Alphabet (NASDAQ:GOOGL) Inc. (NASDAQ:GOOG) announced a strong Q3 2024 earnings release, reporting revenue of $88.3 billion, up 15% year-over-year (YoY). Such growth points to the firm standing on solid ground in digital advertising and, increasingly, in cloud service.

Indeed, Alphabet's main segments, Google Services and Google Cloud, remained the main drivers of such growth, showing that the company can keep its revenue streams strong in an increasingly competitive space.

Google Cloud Powers Up: 35% Revenue Growth and $1.95B Profit Surge

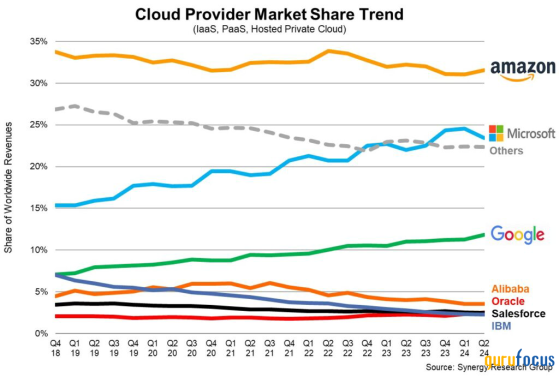

Alphabet's Google Cloud segment continues to perform exceptionally well, reporting a 35% year-over-year revenue growth, reaching $11.35 billion. This growth underlines Alphabet's competitive advantage in the enterprise technology space, especially with business enterprises increasingly relying on cloud-based infrastructures and AI solutions. Alphabet's CEO Sundar Pichai attributed the growth to strategic investments in AI infrastructure and advanced Generative AI tools, addressing the fast-evolving demands of enterprise clients in data analytics, machine learning, and automation.Operating income at Google Cloud expanded to hit $1.95 billion against just $266 million in Q3 2023. This case reflects how Alphabet has achieved economies of scale within the cloud segment because of the higher value accruing from the services being offered and, as a result, better efficiency in operations. As more and more customers flock to Google Cloud, winning new customers and earning bigger contracts, Alphabet continues to gain market share.

Alphabet Shines: Google Services Hits $76.5B with YouTube Ads and Subscriptions Soaring Amid Competition

Google Services, which includes Google Search, YouTube, subscriptions, platforms, and devices, was $76.5 billion, up 13% YoY. Google Search and other ad revenues leaped to $49.4 billion, a gain of 12%, reflecting the durability of its advertising platform. During a period where AI-powered startups and social media upstarts challenged their dominance, Alphabet continued to focus on continuous innovation through AI-driven enhancements with Search, holding onto market position and ad dollars.YouTube ads also grew 12% to $8.92 billion. With YouTube's total ads and subscription revenue surpassing $50 billion over the last four quarters, Alphabet has now truly positioned YouTube as one of the premier video advertising platforms. This really shows that YouTube has been very resilient to changes in user and advertiser preferences, especially with the rising competition from its competitors, including TikTok and Reels.

Meanwhile, Alphabet's subscription, platforms, and devices segment delivered an impressive 28% growth, reaching $10.7 billion. This surge highlights Alphabet's ability to diversify its revenue streams beyond traditional ad-based services, leveraging its ecosystem to drive value from hardware and consumer subscriptions, such as Google One and YouTube Premium.

Operating income Jumps 34%, with Margins Rising Amid Disciplined Cost Management

Alphabet's commitment to improving operational efficiency was evident, as operating income surged by 34% to $28.5 billion. The operating margin increased to 32%, up from 28% a year ago, showing Alphabet's success in controlling costs while driving revenue growth. Total (EPA:TTEF) expenses rose by just under 8%, reaching $59.75 billion, indicating Alphabet's disciplined approach to managing its cost base, particularly in high-growth segments like cloud and AI infrastructure.Additionally, Alphabet's bottom line was bolstered by a notable increase in other income, which contributed $3.2 billion, compared to a $146 million expense in the same quarter last year. This improvement in non-operating income reflects Alphabet's enhanced financial performance beyond core operating metrics, further strengthening its balance sheet.

Alphabet's Valuation Signals Caution: Fairly Priced but Premium Multiples Limit Near-Term Upside

According to recent valuation metrics, Alphabet appears fairly valued but shows elevated multiples relative to industry peers. Its GF Value is estimated at $166, indicating that the current stock price aligns with fair value. However, a Price to earnings (P/E) ratio of 23 and forward P/E of 20 place Alphabet at a premium in its sector.With a PEG ratio of 1.1, Alphabet's future high-growth potential may be limiteda caution for growth-focused investors. Additionally, a Price-to-Sales ratio of 6.7 and Price-to-Book ratio of 7.45 suggest significant growth expectations are already factored in. Finally, the price-to-free-cash-flow ratio of 40 signals an optimistic, if not stretched, valuation, especially given Alphabet's extensive capital outlays in AI and cloud infrastructure.

Rising Costs and Intense Competition Weigh on Near-Term Profitability Despite Long-Term AI Ambitions

One of the primary risks facing Alphabet is its rising Traffic Acquisition Costs (TAC), which increased by 6.1% year-over-year to $13.7 billion. TAC represents the expenses Alphabet incurs to drive traffic to its platforms, and its continued growth could pressure Alphabet's advertising profit margins. Additionally, Alphabet's capital expenditures (CapEx) surged 71.9% to $13.06 billion, largely allocated to AI infrastructure investments. This rapid increase in CapEx, while supporting Alphabet's long-term AI strategy, could challenge short-term profitability if revenue growth does not keep pace with investment.Alphabet operates in an intensely competitive environment, with section starvation coming from all corners, including Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT). This AI-driven transformation has put Google Cloud and Search in a great position against Alphabet's flight for retention. Furthermore, considering the fast-paced traffic, Alphabet continues to have more work ahead to really push through its position.

Meanwhile, the number one and two positions remain with Cloud Azure from Microsoft-MSFT and Amazon Web Services from AMZN, respectively. Any deceleration in growth at Google Cloud or delays in AI-related product development will hurt Alphabet's market share capture and its ability to maintain its competitive edge.

According to the tech expert, Jason Wise (LON:WISEa) Alphabet's rising TAC and significantly higher AI-focused CapEx suggest an ambitious, long-term growth strategy, but such high levels of spending will also challenge near-term margins. After all, to be successful, Alphabet now must turn these investments into revenue-generating digital ad and cloud product innovations. While effective monetization could provide tremendous future returns, delays or unfavorable shifts in markets may well test Alphabet's valuation.

That said, Alphabet remains a great long-term hold based on strong revenue streams and very fast-growing AI and cloud technology exposure. Moreover, increasing costs at a rapid pace, extended valuations relative to the peer universe, and competitiveness pressures also pose risks holding near-term growth in check. Investors will want to remain focused on cost structure, investment returns, and competitive dynamics as Alphabet pursues its next leg of growth.

This content was originally published on Gurufocus.com