The launch of these three new active, equity ETFs reflect the firm’s intention to expand the breadth of their product shelf. In this article we’ll look at each, examining their individual investment objectives and how they can be utilized by investors.

AB US Low Volatility Equity ETF | Ticker: LOWV | Expense Ratio: 0.48%

LOWV is an actively managed, high conviction equity portfolio comprised of 60-80 stocks that strive to outperform US markets over a full market cycle, while emphasizing downside mitigation and capturing most of the upside in rising markets.

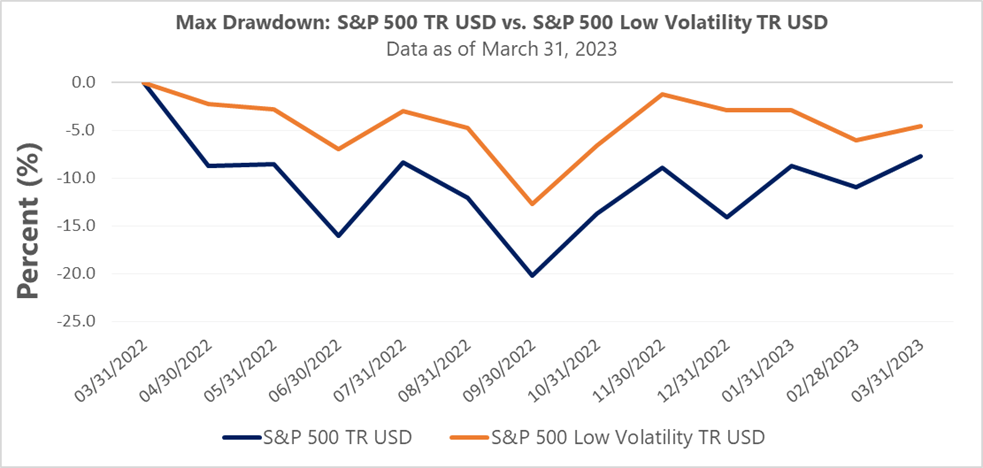

As highlighted in a previous article, low volatility investing is a proven factor-based investing style that investors can utilize during periods of market uncertainty and for achieving their long-term investment objectives. In contrasting the trailing 1-year max drawdown of the S&P 500 Index and S&P 500 Low Volatility Index, of which the latter measures the performance of the 100 least volatile stocks in the S&P 500; the investment strategy is effective in minimizing portfolio losses.

As observed from the chart, low volatility investing is not impervious to market drawdowns, as over the last two decades, equity markets have faced numerous shocks to the system – but this investing approach does allow for investors to meaningfully mitigate their risk exposure and still participate in upside market movements. For investors seeking to limit their volatility exposure, this solution is worth considering.

AB US High Dividend ETF | Ticker: HIDV | Expense Ratio: 0.45%

HIDV seeks to produce substantially more yield than the S&P 500 Index (with a minimum of 200 basis points), while remaining beta neutral to the index. The active ETF employs a systematic approach to identify attractive companies that pay dividends but also have the potential for long-term capital appreciation.

