervalued, particularly with its AI and cloud segments fueling renewed optimism.

If Alibaba continues executing wellmaintaining double-digit free cash flow margins, expanding its cloud business through AI, and driving earnings growththe stock could re-rate to a more appropriate valuation. A 20x P/E multiple, which I believe is justified given its strong free cash flow and aggressive share buybacks, would imply a fair value of around $200 per share. This is my long-term price target, and I see it as a relatively conservative estimate. It doesn’t even factor in the growing excitement surrounding China’s tech sector in recent months. For context, Alibaba was trading at $310 per share back in 2020, before AI became the major growth catalyst it is today. In my view, the company is stronger now than it was five years ago, yet its stock price remains less than half of its former peak. While macroeconomic concerns and China-related risks persist, I still see opportunities for value in select Chinese stocks. I wouldn’t argue that Alibaba deserves the same valuation multiples as its U.S. peers, but the numbers suggest significant upside.

To validate this thesis, I looked at a DCF model using conservative assumptionsapplying a 10% discount rate and a 4% terminal growth rate. Even under these cautious projections, Alibaba’s fair value comes in at $182 per share, representing a 21% margin of safety despite the recent rally. While it’s fair for the market to apply a discount due to regulatory and political risks, I believe the stock is still being undervalued.

[Alpha Spread]

Beyond its growth potential, Alibaba remains committed to returning value to shareholders. The company has been deploying its free cash flow for aggressive stock buybacks, further boosting per-share value. Its participation in the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect programs also increases liquidity, making it easier for mainland Chinese investors to access Alibaba shares. This added demand could provide further support for the stock. All things considered, while Alibaba isn’t as dirt-cheap as it was half a year ago, I still see meaningful upside, particularly with the company proving its ability to execute across key growth segments.

Final ThoughtsAlibaba’s latest earnings report confirmed what I’ve believed for some timethis company is still a top-tier growth play for investors looking to gain exposure to China. The acceleration in revenue growth, particularly in its core e-commerce platforms (Taobao and Tmall) and its expanding Cloud business, is a clear sign that Alibaba’s fundamentals are strengthening. Despite macroeconomic challenges, the company is on track to generate $20 billion in annual free cash flow, which is a testament to its resilience and operational efficiency.

While regulatory pressures, geopolitical concerns, and China’s economic slowdown have weighed on sentiment, Alibaba’s business is showing signs of a solid recovery. Investors appear to be growing more comfortable with Chinese equities again, and Alibaba is arguably the best way to gain exposure. Even after the recent share price rally, I believe the stock remains undervalued, offering significant revaluation potential. The company’s focus on efficiency and capital returns is also being overlooked. With $52 billion in net cash and $22 billion in authorized buybacks, Alibaba provides both downside protection and upside potential. As the company continues investing in AI, cloud infrastructure, and international expansion, I remain bullish on its long-term prospects. The risk/reward here remains favorable, and I see Alibaba as a compelling opportunity for those willing to look beyond the short-term noise.

This content was originally published on Gurufocus.com