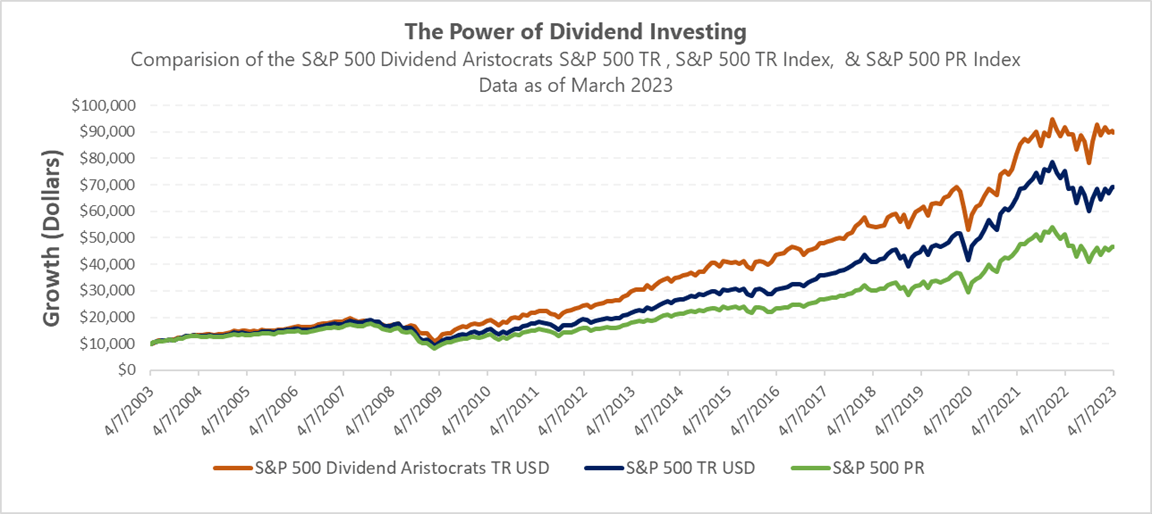

Though the importance of dividends regarding a stock’s total return is often spoken about, its impact is truly undersold at times, as dividend income is responsible for approximately one-third of the S&P 500 Index’s total return. The importance of dividend investing is demonstrated when looking at the long-run performance of the S&P 500 Price Return Index versus the S&P 500 Total Return Index, as the latter has significantly outperformed the former.

For companies that can maintain a consistent and growing dividend over time, their long-run performance has been truly exceptional – outperforming the S&P 500 TR Index. The S&P 500 Dividend Aristocrats Index reflects companies that have been able to achieve the aforementioned dividend policy over a 25-year plus period; highlighting their ability to truly reward investors over differing market cycles.

For investors interested in dividend-focused investing, HIDV provides them with the ability to access this investment strategy. The investment strategy aims to harvest income and returns from all sectors and industries by taking a sector-neutral approach to high dividend investing. By applying a proprietary systematic screening approach to the US equity mid and large-cap space, the fund will hold best-in-class companies that pay dividends, but also provide for long-term capital appreciation.

AB Disruptors ETF | Ticker: FWD | Expense Ratio: 0.65%

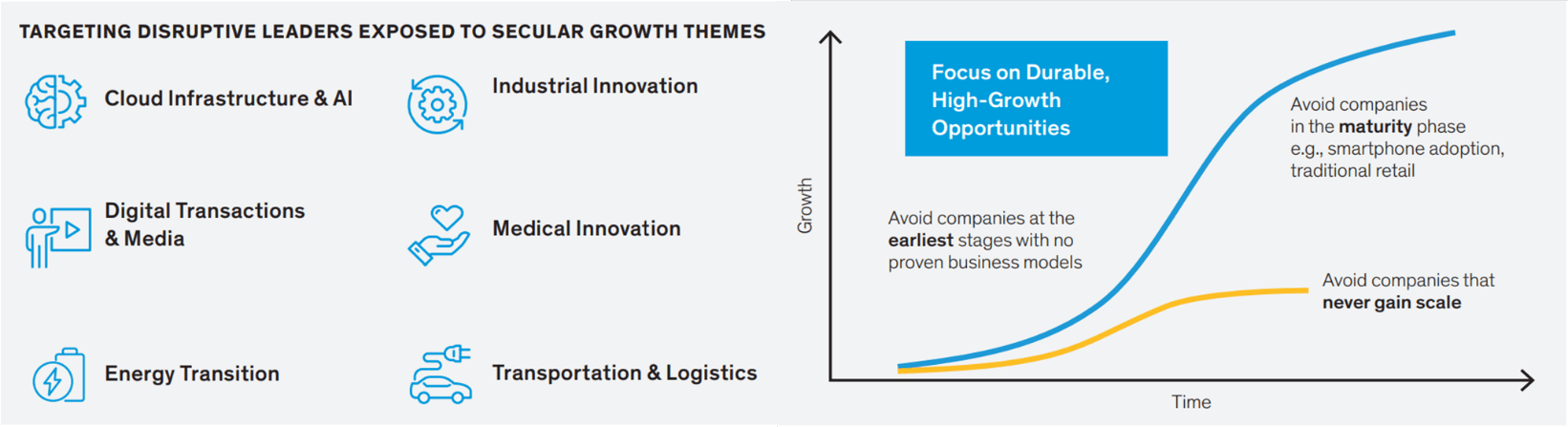

FWD is an actively managed strategy that takes a thematic approach to identifying disruptive leaders across sectors and geographies. The sector-agnostic approach of the fund will allow it to benefit from secular themes that can create powerful and sustainable tailwinds for growth. The strategy will target companies that are at the rapid adoption phase of the S-curve, capable of developing high-growth opportunities with a proven business model and defined pathway to profitability.

Source: AllianceBernstein, March 2023.

For investors that are interested in having growth-focused exposure within their portfolio and the opportunity to invest in the innovative companies that will shape the business and societal landscape of the future, the FWD ETF is a holistic solution that will provide that broad-based access to the emergent companies of the future.

This content was originally published by our partners at ETF Central.